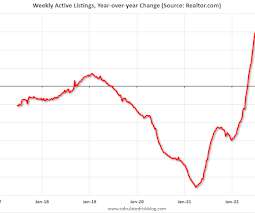

Realtor.com Reports Weekly Active Inventory Up 30% Year-over-year; New Listings Down 17%

Calculated Risk

OCTOBER 7, 2022

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale and Jiayi Xu: Weekly Housing Trends View — Data Week Ending Oct 1, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory. • Active inventory continued to grow, increasing 30% above one year ago.

Let's personalize your content