Representation, Tech and the Future of Financial Services: My Advyzon Experience

Wealth Management

FEBRUARY 21, 2025

Innovation, strategic networking and cross-generational collaboration offer a path forward.

Wealth Management

FEBRUARY 21, 2025

Innovation, strategic networking and cross-generational collaboration offer a path forward.

Advisor Perspectives

FEBRUARY 21, 2025

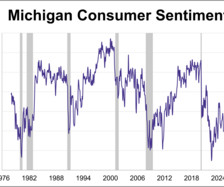

Consumer sentiment plummeted to its lowest level since November 2023 this month, according to the final report for the Michigan Consumer Sentiment Index. The index dropped 6.4 points (-9.0%) to 64.7, marking the largest monthly decline since May and falling short of the 67.3 forecast. Sentiment is now down 15.9% from a year ago, the steepest annual decline since late 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

FEBRUARY 21, 2025

The decision is the latest retreat from the policies of former SEC Chair Gary Gensler, who officials in the crypto industry complained had sought to regulate the industry through enforcement actions.

Advisor Perspectives

FEBRUARY 21, 2025

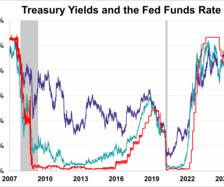

The yield on the 10-year note ended February 21, 2025 at 4.42%, its lowest level since mid-December. Meanwhile, the 2-year note ended at 4.19% and the 30-year note ended at 4.67%.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

FEBRUARY 21, 2025

The movement to debut private-asset ETFs gained momentum last year after Apollo Global Management and State Street Global Advisorsfiled for a fundthat would directly hold private credit investments.

Advisor Perspectives

FEBRUARY 21, 2025

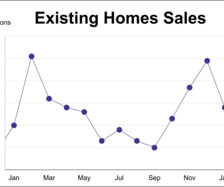

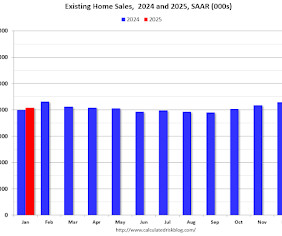

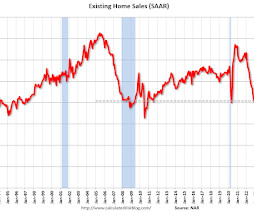

Existing home sales started the year with their first decline in four months. According to the National Association of Realtors (NAR), existing home sales retreated 4.9% from December, reaching a seasonally adjusted annual rate of 4.08 million units in January.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

FEBRUARY 21, 2025

Wall Street brokers and dealers are pushing back on a new margin rule that the world’s largest derivatives-clearing house has proposed to address the risk from the boom in zero-day options even after some revisions.

Wealth Management

FEBRUARY 21, 2025

According to the Department of Justice, Adam Kaplan told an unnamed associate to threaten to harm witnesses in an ongoing fraud investigation against him and his brother.

Advisor Perspectives

FEBRUARY 21, 2025

Wall Street is still awaiting regulatory approval for the first full-blown private-asset ETFs, but for now opportunistic issuers are continuing to churn out products that claim to replicate the booming asset class — and stretching the definition of “liquid private equity.

Wealth Management

FEBRUARY 21, 2025

A legally trained financial advisor helps clients stay on track and avoid missed opportunities for estate planning.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Advisor Perspectives

FEBRUARY 21, 2025

The European stock market’s rally to record highs has caught many strategists by surprise, leaving them racing to catch up and cautious on further gains.

Wealth Management

FEBRUARY 21, 2025

Corey Frayer, the newly installed director of investor protection at the Consumer Federation of America, also said the commissions approach could erode market trust.

Advisor Perspectives

FEBRUARY 21, 2025

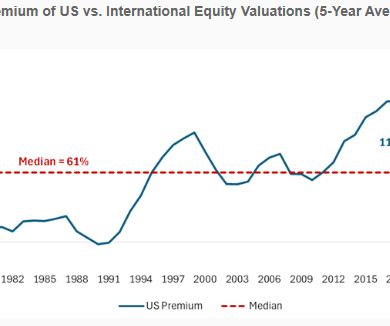

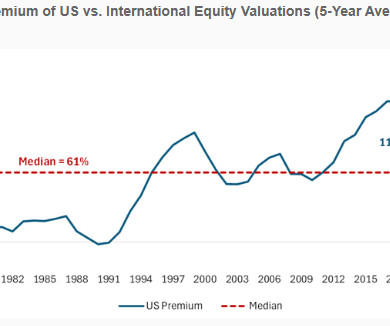

Lofty U.S. stock valuations call for a renewed focus on risk assessment and portfolio diversification.

Calculated Risk

FEBRUARY 21, 2025

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January Excerpt: Sales in January (4.08 million SAAR) were down 4.9% from the previous month and were 2.0% above the January 2024 sales rate. This was the fourth consecutive year-over-year increase after declining YoY every month for over 3 years.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

FEBRUARY 21, 2025

My friends like to make fun of me by taunting that I don’t like to commit to things. I’m constantly trying new hobbies. I don’t like to make plans too far in advance because something more exciting might pop up. I don’t even like to renew my car tags for more than one year.

Calculated Risk

FEBRUARY 21, 2025

From ICE: ICE First Look at Mortgage Performance: Foreclosure Starts Jump as VA Moratorium Ends; Wildfire Delinquencies Emerge Delinquencies fell 24 basis points (bps) to 3.47% in January ; thats 10 bps higher than last year, but 33 bps below pre-pandemic levels Foreclosure starts jumped by 30% and sales rose by 25% in January driven by an expiration in the VA foreclosure moratorium with active inventory rising by 7% in the month While the number of borrowers past due as a result of last ye

Advisor Perspectives

FEBRUARY 21, 2025

Following the relatively solid January Employment Situation report, the market’s undivided attention, at least economic data-wise, then turned to the latest CPI reading. Indeed, with the jobs aspect of the Fed’s dual mandate clearly showing no urgency to cut rates further at this time, the question then turned to the inflation portion of the policy maker’s mission.

Nerd's Eye View

FEBRUARY 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli Associates finds that while financial planning clients (particularly high-net-worth clients) are overwhelmingly satisfied with their advisors, many advisors face client acquisition challenges despite investors being increasingly willing to pay for advice services.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

FEBRUARY 21, 2025

The S&P 500 notched two new record highs but also logged its worst day of the year—all in the same week. The index is now 2.13% below its record close from February 19th, 2025 and is up 2.46% year to date.

The Big Picture

FEBRUARY 21, 2025

This week, I speak with Charles Ellis, author and Founder of Greenwich Associates. Prior to founding Greenwich Associates in 1972, Charles worked with the Rockefeller family investments office and Donaldson, Lufkin, and Jenrette. Charley was appointed to the faculty of the Yale School of Management and twice to the Harvard Business School. He also served as a trustee at Yale from 1997 to 2008, and was chairman of the Endowment.

Advisor Perspectives

FEBRUARY 21, 2025

Sales of existing US homes fell last month for the first time since September, as the combination of high mortgage rates and prices sets a grim backdrop heading into the crucial spring selling season.

Calculated Risk

FEBRUARY 21, 2025

From the NAR: Existing-Home Sales Decreased 4.9% in January, But Increased Year-Over-Year for Fourth Consecutive Month Existing-home sales retreated in January, according to the National Association of REALTORS. Sales slipped in three major U.S. regions and held steady in the Midwest. Year-over-year, sales rose in three regions and were unchanged in the South.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

FEBRUARY 21, 2025

Alibaba Group Holding Ltd. is turning out to be a great investment this year: Not only its shares have jumped more than 60%, its convertible bonds are also up big time.

Calculated Risk

FEBRUARY 21, 2025

From BofA: We initiated our 1Q US GDP tracker with the January retail sales print on February 14. Since then, our 1Q GDP tracker is down two-tenths to 2.3% q/q saar from our official forecast of 2.5% q/q saar. Meanwhile, our 4Q GDP tracking is down two-tenths to 2.2% q/q saar since our last weekly publication. [Feb 21st] emphasis added From Goldman: [W]e lowered our Q1 GDP tracking estimate by 0.1pp to +1.9% (quarter-over-quarter annualized) and our Q1 domestic final sales estimate by 0.1pp to +

Advisor Perspectives

FEBRUARY 21, 2025

Consider estate planning strategies to minimize the impact of taxes on your estate. Our Bill Cass highlights several key actions including document reviews, naming beneficiaries and the use of 529 college savings plans to enhance tax efficiency.

Alpha Architect

FEBRUARY 21, 2025

The listing domicile explained about 50% of the valuation gap. In other words, US-listed stocks are substantially more expensive than internationally listed stocks for no reason other than the place of listing. Listing Domicile Driving Valuations was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

FEBRUARY 21, 2025

At some point in time, the top brass that manage your organization’s investments will no longer be with the organization, whether that’s through retirement, a job change, or a change in personal circumstances. Then what?

Alpha Architect

FEBRUARY 21, 2025

The listing domicile explained about 50% of the valuation gap. In other words, US-listed stocks are substantially more expensive than internationally listed stocks for no reason other than the place of listing. Listing Domicile Driving Valuations was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

FEBRUARY 21, 2025

Europe has real risks and real bargaining tools in a trade confrontation.

Random Roger's Retirement Planning

FEBRUARY 21, 2025

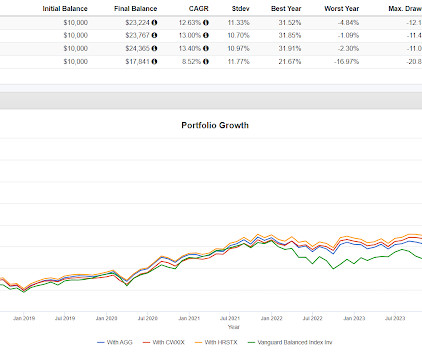

Today, a follow up to yesterday's post by plugging the Catalyst/Warrington Strategic Program Fund (CWXIX) and the Rational Tactical Return Fund (HRSTX) into a portfolio as bond substitutes. The primary strategy for both is primarily using option combos to create a T-bill like return similar to client holding Alpha Architect Box ETF (BOXX).The funds have a little more going on with trend and volatility trading than BOXX does.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content