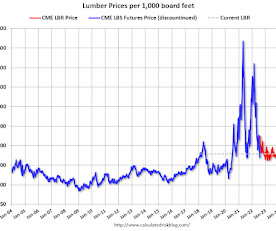

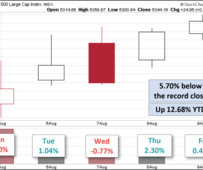

Update: Lumber Prices Up Slightly YoY

Calculated Risk

AUGUST 9, 2024

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

Let's personalize your content