How the Pandemic Has Changed 401(k) Plans

Wealth Management

JULY 10, 2023

Slower June job growth is cooling the war for talent.

Wealth Management

JULY 10, 2023

Slower June job growth is cooling the war for talent.

Nerd's Eye View

JULY 10, 2023

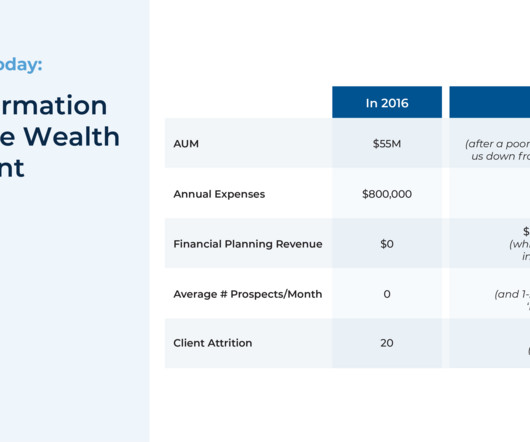

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family. At the same time, the business strategies that worked for the original owner might not be suitable or as successful for their successor, which can force the 2nd-generation owner to take a different path to ensure the firm

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 10, 2023

Office REITs rose more than 10% among broad-based gains for most property subsectors.

Calculated Risk

JULY 10, 2023

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Decline in June Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 4.2% in June from May. The Manheim Used Vehicle Value Index (MUVVI) declined to 215.1, down 10.3% from a year ago. “ The 4.2% drop is among the largest declines in MUVVI history and the largest decline since the start of the pandemic in April 2020 when the index plunged 11.4%,” said Chris Frey, senior manager of Economic

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 10, 2023

Multifamily completions are on track for their strongest year since the 1980s, according to data from CoStar Analytics. CNN Business looks at whether the boom in generative AI could help turn around San Franciso’s real estate fortunes. These are among the must reads from around the real estate investment world to kick off the new week.

Abnormal Returns

JULY 10, 2023

Podcasts Meb Faber talks with Blake Street is a Founding Partner and CIO of Warren Street Wealth Advisors. (mebfaber.com) Ashby Daniels talks with Hannah Moore about "doing" financial planning. (wiredplanning.com) Laurence Kotklikoff talks with David Blanchett about problems with conventional financial planning tools. (larrykotlikoff.substack.com) The biz Goldman Sachs ($GS) has snagged another custodian client, NewEdge Wealth.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 10, 2023

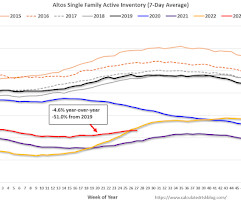

Altos reports that active single-family inventory was down 0.2% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 7th, inventory was at 465 thousand (7-day average), compared to 466 thousand the prior week. Year-to-date, inventory is down 5.3%. And inventory is up 14.7% from the seasonal bottom 12 weeks ago.

Wealth Management

JULY 10, 2023

Advisors Asset Management's CIO Cliff Corso provides his investment outlook for the remainder of 2023.

Calculated Risk

JULY 10, 2023

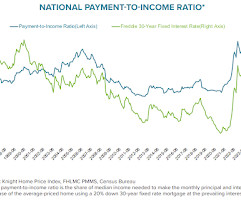

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May A brief excerpt: National Payment to Income Ratio Increased to Near Record This was as of June 22nd when mortgage rates (according to the Freddie Mac PMMS), were at 6.67%. Rates have increased since then, and it is likely the payment-to-income ratio is now at a new record high.

Wealth Management

JULY 10, 2023

Yet, average assets per deal is on track to hit the second-highest level ever recorded by Echelon.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 10, 2023

From Matthew Graham at Mortgage News Daily: Rates Remain Over 7% Despite Modest Improvement We've been here before--just a few months ago, but not for very long. Also, we haven't been much higher than this in more than 20 years. That said, many experts thought we might not be back here quite so soon--if at all during the same cycle. [ 30 year fixed 7.12% ] emphasis added Tuesday: • At 6:00 AM ET, NFIB Small Business Optimism Index for June. • At 8:00 AM, Corelogic House Price index for May.

Wealth Management

JULY 10, 2023

As with all things money and family, it can be a struggle to balance financial and personal goals with avoiding hard feelings and disputes.

Cornerstone Financial Advisory

JULY 10, 2023

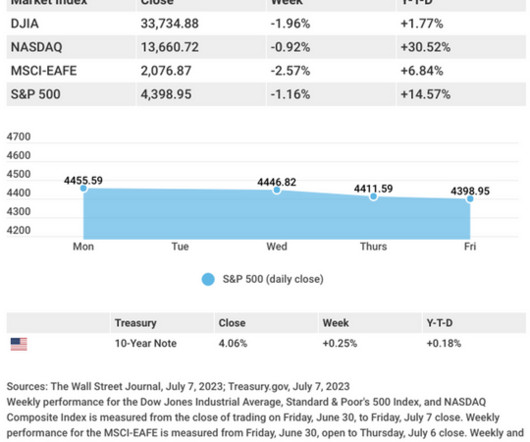

Weekly Market Insights: Stocks Stumble With CPI On Deck Presented by Cornerstone Financial Advisory, LLC Rising concerns about further rate hikes sent stocks lower to kick off the second half of trading. The Dow Jones Industrial Average lost 1.96%, while the Standard & Poor’s 500 retreated 1.16%. The Nasdaq Composite index surrendered 0.92% for the week.

Calculated Risk

JULY 10, 2023

With the pandemic, there was a surge in 2nd home buying. I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic. This graph is for South Lake Tahoe since 2004 through June 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

JULY 10, 2023

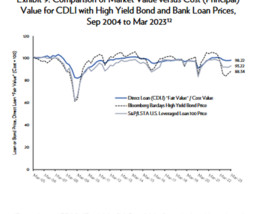

Investors seeking higher yields and relatively low risk, and are willing to sacrifice liquidity, will find attractive opportunities in interval funds that invest in senior-secured, sponsored middle-market loans.

Sara Grillo

JULY 10, 2023

Financial advisors are skeptical that you can actually get leads from social media. Well today I have a planner who has blown up his lead pipeline, in less than nine months. Today we’ll be talking to Thomas Kopelman , co-founder of AllStreet Wealth and you want to pay attention here because he makes getting leads from financial advisor social media look like a piece of cake!

Advisor Perspectives

JULY 10, 2023

The world’s sovereign investors are seeking to boost investment in bonds as yields rise, while a freeze on Russian assets has increased their demand for gold, Invesco Ltd. said in an annual report.

Norman Marks

JULY 10, 2023

I recently re-read an article in a McKinsey’s Strategy & Finance newsletter, Overcoming a bias against risk. (I strongly recommend subscribing.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 10, 2023

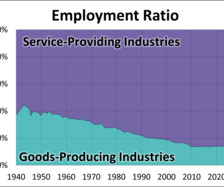

The latest monthly employment report showed 209,000 nonfarm jobs were added in June. An industry breakdown of that number shows a gain of 180,000 service-providing jobs and a gain of 29,000 goods-producing jobs.

Don Connelly & Associates

JULY 10, 2023

There's never been a better time to build a financial advisory practice. More people than ever are clamoring for quality, objective financial advice to guide critical life decisions. It's also a very challenging time for newer financial advisors as the competition for quality prospects is fierce. However, unlike fledgling financial advisors of yesteryear who worked with little more than a reverse phone directory to find clients, advisors building a practice today have the advantage of years of h

Advisor Perspectives

JULY 10, 2023

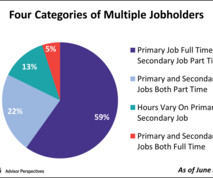

Multiple jobholders account for 4.9% of civilian employment. The survey captures data for four subcategories of the multi-job workforce, the relative sizes of which we've illustrated in a pie chart.

International College of Financial Planning

JULY 10, 2023

CFP, or the Certified Financial Planner exam, is a significant milestone in becoming a certified financial planner. It requires dedicated preparation, comprehensive knowledge, and effective study strategies. In this blog post, we will explore valuable tips to help you navigate the CFP exam and maximize your chances of success. Understand the Exam Structure and Content Before diving into your CFP exam preparation, it is essential to familiarize yourself with the exam structure and content.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JULY 10, 2023

We believe that avoiding whole sectors or business models introduces portfolio risk and should be done only with careful consideration and a strategic, holistic plan.

International College of Financial Planning

JULY 10, 2023

How Investment Advisors Play a Significant Role in Managing Finances? The field of investment advisory presents a world of opportunities for individuals passionate about finance and investments. If you have an analytical mindset, a keen interest in the financial markets, and the desire to help others achieve their financial goals, a career as an investment advisor may be the perfect fit.

Advisor Perspectives

JULY 10, 2023

VettaFi’s Dave Nadig checks-in on some of the hottest ETF topics over the past several years. Cambria’s Meb Faber discusses the firm’s continued growth and spotlights the Cambria Shareholder Yield ETF (SYLD). Strategas’ Todd Sohn provides the 10 ETFs he’s using to track market conditions in the second half of 2023.

WiserAdvisor

JULY 10, 2023

High-interest rates and inflation can be challenging for investors. Interest rates directly impact your investment returns, and inflation compromises the purchasing power of your money. When this happens at the same time, you can be left in a tricky situation. The U.S. experienced one of the highest inflationary periods in history when the inflation rate was more than 9% in June 2022.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Zoe Financial

JULY 10, 2023

Market Drama Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA July 10, 2023 Watch Time: 2 minutes Welcome to this week’s Market Drama! The Stock Market: The S&P was down over 1% for the week. It’s up close to 15% year-to-date. Economic Data: Payroll’s data could have driven the markets to sell-off. U.S. payroll came in weaker than expected at 209,000 vs. the expected 240,000.

NAIFA Advisor Today

JULY 10, 2023

After 17 years of working with animals in pet shops, shelters, and zoos, Christian Kalinowski decided it was time for a change. He considered a sales career in a few different sectors before finally settling on insurance and financial services. He wanted to help educate people on a topic he didn’t learn much about growing up—personal finance. So, in 2021, he joined Dipaola Financial Group as a financial service professional.

Validea

JULY 10, 2023

In his 58 years of running Berkshire Hathaway, buying stock in Apple is arguably Warren Buffett’s biggest investment success, contends an article in Barron’s. At the end of June, Apple’s market value reached $3 trillion, making Berkshire’s stake in the company worth $176 billion—five times the original cost of $31 billion when Buffett bought it in 2016.

Clever Girl Finance

JULY 10, 2023

If you’re ready to leave a relationship but are staying because you have no money, it can put you in a pretty bad situation. Living unhappily or feeling trapped doesn’t do anyone any good and can have many negative effects. It’s important to know when to leave a relationship and not to feel like you don’t have options when it’s time to go. Table of contents How do you know when it’s time to leave a relationship?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content