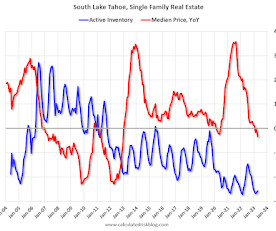

Second Home Market: South Lake Tahoe in April

Calculated Risk

MAY 9, 2023

With the pandemic, there was a surge in 2nd home buying. I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic. This graph is for South Lake Tahoe since 2004 through April 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Let's personalize your content