Wealth.com Adds Brian Hamburger as Strategic Advisor

Wealth Management

SEPTEMBER 28, 2023

MarketCounsel founder Brian Hamburger joins estate planning tech platform Wealth.com as a strategic advisor.

Wealth Management

SEPTEMBER 28, 2023

MarketCounsel founder Brian Hamburger joins estate planning tech platform Wealth.com as a strategic advisor.

Calculated Risk

SEPTEMBER 28, 2023

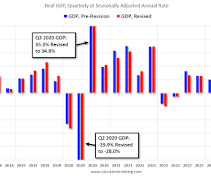

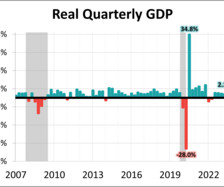

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), Second Quarter 2023 and Comprehensive Update Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2023 , according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2 percent (revised).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 28, 2023

The outgoing CEO of Orion Advisor Solutions shares his journey from the founding of the company, the firm’s growth over the years and perspectives on the future of wealth management, technology and AI.

Abnormal Returns

SEPTEMBER 28, 2023

Books An excerpt from "Optimal Illusions: The False Promise of Optimization" by Coco Krumme. (engadget.com) An excerpt from Michael Wolff's new book, "The Fall: The End of Fox News and the Murdoch Dynasty." (theankler.com) A Q&A with Taylor Lorenz author of "Extremely Online: The Untold Story of Fame, Influence, and Power on the Internet." (vox.com) Health Is the 'war on cancer' a failure?

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 28, 2023

Preferred equity providers are increasingly looking to close financing gaps in the multifamily sector, according to Multi-Housing News. CoStar News looks into how the proliferation of AI is driving data center growth beyond their usual markets. These are among today’s must reads from around the commercial real estate industry.

Calculated Risk

SEPTEMBER 28, 2023

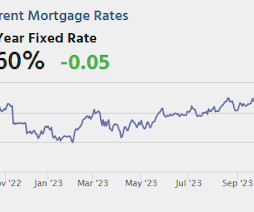

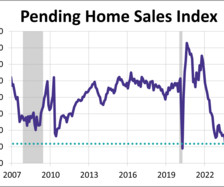

From the NAR: Pending Home Sales Tumbled 7.1% in August Pending home sales slid 7.1% in August , according to the National Association of REALTORS®. All four U.S. regions posted monthly losses and year-over-year declines in transactions. "Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers," said Lawrence Yun, NAR chief economist.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 28, 2023

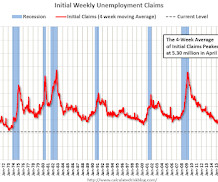

The DOL reported : In the week ending September 23, the advance figure for seasonally adjusted initial claims was 204,000 , an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 201,000 to 202,000. The 4-week moving average was 211,000, a decrease of 6,250 from the previous week's revised average.

Wealth Management

SEPTEMBER 28, 2023

Harness “digital” to improve the 6-steps of the client experience.

Calculated Risk

SEPTEMBER 28, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, Personal Income and Outlays, August 2023. The consensus is for a 0.5% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.5% YoY, and core PCE prices up 3.9% YoY. • At 9:45 AM, Chicago Purchasing Managers Index for September.

Wealth Management

SEPTEMBER 28, 2023

Kraken has applied with FINRA for a broker/dealer license to allow it to trade US-listed stocks and ETFs, targeting a 2024 launch.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

SEPTEMBER 28, 2023

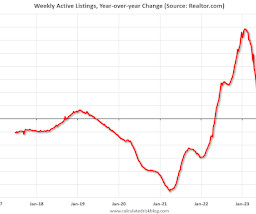

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Jiayi Xu: Weekly Housing Trends View — Data Week Ending Sep 23, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 3.7%. During the past week, we observed the 14th successive drop in the number of homes available for sale when compared to the previous year.

Wealth Management

SEPTEMBER 28, 2023

The money manager says sustainable investing is here to stay, but ESG-labeled index-tracking portfolios are the wrong path.

Calculated Risk

SEPTEMBER 28, 2023

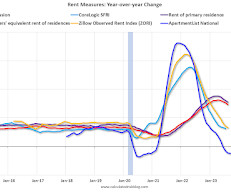

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.2% Year-over-year A brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

Wealth Management

SEPTEMBER 28, 2023

Republican Party presidential contenders outline policies on China, Social Security, tax cuts, banking and energy.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

SEPTEMBER 28, 2023

Strategy Understanding seasonality can enlighten your view of the stock market. (theirrelevantinvestor.com) Why it is so hard to be a truly long term investor. (behaviouralinvestment.com) Why traditional diversification isn't enough. (morningstar.com) Finance M&A volume has fallen off the table. (ft.com) Why auto insurance premiums are soaring. (barrons.com) How much is Tesla ($TSLA) worth?

Wealth Management

SEPTEMBER 28, 2023

According to the latest study, roughly one-third of HNW investors don’t work with an advisor. Learn how to leverage the sizeable opportunity to attract more of them to your practice.

A Wealth of Common Sense

SEPTEMBER 28, 2023

A reader asks: I just turned 27 and I make $260k at a job that I just started less than a year ago. It was a grind to get here and then the job itself is very stressful. I dread going to work in the morning, but I deal with it for the money and save/invest the vast majority of it so I don’t have to do this forever. For context I have ~$400k total in investments right now.

Wealth Management

SEPTEMBER 28, 2023

Schwab cut the fees on SCYB and SCHP, bringing all nine of its fixed-income funds to three basis points or below.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Trade Brains

SEPTEMBER 28, 2023

Top Indian Stocks Held By Societe Generale : Societe Generale was established in India in 1978. Today, Societe Generale operates through its local branches based in Mumbai and Delhi serving both Indian corporates and financial institutions, helping them to expand their footprint outside of India as well as global clients of Societe Generale, from Europe, US, Middle East, Africa, and Asia-Pacific, to develop their operations in India Societe Generale’s expertise ranges from corporate and investme

The Irrelevant Investor

SEPTEMBER 28, 2023

Cullen Roche once said, “The stock market is the only market where things go on sale and all the customers run out of the store… ” This behavior might seem irrational, but it’s understandable when you consider how averse people are to losing money. The fastest way to make the pain disappear is to sell, regardless of the irreparable damage you may be doing to your long-term returns.

Trade Brains

SEPTEMBER 28, 2023

India can become the 3rd largest economy by 2027 and even the 2nd largest by 2075, surpassing the US. But hold on! Isn’t it very soon to celebrate? Here’s a truth, a fact, or, you can say, a reality, that we are not yet ready to accept. The increasing youth unemployment! 66% of India’s population (that’s 808 million people) is under the age of 35. Now, that’s a huge number of young, talented people, and a great opportunity for the country to grow its economy with multitalented and skilled

Carson Wealth

SEPTEMBER 28, 2023

By Ryan Detrick, Chief Market Strategist, Carson Group “I don’t make jokes. I just watch the government and report the facts.” -Will Rogers As you’ve probably heard by now, the government is on the brink of shutting down unless Congress connects on a Hail Mary to pass a dozen spending bills before the September 30 funding deadline. The odds are this won’t happen and on October 1 the government will be at least partially shutdown.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

NAIFA Advisor Today

SEPTEMBER 28, 2023

NAIFA and Sales Activity Management , Inc. (SAM) have completed an educational and affinity partnership agreement, under which the popular SAM Planner can be obtained by NAIFA members at a preferred rate. Additionally, Sales Activity Management, Inc. will become a sponsor of NAIFA’s Talent Development Center of Excellence to collaborate on blog posts, webinars, and other tools focused on enhancing individual advisor/agent performance.

Advisor Perspectives

SEPTEMBER 28, 2023

The MOVEit breach affected the clients of every wealth manager in America.

The Irrelevant Investor

SEPTEMBER 28, 2023

Today’s Compound and Friends is brought to you by Wealth.com: See here for more information on estate planning solutions for financial advisors. On today’s show, we discuss: META’s new smart glasses The FTC suit against Amazon FTC sues Amazon for illegally maintaining monopoly power Amazon takes a big stake in the AI start-up Anthropic Tech stocks weigh on major indexes OpenAI seeks new valuatio.

Advisor Perspectives

SEPTEMBER 28, 2023

The National Association of Realtors® (NAR) released the latest monthly data for its pending home sales index. The index plummeted 7.1% in August to 71.8, a larger decline than the expected -0.8% decrease. This is the lowest reading for the index since April 2020 and is the second lowest figure in the historical series. Pending home sales are down 18.7% compared to one year ago.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Steve Sanduski

SEPTEMBER 28, 2023

Guest: Manisha Thakor , MBA, CFA, CFP®, a national thought leader and personal finance expert with more than 25 years of experience working in the worlds of personal finance and investing. She’s also the author of a great new book, MoneyZen: The Secret to Finding Your “Enough.” In a Nutshell: Society trains us to believe that the answer to all of our problems is More: more stuff, more clicks, more Likes, and, of course, more money.

Advisor Perspectives

SEPTEMBER 28, 2023

Real gross domestic product increased at an annual rate of 2.1% in Q2 2023, according to the third estimate. The latest estimate is consistent with growth expectations and is a slightly slower pace than the Q1 2023 GDP final estimate of 2.2% (revised).

Trade Brains

SEPTEMBER 28, 2023

Vishnusurya Projects and Infra IPO Review : Vishnusurya Projects and Infra Limited is coming up with its Initial Public Offering. This is an SME (small and medium size enterprise) which is going to be listed on NSE SME. The IPO will open for subscription 29th September 2023, and closes on 4th October 2023. This review will delve in about the company and their financials, GMP, strengths and weaknesses.

Advisor Perspectives

SEPTEMBER 28, 2023

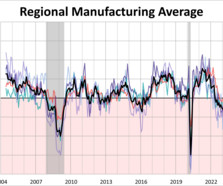

Five out of the 12 Federal Reserve Regional Districts currently publish monthly data on regional manufacturing: Dallas, Kansas City, New York, Richmond, and Philadelphia. The September average of the five districts is -6.5, down from the previous month.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content