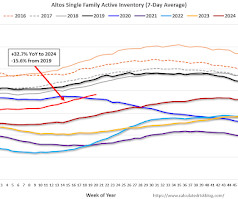

Housing May 19th Weekly Update: Inventory up 1.5% Week-over-week, Up 32.7% Year-over-year

Calculated Risk

MAY 19, 2025

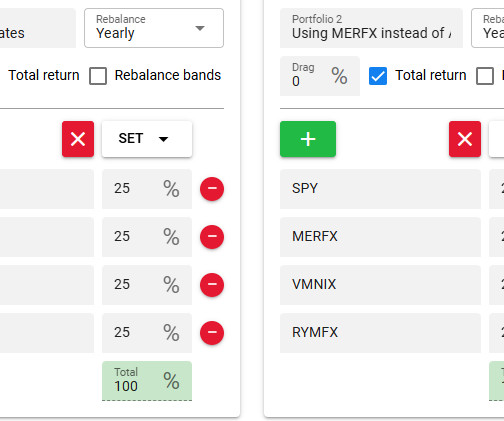

Altos reports that active single-family inventory was up 1.5% week-over-week. Inventory is now up 22.9% from the seasonal bottom in January and is increasing. Usually, inventory is up about 13% from the seasonal low by this week in the year. So, 2025 is seeing a larger than normal pickup in inventory. The first graph shows the seasonal pattern for active single-family inventory since 2015.

Let's personalize your content