Two Teams From Rival Private Banks Overseeing $6B Launch RIA

Wealth Management

AUGUST 12, 2022

Fidelis hopes to bring private banking services to the independent space, at a time when, these advisors say, the big institutions are cutting back.

Wealth Management

AUGUST 12, 2022

Fidelis hopes to bring private banking services to the independent space, at a time when, these advisors say, the big institutions are cutting back.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S. Senate has passed the Inflation Reduction Act, which while being light on individual tax changes, nevertheless includes some important financial planning provisions such as prescription drug price relief for Medicare enrollees, continuation of expanded Affordable Care Act healthcare premium subsidies, and tax credits for energy efficiency upgrade

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 12, 2022

Numerous advisor innovations have become permanent; it's not just Zoom and hybrid work.

Calculated Risk

AUGUST 12, 2022

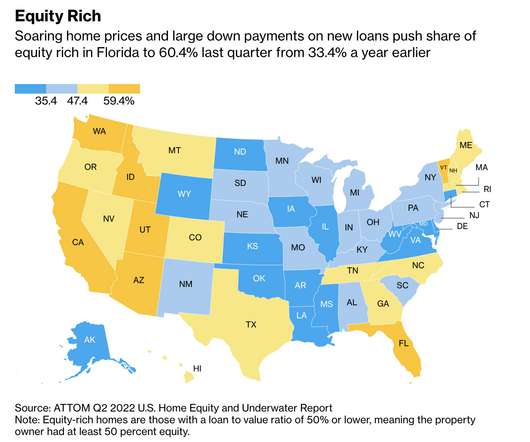

Today, in the Calculated Risk Real Estate Newsletter: Realtor.com Reports Weekly Inventory Up 28% Year-over-year Excerpt: As I noted earlier, Inventory will Tell the Tale about the housing market. And housing inventory is increasing, but the pace of growth has slowed in recent weeks. As the housing market slows, we need to watch inventory very closely.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 12, 2022

Retirement industry thought leaders answer three probing questions on critical issues providing an open, honest and candid dialogue.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S. Senate has passed the Inflation Reduction Act, which while being light on individual tax changes, nevertheless includes some important financial planning provisions such as prescription drug price relief for Medicare enrollees, continuation of expanded Affordable Care Act healthcare premium subsidies, and tax credits for energy efficiency upgrade

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 12, 2022

From housing economist Tom Lawler: American Homes 4 Rent Slashing MLS Purchases of Single Family Homes In American Homes 4 Rent (AMH) earnings conference call last week, officials said that the company was slashing its MLS-based purchases of single-family homes in the second half of 2022. Here are a few excerpts: “Now, turning to our investment strategy more broadly.

Wealth Management

AUGUST 12, 2022

The largest financial planning designation group announced several suspensions of advisors, including a Delaware-based planner who faces five counts of dealing child pornography, as well as a Maryland planner who was arrested and charged with manslaughter in an alleged drunk driving incident.

Abnormal Returns

AUGUST 12, 2022

Markets A 20% rally doth not a bull market make. (marketwatch.com) High yield bonds are bouncing. (allstarcharts.com) Companies The New York Times ($NYT) has attracted an activist investor in ValueAct. (cnbc.com) Why time isn't on Elon Musk's side when it comes to Twitter ($TWTR). (theverge.com) Which companies might get hit by a global minimum tax.

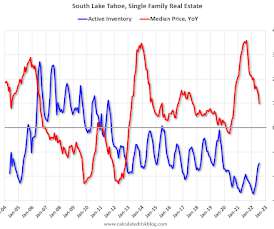

Calculated Risk

AUGUST 12, 2022

With the pandemic, there was a surge in 2nd home buying. I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic. This graph is for South Lake Tahoe since 2004 through July 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

AUGUST 12, 2022

Sure there are risks, but taking a benchmark US Treasury security and putting it into an exchange-traded fund wrapper is a revolutionary idea.

Calculated Risk

AUGUST 12, 2022

From BofA: Looking ahead to next week, we will initiate our US GDP tracking for Q3 following the release of July retail sales. If our forecast for July retail sales prove accurate, it would suggest that household spending is off to a fast start in Q3 and pose upside risk to our forecast for another modest decline in real GDP in the quarter. [ -0.5 percent Q3 , perliminary estimate] emphasis added From Goldman: We left our Q3 GDP tracking estimate unchanged at +0.9% (qoq ar).

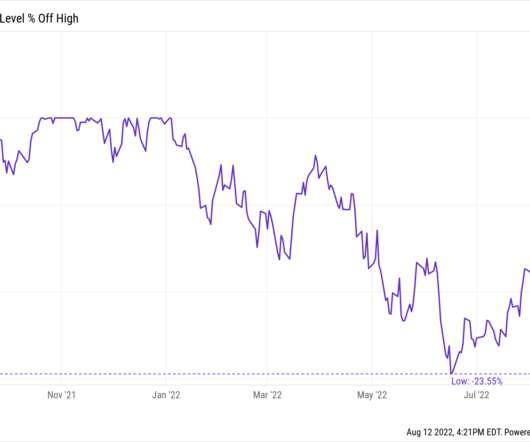

Wealth Management

AUGUST 12, 2022

The latest trading patterns suggest that the nasty selloff in the first half of the year may be over.

Abnormal Returns

AUGUST 12, 2022

The biz Apple ($AAPL) is funding podcasts in search of new TV shows. (theverge.com) Economics 30 economics-related podcasts that Cardiff Garcia recommends. (twitter.com) Barry Ritholtz talks with Prof. Anat Admati co-author of "The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It." (ritholtz.com) Virginia Heffernan talks housing affordability with Aaron Glantz.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

AUGUST 12, 2022

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Alex Morris, and Downtown Josh Brown discuss earnings, the jobs recovery, Netflix and the streaming wars, the bull case for Meta, the worst investing advice ever, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

The Irrelevant Investor

AUGUST 12, 2022

Each day ~94 million unique pieces of financial content are created and posted on the internet. I made that number up, but it seems reasonable. Time is your most precious resource, so you have to be vigilant about how you allocate it. You can lean on curators like Tadas Viskanta, use financial publication outlets like The Wall Street Journal or Barron’s, or read people who write on topics that are of particular inte.

Clever Girl Finance

AUGUST 12, 2022

As a legal adult, life can start to get expensive quickly. Everyone has some bills to pay. So, it’s not surprising that you’ve searched for high paying jobs for 18 year olds. The great news is there are a lot of good paying jobs for 18 year olds. Whether you are looking for a lucrative way to make ends meet or possibly fund your education, you’ve come to the right spot.

A Wealth of Common Sense

AUGUST 12, 2022

When my wife got pregnant for the second time she said something felt off. It was just a different feeling than the first time. On the way to her first ultrasound, she had an uneasy feeling. “I feel like it’s multiples.” I said no way that’s possible. We had infertility problems for years. Having one child felt like a miracle.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Meb Faber Research

AUGUST 12, 2022

Ehren Stanhope, O’Shaughnessy Asset Management – The Great Inflation, Factors, and Stock Returns (The Best Investment Writing Volume 6) Author: Ehren Stanhope is a Principal and Client Portfolio Manager at O’Shaughnessy Asset Management, where he is Responsible for positioning OSAM’s investment capabilities within the context of client needs and the current market environment to key […].

Norman Marks

AUGUST 12, 2022

WARNING: This is likely to be a controversial post! I have been talking (OK, preaching) about the need to manage the likelihood of achieving objectives (i.e., success) rather than limiting yourself and the organization by managing or mitigating risks. You need to take risks if you ever want to achieve objectives; the key is taking […].

Validea

AUGUST 12, 2022

Legendary investor Warren Buffett and his company Berkshire Hathaway are taking the age-old advice to “buy the dip,” reports an article in Bloomberg. In the second quarter of this year the conglomerate reported $3.8 billion in equity purchases, making it a net buyer that quarter; last year during the same period, it was a net seller. As the S&P 500 lost 16% in the last quarter, Berkshire posted a profit of $9.2 billion, scooping up massive gains from its insurance and railroad businesses.

ModernAdvisor

AUGUST 12, 2022

July was strong month for both equity and fixed income investors alike. July 2022 Market Performance All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted. *Absolute change in yield, not the return from holding the security. July was strong month for both equity and fixed income investors alike.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Validea

AUGUST 12, 2022

In an interview with CNBC’s Squawk Box , billionaire investor Bill Ackerman said the Fed’s actions to curb inflation have not been effective and that inflation remains the economy’s biggest problem. Though Ackman stressed that the economy is actually quite strong right now with full employment, wage increases, and plenty of jobs available, it’s hard to say whether that will be the case in 6 or 12 months.

Mullooly Asset Management

AUGUST 12, 2022

In this week’s podcast, Brendan, Tim and Casey discuss the most recent economic headlines including this week’s inflation reading, last week’s jobs report and Q2 earnings. The guys highlight a theme that’s been apparent over the last couple of weeks… the market’s reactions are more based on expectations rather than what’s actually going on right […] In this week’s podcast, Brendan, Tim and Casey discuss the most recent economic headlines including

Validea

AUGUST 12, 2022

The second quarter saw dividend payouts hit a record, a good sign for investors who have relied on income-producing stocks during this year’s slowdown, reports an article in The Wall Street Journal. According to S&P Dow Jones Indices, S&P 500 companies paid out $140.6 billion in dividends in the second quarter, an increase of $3 billion from the first quarter and $17.2 billion from the same period in 2021.

Random Roger's Retirement Planning

AUGUST 12, 2022

After seeing a quick video hit about a new ETF that benefits from rising rates, it got me to thinking about the current bear market in bonds. It's been going on a little longer than you might think. Here's a jam packed chart with all sorts of fixed income related funds. The funds that are down a lot are some of the bigger, more benchmarky types of trackers ranging from longer dated treasuries to broader bond proxies like AGG and LQD.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Validea

AUGUST 12, 2022

Though the current bear market is taking its toll everyone, from institutions to individual investors, an article in The New York Times posits that right now is actually a good moment for new, young, investors to put money into the market. That’s because investing now, when stock prices are down, but have a long stretch ahead of you to rebound, gives you a good chance to reap substantial rewards.

Calculated Risk

AUGUST 12, 2022

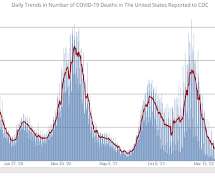

On COVID (focus on hospitalizations and deaths): Hospitalizations have almost quadrupled from the lows in April 2022. COVID Metrics Now Week Ago Goal New Cases per Day 2 103,105 118,550 ?5,000 1 Hospitalized 2 36,063 37,539 ?3,000 1 Deaths per Day 2 413 439 ?50 1 1 my goals to stop daily posts, 2 7-day average for Cases, Currently Hospitalized, and Deaths ??

Validea

AUGUST 12, 2022

As big banks report their second-quarter earnings, those reports could hold a clue as to whether or not a recession is on the horizon, contends an article in The Wall Street Journal. Bank executives generally have good insight into how healthy the U.S. economy is, based on their clients’ bank accounts. And though the first quarter did carry some positives—plentiful jobs and consumer spending—it was also hit by the highest inflation in 40 years, and a recent survey from JPMorgan shows a mere 19%

The Big Picture

AUGUST 12, 2022

My end-of-week morning train WFH reads: • This 20% Nasdaq gain doesn’t mean we’re in a new bull market : Explosive rallies are actually more common in bear markets ( Marketwatch ). • What the Great Mayonnaise Inflation Mystery Can Tell Us About Prices. Measuring price changes can be fiendishly difficult and highly subjective. Mayonnaise is a perfect example. ( Bloomberg ). • Is America’s Job Market “Too Good”?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content