Charitable Planning with Retirement Assets

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Calculated Risk

MARCH 13, 2023

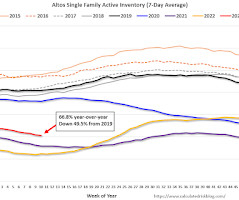

Altos reports that active single-family inventory was down 1.5% week-over-week. Usually inventory bottoms in early February, so the bottom this year will be late. Here are the same week inventory changes for the last five years: 2023: -6.2K 2022: +7.1K 2021: -7.5K 2020: -3.7K 2019: -0.4K Click on graph for larger image. This inventory graph is courtesy of Altos Research.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 13, 2023

Some highly-leveraged investors who bought at the market peak are running out of time and may be forced to sell.

Nerd's Eye View

MARCH 13, 2023

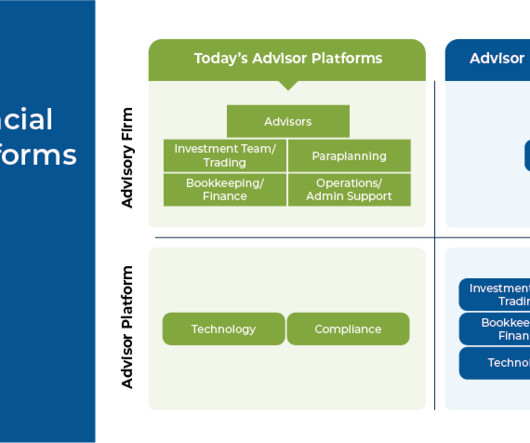

For the past several decades, platforms for advisors have differentiated with the quality of their technology. The focus on ‘tech’ was a natural evolution for advisor platforms away from their roots – which was originally to differentiate by the quality of their proprietary product shelf, the primary means that brokerage firms and insurance companies attracted advisors to them in the 1960s, 70s, and 80s.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MARCH 13, 2023

It all comes down to a desire to retain control.

Calculated Risk

MARCH 13, 2023

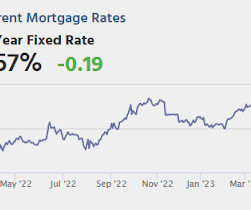

From Matthew Graham at Mortgage News Daily: Mortgage Rates Down Big, But Lagging Other Indicators If you're just getting caught up or otherwise haven't heard, the biggest news in financial markets since last Friday has been the precipitous failure of Silicon Valley Bank. While not necessarily a household name, SVB was the 16th largest bank in terms of assets and the 2nd biggest bank failure in history behind Washington Mutual 15 years ago.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MARCH 13, 2023

Note: There were over 500 bank failures during and immediately following the GFC, and almost 300 in just 2009 and 2010. That was mostly due to default risk (poor performing MBS). I don't expect a large wave of failures now. From the FDIC: FDIC Establishes Signature Bridge Bank, N.A., as Successor to Signature Bank, New York, NY Signature Bank, New York, NY, was closed today by the New York State Department of Financial Services, which appointed the Federal Deposit Insurance Corporation (FDIC) as

Wealth Management

MARCH 13, 2023

Advisors in SVB's $17 billion wealth management unit, which includes its 2021 acquisition of Boston Private, were told that the unit will be sold off separately from the bank in the wake of its collapse.

Abnormal Returns

MARCH 13, 2023

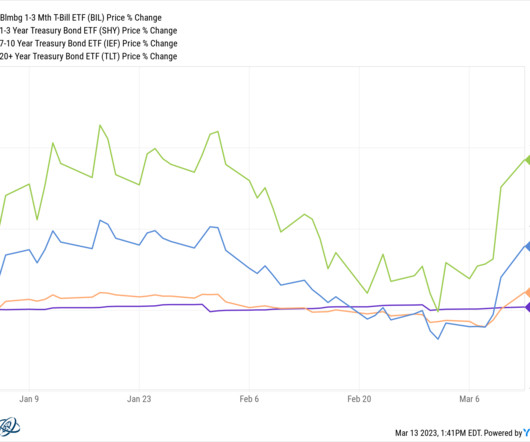

Strategy Chasing past returns often ends badly. (bilello.blog) Why you always seem to sell your stocks at the bottom. (dariusforoux.com) Finance The $250,000 FDIC cap has been effectively lifted. (bonddad.blogspot.com) We still don't know everything about the downfall of Silicon Valley Bank. (ritholtz.com) The reversal in interest rates could relieve some pressure on bank portfolios.

Wealth Management

MARCH 13, 2023

The younger generation's spending is increasingly defined by values, rather than conspicuous consumption.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

MARCH 13, 2023

Final Trades: Oracle, Abbvie & Gold from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

MARCH 13, 2023

Lessons learned from NEPC’s 17th annual DC survey.

The Reformed Broker

MARCH 13, 2023

On this special episode of Live from The Compound, Samir Kaji (CEO and co-founder of Allocate) joins Michael Batnick and Josh Brown to discuss the collapse of Silicon Valley Bank and the impact it could have on the banking system and the stock market. Follow Samir on: Twitter Linkedin Substack Let us know if we can help you with your financial plan or portfolio: [link].

Wealth Management

MARCH 13, 2023

Commissioner Mark Uyeda argued that such dates all can’t “hit at the same time” during a discussion at the Investment Adviser Association Compliance Conference.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

MARCH 13, 2023

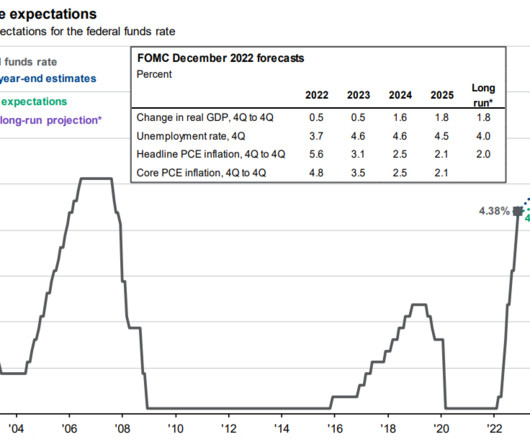

Today, in the Calculated Risk Real Estate Newsletter: Pandemic Economics, Housing and Monetary Policy: Part 2 A brief excerpt: Special Note: This was mostly written prior to the failure of Silicon Valley Bank. Now it appears the Fed might pause in March. Goldman Sachs economists wrote last night: “we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22 (vs. our previous expectation of a 25bp hike)”, although BofA economists wrote this morning “After the latest develop

Wealth Management

MARCH 13, 2023

Three million U.S. households continue to rent their homes rather than own them in spite of having relatively high incomes, reports The Wall Street Journal. The Real Deal talked to REIT analyst Alex Goldfarb about the outlook for a commercial real estate downturn. These are among today’s must reads from around the commercial real estate industry.

Abnormal Returns

MARCH 13, 2023

Podcasts Mihael Kitces talks the challenges of succession planning with Yonhee Choi Gordon a Principal and the COO of JMG Financial Group. (kitces.com) Peter Lazaroff talks SECURE Act 2.0 with Plancorp's Brian King. (peterlazaroff.com) Daniel Crosby talks with Eben Burr, who is the President of Toews, about risk management. (standarddeviationspod.com) Retirement saving Too many people cash out their 401(k) accounts when they leave their employer.

Wealth Management

MARCH 13, 2023

AdvizorStack's Paul and Nico DeMaio join the show in a very fun and energetic conversation.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Getting Your Financial Ducks In A Row

MARCH 13, 2023

Photo credit: jb For the most part, it is recommended to merge all of your IRA money together into a single account, to simplify record-keeping, allocation, and paperwork in general. However, there may be circumstances where it could make very good sense to separate your contributory IRAs from 401(k) plan rollovers – and it pertains to creditor’s rights.

Wealth Management

MARCH 13, 2023

If national growth needs to decelerate, conditions are likely to get worse for the Bay Area and Seattle.

A Wealth of Common Sense

MARCH 13, 2023

On today’s show, we spoke with Dr. David Kelly, Chief Global Strategist and Head of the Global Market Insights Strategy Team for J.P. Morgan Asset Management about the SVB drama and knock-on effects in the economy. On today’s show, we discuss: Silicon Valley Bank drama Will the Fed break something else? What does SVB mean for interest rate hikes?

Wealth Management

MARCH 13, 2023

Wednesday, March 29, 2023 | 2:00 PM ET

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MARCH 13, 2023

Your clients need a hero – one who can help them navigate the uncertain world and keep them on track to living their best lives no matter what circumstances they face. That hero should be their financial advisor.

Wealth Management

MARCH 13, 2023

Both Signature’s insured and uninsured customers will be able to access all their deposits under the same “systemic risk exception” that will give Silicon Valley Bank customers access to their cash starting Monday.

Advisor Perspectives

MARCH 13, 2023

Here is some research on why our clients built a sizable portfolio while others had high income but little savings. I’ll address specifics on how to get savers to enjoy their money.

Wealth Management

MARCH 13, 2023

Tuesday, March 28, 2023 | 2:00 PM ET

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

MarketWatch

MARCH 13, 2023

Acadia Pharmaceuticals Inc. ACAD said its newly approved treatment for Rett syndrome has an annual list price ranging from $575,000 to $595,000, according to a company spokesperson. The Food and Drug Administration on Friday approved Daybue, the first therapy to treat Rett syndrome, a rare disease that has been diagnosed in 4,500 adults and children in the U.S.

Wealth Management

MARCH 13, 2023

Wealthy members in the elite network Tiger 21 are nervous about political instability, but they’re still putting money into riskier assets.

NAIFA Advisor Today

MARCH 13, 2023

NAIFA-OK Vice President of Advocacy Chad Tredway, LUTCF ® , FSCP ® , always knew he wanted to be in the financial services industry. He studied actuarial science in college but found his true calling working with customers directly, learning their stories, and helping them as they mapped out their financial futures. After several years as an agent, he was appointed as a district manager.

Wealth Management

MARCH 13, 2023

If the saga at Silicon Valley Bank hastens the arrival of the next recession, expect to see many more properties go into default sooner rather than later. This is bad news for lenders because they have ramped up their financing of real estate.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content