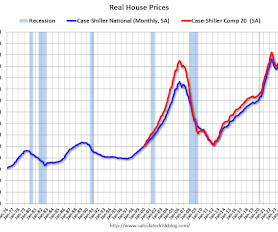

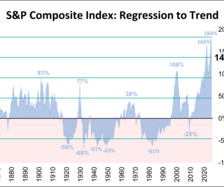

Inflation Adjusted House Prices 0.8% Below 2022 Peak; Price-to-rent index is 7.5% below 2022 peak

Calculated Risk

MAY 1, 2025

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 0.8% Below 2022 Peak Excerpt: It has been over 18 years since the housing bubble peak. In the February Case-Shiller house price index released this week, the seasonally adjusted National Index (SA), was reported as being 79% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 12% above the bubble peak (and historically there has been an upward slope to real house prices).

Let's personalize your content