A Walkthrough of August's ETF Launches

Wealth Management

SEPTEMBER 8, 2022

Overall, nearly 40 new ETFs came to the market in the past month.

Wealth Management

SEPTEMBER 8, 2022

Overall, nearly 40 new ETFs came to the market in the past month.

The Big Picture

SEPTEMBER 8, 2022

Barry Ritholtz, Ritholtz Wealth Management Chairman & CIO and “Masters in Business” Bloomberg Radio & Podcast Host, discusses global shocks impacting market volatility (Source: Bloomberg). Hard for an Individual to Beat the Collective. Source: Bloomberg. The post Tough to Beat the Market appeared first on The Big Picture.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 8, 2022

The proceedings centered on investors harmed by Horizon Private Equity III, an alleged Ponzi scheme concocted by a former Oppenheimer advisor.

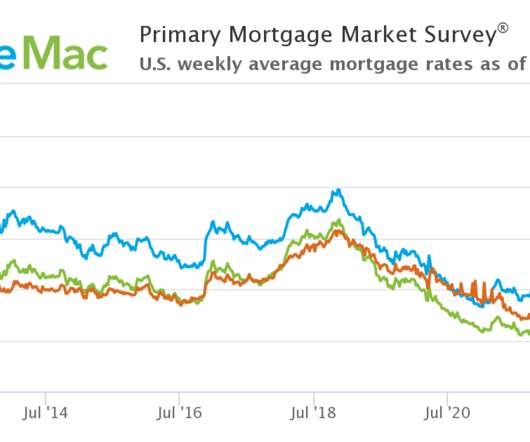

Calculated Risk

SEPTEMBER 8, 2022

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in August: Increased Incentives Helping Sales A brief excerpt: Here are some interesting homebuilder comments from around the country. In August, builders have cut prices and increased incentives. And cycle times are improving with less demand. Homebuilder comments courtesy of Rick Palacios Jr. , Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 8, 2022

Meant to minimize shortfall risk, the system has been in development for almost a decade.

Nerd's Eye View

SEPTEMBER 8, 2022

For many financial advisors, the most valuable part of what they offer comes down to the financial advice that they give, whether it be the expert guidance they give to a certain niche or a unique point of view that presents unique insights to an individual client. However, the advice given to clients is not always the only useful offering provided, as the process through which financial advisors deliver their advice can also be an important part of their value proposition.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

SEPTEMBER 8, 2022

Finance Are dividends ever going to be a thing again? (citywireusa.com) How did stock buybacks become such a political football? (thinkadvisor.com) Apple Apple ($AAPL) is increasingly a services company, and its new iPhone launch belies it. (stratechery.com) All the stuff Apple ($AAPL) didn't announce yesterday, including a new iPhone Mini. (theverge.com) What's behind Apple's ($AAPL) introduction of passkeys?

Wealth Management

SEPTEMBER 8, 2022

As liquid alternative investment products become increasingly accessible and market conditions shake confidence in the standard 60/40 allocation model, WealthManagement.com asked a variety of boots-on-the-ground advisors how they view alternative investing under the new paradigm. Here’s what they said.

The Reformed Broker

SEPTEMBER 8, 2022

Final Trades: Mativ, Air Products, Volkswagen & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

SEPTEMBER 8, 2022

The diversity represented at the decision-making table is a different imperative than filling lower-level seats simply to check a box in the name of a mission statement.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

SEPTEMBER 8, 2022

Books An excerpt from "Survival of the Richest: Escape Fantasies of the Tech Billionaires" by Douglas Rushkoff. (theguardian.com) An excerpt from "Birds and Us: A 12,000-Year History From Cave Art to Conservation" by Tim Birkhead. (smithsonianmag.com) Environment The battle over access to Colorado's rivers is getting heated. (nytimes.com) Hunting invasive species is increasingly a sport.

Wealth Management

SEPTEMBER 8, 2022

The funds will invest in equity securities that exclude certain categories, such as gambling, adult entertainment and chemical weapons.

Alpha Architect

SEPTEMBER 8, 2022

Standardized Performance. Factor Performance. Factor Exposures. Factor Premiums. Factor Attribution. Factor Data Downloads. Global Factor Performance: September 2022 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

SEPTEMBER 8, 2022

Murphy also said he is confident New Jersey won’t have to put more taxpayer money into the American Dream megamall project in order for it to survive. “I’m confident to say that I think this thing is turning the corner,” Murphy said.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Validea

SEPTEMBER 8, 2022

The famously bearish Jeremy Grantham warns that the stock “super bubble” that he’s previously spoken about “has yet to burst” and that when it does it will be an “epic finale,” reports Bloomberg. The GMO co-founder sees equities, bonds and housing as all overvalued, and cautions that if we see a repeat of past bubble bursts, “the play will once again be a Tragedy,” adding that we can still “hope this time for a minor one.

Wealth Management

SEPTEMBER 8, 2022

The UK-based movie theater chain, which draws most of its revenues from the US after the acquisition of Regal Cinemas in 2018, filed for Chapter 11 protection on Wednesday.

Carson Wealth

SEPTEMBER 8, 2022

Ryan Yamada, CFP ® , Senior Wealth Planner. We’ve all heard the conventional wisdom about claiming Social Security: you should wait as long as you can before claiming your benefit. Wait right up to age 70, if possible. After all, that’s when you would get the greatest monthly benefit. But that may not be the right move for some. What if I told you that, in some cases, taking your benefit as soon as you are eligible is the most ideal thing to do?

Wealth Management

SEPTEMBER 8, 2022

Watch as David Armstrong, editor-in-chief, Wealthmanagement.com, and Marian Macindoe, Head of ESG Stewardship, Parnassus Investments, discuss why investors should care about ESG Stewardship and how she predicts it will evolve over time.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

XY Planning Network

SEPTEMBER 8, 2022

2 MIN READ.

Meb Faber Research

SEPTEMBER 8, 2022

Episode #441: Marlena Lee, DFA – Value, Fama & Weathering Bear Markets Guest: Marlena Lee is the Global Head of Investment Solutions for Dimensional Fund Advisors. Lee worked as a teaching assistant for Nobel laureate Eugene Fama and earned a PhD in finance and an MBA from the Chicago Booth School of Business. Date […]. The post Episode #441: Marlena Lee, DFA – Value, Fama & Weathering Bear Markets appeared first on Meb Faber Research - Stock Market and Investing Blog.

Nationwide Financial

SEPTEMBER 8, 2022

Key Takeaways: Annuity living benefit riders can provide a consistent income stream to clients in retirement. Distributions from the annuity with a living benefit rider will be taxed differently depending on the type of account and whether or not the benefit requires annuitization. Certain types of living benefit riders, commonly called withdrawal benefits, do not require annuitization.

Validea

SEPTEMBER 8, 2022

We have looked at a variety of different investing strategies so far in our Show Us Your Portfolio series. We have talked to investors who use factor-based approaches. We have talked to investors who use trend following and managed futures. We have talked to investors who use passive approaches. But regardless of the approach any of us use in our personal portfolios, we can often lose sight of what we are actually trying to achieve.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Cordant Wealth Partners

SEPTEMBER 8, 2022

As you would expect from an outstanding organization like Microsoft, it offers a very robust 401(k) to help employees save for retirement. This article will discuss the key features of the Microsoft 401(k) plan, and after reading it, you should leave with a clear game plan of how to: Maximize the match (free money! ) you receive from Microsoft Reduce your tax bill both now and in retirement Make smart investment decisions within your 401(k) account Microsoft’s 401k Plan The Microsoft 401(k) pla

Validea

SEPTEMBER 8, 2022

Federal Reserve Chair Jerome Powell has abandoned his goal of a “soft landing” and is engineering something that could be much more difficult for the economy, according to an article in Bloomberg. The Fed’s new goal is to combat inflation by slowing down growth, leading to what economists dub a “growth recession” where unemployment rises and growth stagnates for an extended period of time.

SEI

SEPTEMBER 8, 2022

CTA IAS Growthlab meet our reps. lsmith. Thu, 09/08/2022 - 18:06. Contact us. No Image or Icon. Our business development representatives are ready to help you. Connect with us.

Validea

SEPTEMBER 8, 2022

Out of the almost 190 companies that stopped paying dividends to their shareholders in 2020, at the height of the pandemic, 72 have yet to start paying them again, including big names such as Disney and Boeing, reports an article in The Wall Street Journal. With a possible recession looming, those companies are now contemplating whether or not to continue holding off on paying out, or if their cash reserves would be better served by lowering their debt or with stock buybacks.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Wealthfront

SEPTEMBER 8, 2022

When it comes to your savings, account fees are a bad thing. Fees can eat away at your wealth over time and are essentially negative earnings. Unfortunately, many financial institutions charge a broad range of fees on checking, savings, and cash accounts. They do this for two main reasons: one, according to our estimate, banks need […]. The post What Fees Do Banks Charge and How Can I Avoid Them?

Validea

SEPTEMBER 8, 2022

An opinion piece in the Financial Times contends that the focus on stock buybacks in the Inflation Reduction Act, which imposes a 1% excise tax on share repurchases, indicates a lack of understanding of the function of buybacks and the part they play in a healthy economy. One misperception about buybacks is that companies use their cash reserves to buy stock instead of putting it back into their business.

Mullooly Asset Management

SEPTEMBER 8, 2022

In this week’s video, Casey discusses different ideas for where to put your short-term money. We get asked all the time, “I’ve got this money at the bank earning nothing. What should I do with it?” There are always trade-offs being made when you put your dollars anywhere. Are you more concerned with return on […].

Validea

SEPTEMBER 8, 2022

Minneapolis Fed President Neil Kashkari told Bloomberg that he was “happy to see” the reaction to Jerome Powell’s speech at the Fed’s annual retreat in Jackson Hole, in an interview on Bloomberg’s Odd Lots podcast. That reaction was a steep market drop in the wake of the speech, indicating investors are starting to comprehend the Fed’s battle to get inflation back to 2%.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content