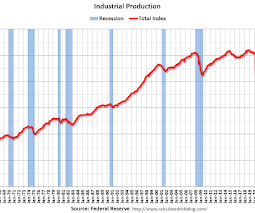

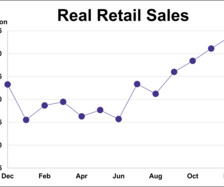

Industrial Production Increased 0.5% in January

Calculated Risk

FEBRUARY 14, 2025

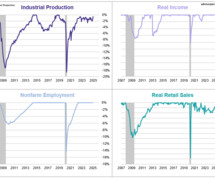

From the Fed: Industrial Production and Capacity Utilization Industrial production (IP) increased 0.5 percent in January after moving up 1.0 percent in December. In January, gains in the output of aircraft and parts contributed 0.2 percentage point to total IP growth following the earlier resolution of a work stoppage at a major aircraft manufacturer.

Let's personalize your content