The Word on WealthTech for September 2023

Wealth Management

AUGUST 31, 2023

F2 Strategy's co-founder and CEO provides his take on the most important wealth management technology news of the last month.

Wealth Management

AUGUST 31, 2023

F2 Strategy's co-founder and CEO provides his take on the most important wealth management technology news of the last month.

Calculated Risk

AUGUST 31, 2023

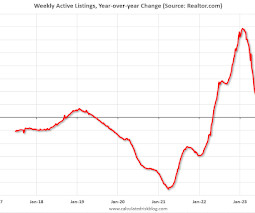

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Hannah Jones: Weekly Housing Trends View — Data Week Ending Aug 26, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 5.9%. This past week marked the 10th consecutive decline in the number of homes actively for sale compared to the prior year, however the gap narrowed for the fourth week in a row. • New listings–a measure of sellers putting homes up for sale

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 31, 2023

Transparency in financial reporting, favorable partnership structures are taking on more importance for family offices in a riskier investment climate.

The Big Picture

AUGUST 31, 2023

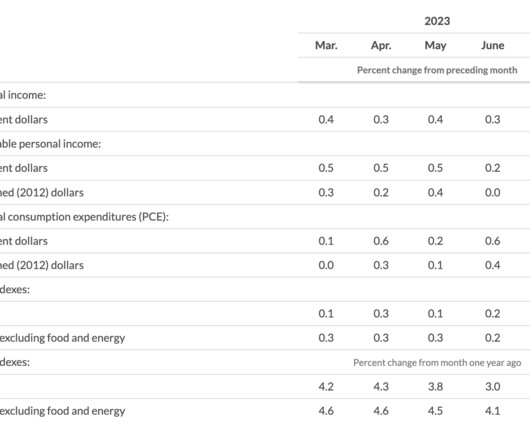

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year. Here is BEA: Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July, according to estimates released today by the Bureau of Economic Analysis (table 3 and table 5). Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billio

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 31, 2023

Two private equity players take Focus private in an all-cash deal; the firm’s stock has ceased trading on the NASDAQ.

Abnormal Returns

AUGUST 31, 2023

Strategy Some neglected aspects of investing including 'The influence of luck in outcomes.' (investmenttalk.co) The story of a top investor's mistake holding a stock too long. (morningstar.com) Banks How is the integration of First Republic going for JP Morgan Chase ($JPM)? (theinformation.com) More capital would not have saved SVB. (ft.com) Finance A handful of big IPOs are queued up after Labor Day including Instacart, Arm Holdings and Klayvio.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

AUGUST 31, 2023

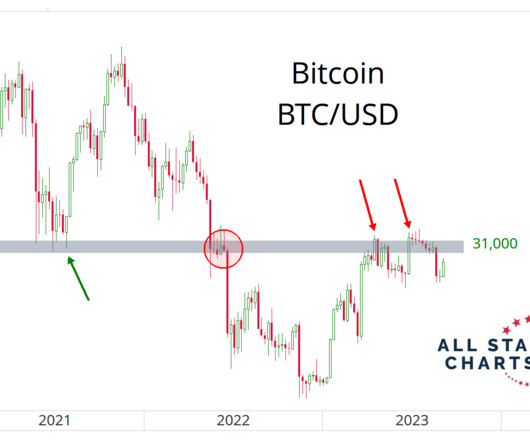

My end of August, morning train WFH reads: • Money Is Pouring Into AI. Skeptics Say It’s a ‘Grift Shift.’ The move from crypto to artificial intelligence has fueled the markets this year, but some are questioning how much of it is real. ( Institutional Investor ) • What to Do With a 45-Story Skyscraper and No Tenants : HSBC’s plan to leave its Canary Wharf tower for a smaller site shows the global challenges ahead in repurposing unwanted office space for a post-pandemic world. ( Citylab ) see al

Wealth Management

AUGUST 31, 2023

Private equity players open up about challenges and opportunities in the wealth management space.

Calculated Risk

AUGUST 31, 2023

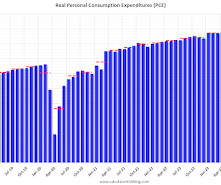

The BEA released the Personal Income and Outlays report for July: Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July , according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billion (0.8 percent).

Wealth Management

AUGUST 31, 2023

Greater education around alternatives and the need for diversified assets have boosted use — and there is still room to grow.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 31, 2023

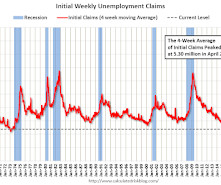

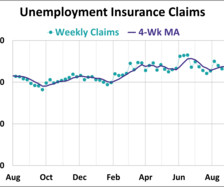

The DOL reported : In the week ending August 26, the advance figure for seasonally adjusted initial claims was 228,000 , a decrease of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 230,000 to 232,000. The 4-week moving average was 237,500, an increase of 250 from the previous week's revised average.

Wealth Management

AUGUST 31, 2023

Some companies that reduced their office space are now going back and signing new leases, reports Bisnow. U.S. non-life insurers are positioned to withstand any difficulties in their mortgage portfolios, according to Fitch Ratings. These are among the must reads from around the real estate investment world to end the week.

Calculated Risk

AUGUST 31, 2023

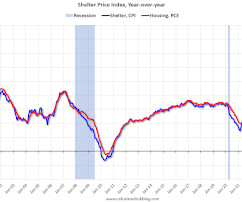

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through July 2023. CPI Shelter was up 7.7% year-over-year in July, down from 7.8% in June, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 7.8% YoY in July , down from 8.0% in June, and down from the cycle peak of 8.4% in April 2023.

Wealth Management

AUGUST 31, 2023

Wednesday, September 20, 2023 | 2:00 PM ET

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 31, 2023

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill: "We estimate nonfarm payrolls rose by 149k in August (mom sa) , below consensus of +170k. our forecast embeds a 26k one-time drag from the combination of Hollywood worker strikes (-18k) and Yellow trucking layoffs (-8k). We estimate that the unemployment rate was unchanged at 3.5% —in line with consensus—reflecting a modest rise in household employment and unchanged labor force participation (at 62.6%).

Wealth Management

AUGUST 31, 2023

Thursday, September 28, 2023 | 2:00 PM ET

Calculated Risk

AUGUST 31, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, Employment Report for August. The consensus is for 187,000 jobs added, and for the unemployment rate to be unchanged at 3.5%. • At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 46.6, up from 46.4 in July. • At 10:00 AM, Construction Spending for July.

Wealth Management

AUGUST 31, 2023

Building a portfolio involves tradeoffs and intelligently evaluating them will yield a better result than using rigid cutoffs.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 31, 2023

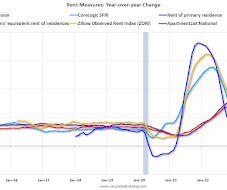

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.2% Year-over-year A brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

The Reformed Broker

AUGUST 31, 2023

Arista Networks upgraded to a buy from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

A Wealth of Common Sense

AUGUST 31, 2023

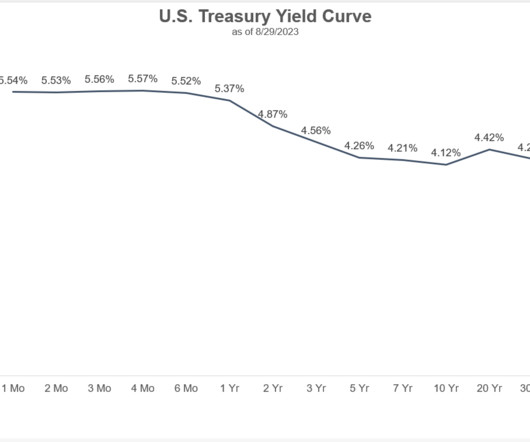

Jonathan Novy, one of our advisors and insurance experts at Ritholtz Wealth, joined me this week to discuss questions about emergency funds, investing when you don’t have a 401k, annuity yields and long-term care insurance. Further Reading: Why I’m More Worried About the Bond Market Than the Stock Market 1The same is true of CDs. I looked at 5 year CD yields at Marcus today.

Advisor Perspectives

AUGUST 31, 2023

In the week ending August 26, seasonally adjusted initial jobless claims fell for a third consecutive week to 228,000. Initial claims decreased by 4,000 from the previous week's revised figure and came in below the forecast of 235,000.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Million Dollar Round Table (MDRT)

AUGUST 31, 2023

By Antoinette Tuscano, MDRT Content Specialist Million Dollar Round Table members’ careers — and sometimes their lives — change because of friends they meet through the organization or speakers they see at events such as the MDRT Annual Meeting. One life-changing speaker was the late Jim Rohn, who went from being broke to a millionaire in a few years and went on to mentor people such as life coach Tony Robbins.

Advisor Perspectives

AUGUST 31, 2023

Valid until the market close on September 30, 2023 The S&P 500 closed August with a monthly loss of 1.71%, after a gain of 3.22% in July. At this point, after close on the last day of the month, two of five Ivy portfolio ETFs — iShares 7-10 Year Treasury Bond ETF (IEF) and Vanguard Real Estate ETF (VNQ)— is signaling "cash", up from last month's single "cash" signal.

Integrity Financial Planning

AUGUST 31, 2023

The history of financial tools is a fascinating topic that takes us back to the earliest civilizations. It reveals a remarkable continuity in financial technology across cultures and epochs, highlighting the importance of these systems in societal development and economic growth. The earliest records of financial tools can be traced back to ancient Mesopotamia, where clay tablets inscribed with cuneiform script were used as ledgers.

Advisor Perspectives

AUGUST 31, 2023

Fears of inflation arise, in part, from the fact that its sources seem mysterious and uncontrollable while it extracts immediate, adverse effects on essentially all people’s lives and household budgets.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can assess your financial situation, long-term goals, risk tolerance, and investment preferences to create personalized strategies. They can also help you optimize your savings and investment plans, ensuring that you maximize your earning potential while minimizing risks.

Advisor Perspectives

AUGUST 31, 2023

Volatile rates are adding to the cost of residential debt.

Fintoo

AUGUST 31, 2023

Highlights Issue Size – 11,128,858 shares Issue Open/Close – Aug 30/Sept 1, 2023 Price Band (Rs.) 418 – 441 Issue Size- Rs 4,651 mn – 4,907 mn Face Value (Rs) 10 Lot Size (shares) 34 Rishabh Instruments Limited is a vertically integrated player incorporated in 1982, involved in designing, developing, manufacturing and supplying (a) Electrical […] The post Rishabh Instruments Ltd IPO (Avoid) appeared first on Fintoo Blog.

Advisor Perspectives

AUGUST 31, 2023

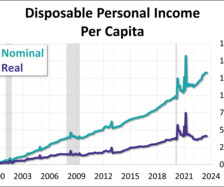

With the release of July's report on personal incomes and outlays, we can now take a closer look at "real" disposable personal income per capita. At two decimal places, the nominal -0.01% month-over-month change in disposable income comes to -0.23% when we adjust for inflation. The year-over-year metrics are 6.66% nominal and 3.27% real.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content