The Non-Compete Revolution Begins

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

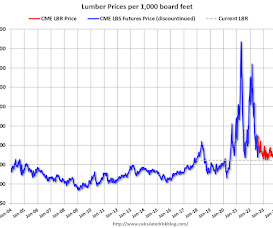

Calculated Risk

JULY 8, 2024

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

JULY 7, 2024

@TBPInvictus here If you’re tired of California-minimum-wage-and-its-impact-on-limited-service-restaurant-employment stories, I understand. Leave this page immediately. I’m tired of it, too, but some stories are so factually challenged that they demand a response. So, allow me to address a hot mess of a story that appeared recently in the California Globe.

Abnormal Returns

JULY 28, 2024

Top clicks this week What is the best performing stock of all-time? (mebfaber.com) Three investment myths, debunked. (morningstar.com) Lessons learned from the best performing stocks of all-time. (awealthofcommonsense.com) For investors, inflation is THE enemy. (disciplinefunds.com) Ian Cassel, "Most big winners were ugly ducklings that transformed themselves into beautiful swans.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

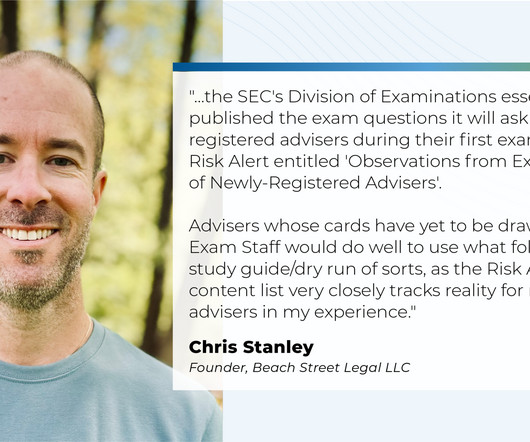

Nerd's Eye View

JULY 31, 2024

For SEC-registered financial advisors, the prospect of an upcoming examination by the SEC can be a source of high anxiety. This is especially the case with newly registered advisors or formerly state-registered advisors who recently became SEC-registered since they may be uncertain about how the examination process will work, what elements of the firm the SEC will dig into, or what information the advisor will need to provide to the examiners.

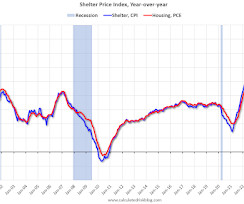

Calculated Risk

JULY 26, 2024

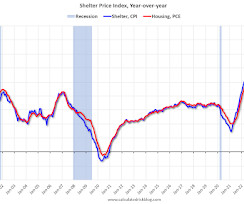

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through June 2024. CPI Shelter was up 5.1% year-over-year in June, down from 5.4% in May, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 5.3% YoY in June , down from 5.5% in May, and down from the cycle peak of 8.3% in April 2023.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

JULY 23, 2024

Helium founder and partner Howard Morin explains the benefits of bridging financial planning with deep tax expertise.

Wealth Management

JULY 30, 2024

A new survey from Cerulli Associates found model portfolio providers are increasingly focused on offering custom options to keep their clients loyal.

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Wealth Management

JULY 5, 2024

On the Foundation for Research on Equal Opportunity website, advisors and clients can search for the ROI of individual programs offered by private and state colleges and universities.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JULY 31, 2024

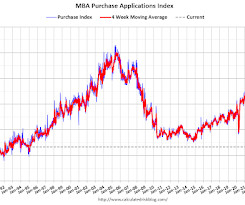

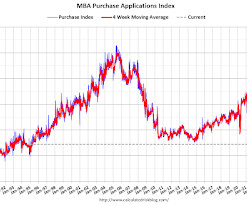

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 26, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JULY 5, 2024

If your only differentiator is that you charge 75 basis points, you’ll likely lose the battle when the advisor across town drops to 50.

Abnormal Returns

JULY 14, 2024

Top clicks this week How the rise of automated investing has changed the stock market. (awealthofcommonsense.com) Why Bill Ackman spends so much time on Twitter. (sherwood.news) The CAPM doesn't work. Maybe this measure does. (klementoninvesting.substack.com) Why young men around the world are breaking hard to the right. (politico.com) Today's constructive CPI report rang a bell for financial markets.

Wealth Management

JULY 1, 2024

Last week, the Court ruled that the commission’s use of in-house administrative law judges violated the Constitution’s guarantee of a jury trial in certain cases. That may change the landscape for financial advisors defending themselves against SEC charges and civil penalties.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

JULY 9, 2024

A quick break from book duty and doing our quarterly client call to share this fascinating discussion from tennis great Roger Federer: “In the 1,526 singles matches I played in my career, I won almost 80% of those matches… What percentage of the POINTS do you think I won in those matches? Only 54%.” -Roger Federer This is one of those great commencement addresses that will only gain stature over time.

Calculated Risk

JULY 2, 2024

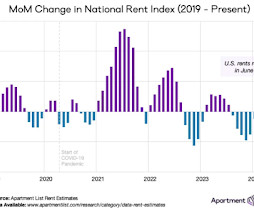

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

Wealth Management

JULY 2, 2024

Dangers abound when wealth enterprises celebrate founders over advisors.

Wealth Management

JULY 8, 2024

Today, the conversation isn’t led by you saying, “Let me tell you about our firm.” It’s led by prospects saying, “Hey, I’ve been following your content, and now I want to meet.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JULY 31, 2024

The real-life succession story playing out among the Murdoch family.

Wealth Management

JULY 19, 2024

The outage began early Friday morning with a software update from the cybersecurity provider Crowdstrike as the likely culprit. Schwab posted on its website a message warning users of potential issues.

Wealth Management

JULY 17, 2024

A recent U.S. Supreme Court decision raises concerns among tax lawyers.

Calculated Risk

JULY 11, 2024

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 4.8% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Wealth Management

JULY 16, 2024

Some 64% of advisory firms have no plans to develop or use client-facing artificial intelligence, yet 46% said it was a chief compliance concern, according to the ACA Group's latest survey.

Wealth Management

JULY 12, 2024

Sometimes, what seems like the most straightforward task can end up the most difficult and meaningful.

Wealth Management

JULY 8, 2024

REIT total returns rose for the second straight month and are approaching a break-even point for the year.

Abnormal Returns

JULY 7, 2024

Top clicks this week How major asset classes performed in June 2024. (capitalspectator.com) Just how useful is historical financial markets data? (retirementresearcher.com) Don't forget, stocks are real assets. (downtownjoshbrown.com) Europe's stock market has badly lagged the U.S. How much longer can it last? (awealthofcommonsense.com) Beware small sample sizes.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Wealth Management

JULY 8, 2024

Bridgewater's Greg Jensen said this current AI boom is nothing like the 1999 tech bubble.

Calculated Risk

JULY 26, 2024

Here is new working paper from Sylvain Leduc and Daniel J. Wilson at the Federal Reserve Bank of San Francisco Snow Belt to Sun Belt Migration: End of an Era Given climate change projections for coming decades of increasing extreme heat in the hottest U.S. counties and decreasing extreme cold in the coldest counties, our findings suggest the “pivoting” in the U.S. climate-migration correlation over the past 50 years is likely to continue, leading to a reversal of the 20th century Snow Belt to Su

Abnormal Returns

JULY 21, 2024

Also on the site this week Why meme stocks and sh*tcoins are the logical outgrowth of the analytics revolution. (abnormalreturns.com) A lifetime subscription is anything but. (abnormalreturns.com) Top clicks this week Seven reasons you may want to venture away from the market portfolio. (humbledollar.com) Rebalance your portfolio to tame risk, not to increase returns.

Calculated Risk

JULY 10, 2024

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 5, 2024. Last week’s results included an adjustment for the July 4th holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased 0.2 percent on a seasonally adjusted basis from one week earlier.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content