Worry About the Right Things

The Irrelevant Investor

APRIL 8, 2023

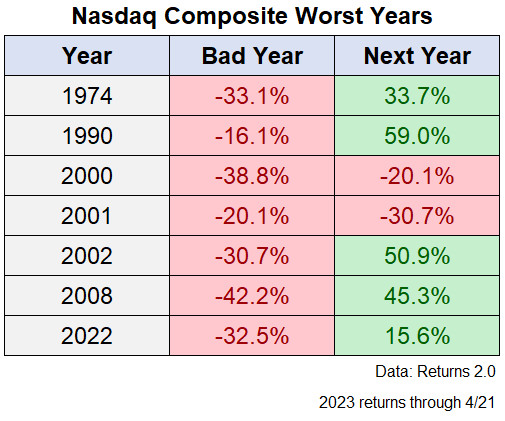

My colleague Nick in Louisiana wrote something excellent that I wanted to share with you. Hope everyone is enjoying their weekend. “Do you know the difference between me and you? Me: Happy, happy, happy, dead. You: Worry, worry, worry, dead.” – Catch-22. The last few years reminded us that it’s more important to know how it feels to lose money than to make it.

Let's personalize your content