$47B RIA Clearstead Names New President and CEO

Wealth Management

DECEMBER 13, 2024

Bradley Knapp takes over for current CEO David C. Fulton, Jr., on Jan. 1, as part of a longstanding succession plan.

Wealth Management

DECEMBER 13, 2024

Bradley Knapp takes over for current CEO David C. Fulton, Jr., on Jan. 1, as part of a longstanding succession plan.

Nerd's Eye View

DECEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent study indicates that surveyed advisory firms that raised their fees in the last year saw almost identical 97% client retention rates as firms that lowered their fees (with the firms raising their fees bringing in more revenue in the first two years after doing so), suggesting that some growing firms might consider raising their fees (commensurate with the va

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

DECEMBER 13, 2024

It will cost you at least $1 million in nearly half the country to retire "comfortably," according to a GOBankingRates study.

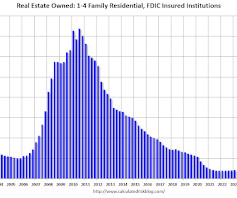

Calculated Risk

DECEMBER 13, 2024

Today, in the Calculated Risk Real Estate Newsletter: Q3 Update: Delinquencies, Foreclosures and REO A brief excerpt: We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

DECEMBER 13, 2024

Sallie Krawcheck, an outspoken investing advocate for women, has stepped down as CEO of Ellevest, citing health reasons.

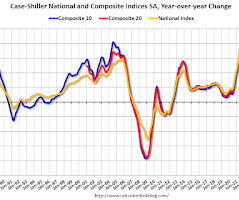

Calculated Risk

DECEMBER 13, 2024

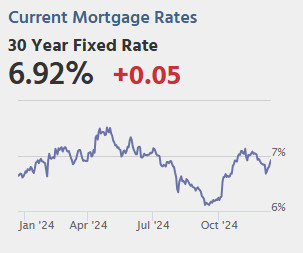

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-December 2024 A brief excerpt: Earlier this week, in Part 1: Current State of the Housing Market; Overview for mid-December 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

DECEMBER 13, 2024

Listening Nilay Patel talks with Nick Quah about why every company wants their own podcast these days. (theverge.com) The best audiobooks of 2024 including "We Solve Murders" by Richard Osman, narrated by Nicola Walker. (slate.com) Business David Senra talks with Brad Jacobs author of "How to Make a Few Billion Dollars." (founderspodcast.com) Joe Weisenthal and Tracy Alloway talk with Mike Yu, co-founder and CEO of Vesta, about why we don't have one-click mortgage refis.

Wealth Management

DECEMBER 13, 2024

Whats the reality when it comes to recruiting and transitions? An annual perspective for advisors.

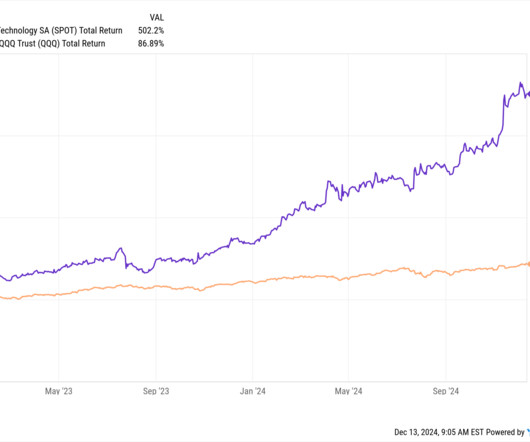

The Big Picture

DECEMBER 13, 2024

This week, we speak with Tony Kim , Managing Director and Head of the Fundamental Equities Global Technology Team at BlackRock. he is manager of the firm’s Technology Opportunities Fund (BGSAX), which has trounced the Nasdaq 100 and the MSCI World Net benchmarks since its inception in June 2000. Prior to joining BlackRock in 2013, he held key roles at institutions like Artisan Partners, Neuberger Berman, and Merrill Lynch.

A Wealth of Common Sense

DECEMBER 13, 2024

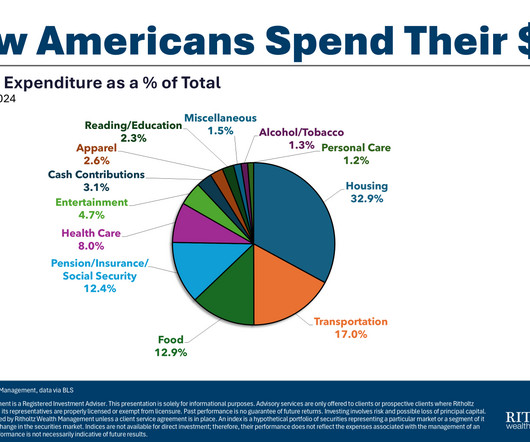

Here’s an email that came to our Animal Spirits inbox this week: A lot of people are wondering the same thing. The overall price level is up more than 20% this decade. Wages have more or less kept up but that’s on aggregate. Those who have seen their wages rise faster than average are offset by those whose incomes haven’t kept pace.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Indigo Marketing Agency

DECEMBER 13, 2024

Start by Owning January: 2025 Marketing Moves for Advisors As 2025 approaches, its crucial for financial advisors to prepare for a strong start to the new year. Implementing effective marketing strategies can help you connect with ideal clients and grow your business. Here are three actionable marketing tips to hit the ground running in January: 1. Enhance Your Online Presence With Service and Niche-Specific Pages Your website often serves as the first impression for potential clients.

Sara Grillo

DECEMBER 13, 2024

Most of you are solo shops.But, if you run or are a part of a company with more than one person, here are some for optimizing employee participation on LinkedIn.Get everybody associated with the company page. See Vid 98 for info about how to create a great company page. You first create the company page […] To access this post, you must purchase Membership Prime Portal.

Validea

DECEMBER 13, 2024

Warren Buffett and Peter Lynch stand as two of investing’s most legendary figures, each with distinct approaches to identifying exceptional companies. Through Validea’s guru-based models, four stocks currently demonstrate the fundamental characteristics that would attract both the Oracle of Omaha and the mutual fund maestro. Let’s examine why these companies align with both investors’ stringent criteria.

Sara Grillo

DECEMBER 13, 2024

Advice-only financial planning is fee-only comprehensive financial planning without the expectation or even the option to manage any client investments. Financial planning is offered as a stand-alone product; it is the only thing that an advice-only financial planner does. Here are a list of advisors who have held themselves out as advice-only planners.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Random Roger's Retirement Planning

DECEMBER 13, 2024

One of the ReturnStacked guys Tweeted out a chart about combining bonds and merger arbitrage. They've had something with merger arbitrage in the hopper and maybe that's coming soon. There was a comment on the post from someone with the following slide but no mention of it yet on the ReturnStacked website. Their other funds with bond exposure, offer AGG-like bond exposure and so for now, I would imagine this will have the same exposure.

Alpha Architect

DECEMBER 13, 2024

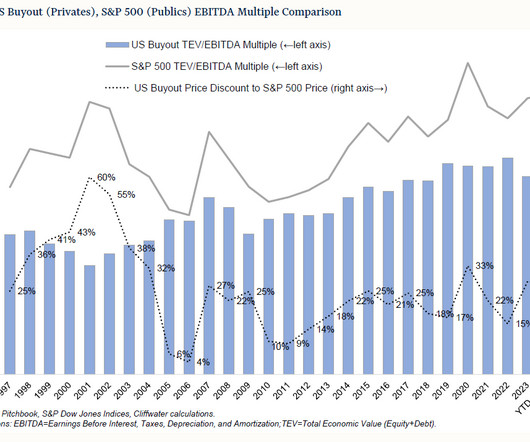

Cliffwater found that private equity allocations by state pensions produced a 11.0% net-of-fee annualized return over the 23-year period ending June 30, 2023. Over the same period the CRSP 1-10 Index (U.S. total market) returned 7.2% and the MSCI All Country World ex USA Index returned 4.4%. Private Equity Versus Public Equity Returns was originally published at Alpha Architect.

Carson Wealth

DECEMBER 13, 2024

In the latest episode of Take 5, Ryan Detrick, Chief Market Strategist at Carson Group, discusses the improving trends in inflation. Ryan also highlights the Federal Reserve’s likely rate cuts, strong economic fundamentals, and the resilience of the current bull market, which has seen a 70% gain since October 2022! Whats Ryans outlook as we head into 2025?

Calculated Risk

DECEMBER 13, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. For deaths, I'm currently using 4 weeks ago for "now", since the most recent three weeks will be revised significantly. Note: " Effective May 1, 2024, hospitals are no longer required to report COVID-19 hospital admissions, hospital capacity, or hospital occupancy data. " So I'm no longer tracking hospitalizations.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

DECEMBER 13, 2024

Markets Want to understand the current market regime? Think margins. (ft.com) Lessons learned from the young Warren Buffett. (wsj.com) Crypto Is there room in the market for another stablecoin? (sherwood.news) Bitcoin ETF provider Blackrock ($BLK) thinks you should own some Bitcoin. (rogersplanning.blogspot.com) Pay your (crypto) taxes! (theblock.co) IPOs ServiceTItan ($TTAN) had an eventful first day of trading.

Let's personalize your content