10 Wednesday AM Reads

The Big Picture

MARCH 15, 2023

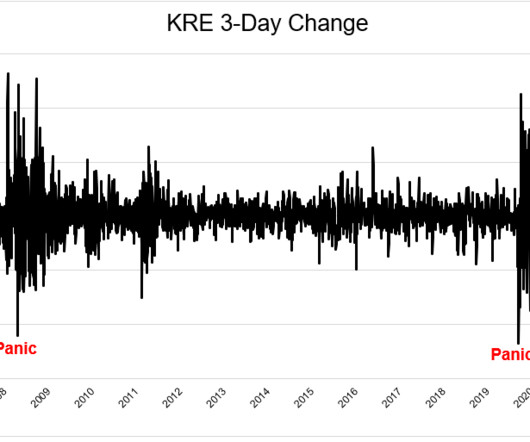

Programming note: Morning Reads will be in Dallas Thursday and Friday — we will be back on the weekend… My mid-week morning train reads: • Dissecting Goldman’s gory $2.25bn SVB equity issue Well that escalated quickly. ( Financial Times ) • Whose Fault is it Anyway : It has been 872 days since a bank failed in the United States. This was the longest streak on record.

Let's personalize your content