The Alabama Dock Brawl Offers Insight into Toxic Corporate Culture

Wealth Management

AUGUST 9, 2023

Privilege and presumed power often can cause an all-too-avoidable ruckus.

Wealth Management

AUGUST 9, 2023

Privilege and presumed power often can cause an all-too-avoidable ruckus.

The Big Picture

AUGUST 9, 2023

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are Your Thoughts? Don’t miss my favorite chart from this week’s discussion 46 minutes deep into the episode ; its from Bank of America by way of Batnick (above). All of the fall-off surrounding the 8% pullback in S&P 500 profits — literally, more than 100% of it — is due to the huge drop in energy profits.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

AUGUST 9, 2023

Podcasts Christine Benz and Jeff Ptak talks with Manisha Thakor about her new book ”MoneyZen: The Secret to Finding Your “Enough.” (morningstar.com) Peter Lazaroff talks with John Jennings, author of "The Uncertainty Solution" about how to invest with confidence in inherently uncertain markets. (peterlazaroff.com) Fraud How an empty lot was sold without the owner's knowledge or consent.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 9, 2023

Thirteen tips for structuring an FLP.

Abnormal Returns

AUGUST 9, 2023

Strategy Every investment strategy has multiple 'points of failure.' (blog.validea.com) There's only one way to make money on gloom-and-doom forecasts. (klementoninvesting.substack.com) Why are market cap weighted indices hard to beat for managers? (behaviouralinvestment.com) Crypto Why PayPal ($PYPL) is planning to offer a stablecoin. (vox.com) David Rubenstein on his Bitcoin regrets.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 9, 2023

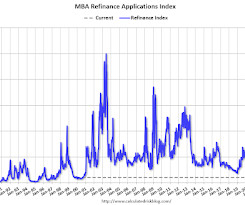

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 4, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.1 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

AUGUST 9, 2023

Bipartisan Senate proposal also provides de minimis exclusion from gross income for use of crypto assets.

Calculated Risk

AUGUST 9, 2023

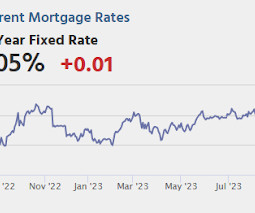

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 227 thousand last week. • Also at 8:30 AM, The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

Wealth Management

AUGUST 9, 2023

The Secrets to Unlocking Growth and Ongoing Success - Wednesday, August 23, 2023 | 2:00 PM ET

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 9, 2023

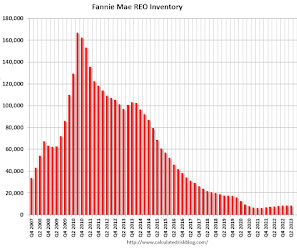

Fannie reported results for Q2 2023. Here is some information on single-family Real Estate Owned (REOs). Foreclosure have increased slightly year-over-year since the end of the foreclosure moratorium. Fannie Mae reported the number of REOs decreased to 8,615 at the end of Q2 2023, down from 8,780 in Q1 2022, and up 13% from 7,637 at the end of Q2 2022.

Wealth Management

AUGUST 9, 2023

Third Circuit reviews Pennsylvania law on gifts “causa mortis.

Calculated Risk

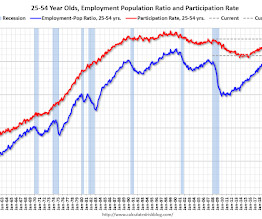

AUGUST 9, 2023

Last Friday I posted the incorrect chart for the 25 to 54 employment-population ratio and participation rate (ht Kevin). Here is the correct graph. Prime (25 to 54 Years Old) Participation Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Wealth Management

AUGUST 9, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

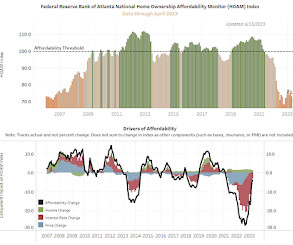

Calculated Risk

AUGUST 9, 2023

Today, in the Calculated Risk Real Estate Newsletter: Atlanta Fed: Home Ownership Affordability Monitor A brief excerpt: For house prices, there is an ongoing battle between low inventory and affordability. Here is another measure of affordability that readers might find useful from the Atlanta Fed: Home Ownership Affordability Monitor. Here is a graph of affordability (higher is more affordable), and of the year-over-year change in affordability through April 2023.

Wealth Management

AUGUST 9, 2023

Most workers lack the money and time to invest enough in the stock market. The US government has plenty of both.

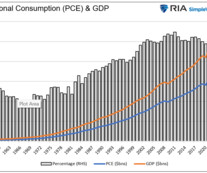

Advisor Perspectives

AUGUST 9, 2023

Personal consumption growth rates are showing signs of fatigue. Given it consistently accounts for more than two thirds of economic activity, it's worth exploring the state of the consumer.

Wealth Management

AUGUST 9, 2023

With interest set to start accruing again after a three-year pause, some are getting ready to zero out their balances.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

NAIFA Advisor Today

AUGUST 9, 2023

If it’s Tuesday after business hours, you’ll probably find Jennifer Hodges , LACP, CIC, at the local American Legion post in her regular place at the $10 poker game she’s been a part of for the past five years. But if you ask her about her poker face, she might hesitate.

Wealth Management

AUGUST 9, 2023

New York’s top law enforcement office is looking into “brokerage execution quality” at Robinhood.

XY Planning Network

AUGUST 9, 2023

Discover cutting-edge advice-engagement tech at XYPN LIVE 2023 Each year, XYPN puts out the call for tech companies releasing the most innovative technology for financial advisors to share what they’ve been working on. Once again, they’ve answered! Real financial planning will always be a collaboration between the advisor and their client, and getting clients to engage and change their behavior can often be an advisor’s biggest challenge.

Fintoo

AUGUST 9, 2023

Highlights Issue Size – 46,298,759 – 44,670,050 shares Issue Open/Close – Aug 10/Aug 14, 2023 Price Band (Rs.) 187-197 Issue Size- Rs 8,660 – 8,800 mn Face Value (Re.) 1 Lot Size (shares) 76 TVS Supply Chain Solutions Ltd (TVS SCSL) is India’s largest and one of the fastest growing integrated supply chain solutions providers […] The post TVS Supply Chain Solutions Ltd IPO (Subscribe) appeared first on Fintoo Blog.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

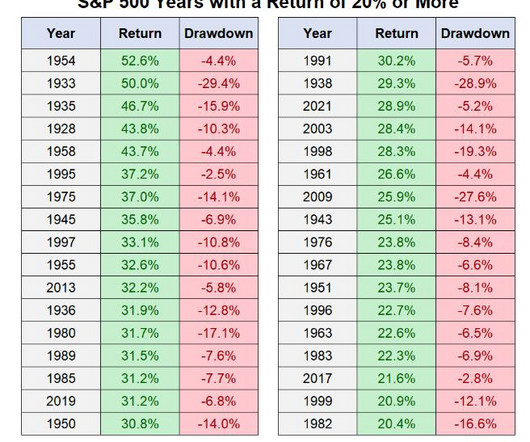

A Wealth of Common Sense

AUGUST 9, 2023

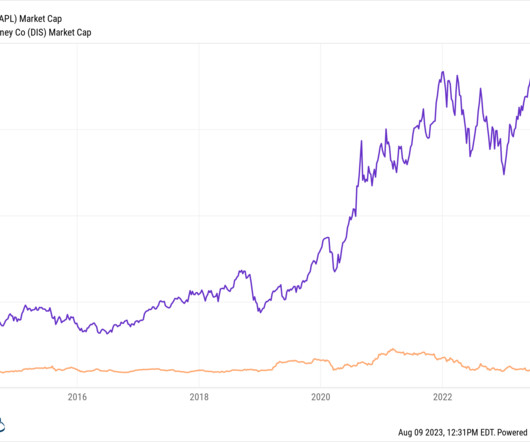

Today’s Animal Spirits is brought to you by YCharts: Submit your email here to receive 20% off a YCharts subscription for new clients On today’s show, we discuss: Even when the stock market goes up it still goes down On the ‘course’ to a new normal Dalio says the $73t great wealth transfer isn’t just from boomers to millennials – it’s from the government to you and me Amer.

Trade Brains

AUGUST 9, 2023

MRF Vs Balkrishna Industries : What does Virat Kohli, one of the most famous and celebrated cricketers of India, have in common with a Bollywood superstar who portrayed Kapil Dev in 83? Answer – They’re both brand ambassadors of competing companies. And not just any companies, specifically, tyre manufacturers. We’re talking about MRF and Balkrishna Industries (BKT).

Advisor Perspectives

AUGUST 9, 2023

If you are paying for any of the following garbage, get the scissors and snip it out of your budget.

Integrity Financial Planning

AUGUST 9, 2023

The difficult thing about “financial freedom” as a concept is that many people define it in a vague way. Most people think of it as not having to worry about money and being able to have the things they want without having to scrimp and save for them. But there are all sorts of things that cause worry in regard to our money: mortgage payments, credit card debt, or how much money is in our retirement account.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

AdvicePay

AUGUST 9, 2023

Many financial advisors grapple with the idea of focusing on a niche. You may fear that narrowing your target market will limit your opportunities for growth and success. However, research and experience show that the opposite is true. Focusing on a niche can actually lead you to accelerated growth and a more impactful presence in your target market.

Ron A. Rhodes

AUGUST 9, 2023

Before choosing specific securities (stocks, bonds, mutual funds, etc.), a preliminary step in portfolio design is discerning the investment strategies that should be utilized.

XY Planning Network

AUGUST 9, 2023

Discover cutting-edge advice-engagement tech at XYPN LIVE 2023 Each year, XYPN puts out the call for tech companies releasing the most innovative technology for financial advisors to share what they’ve been working on. Once again, they’ve answered! Real financial planning will always be a collaboration between the advisor and their client, and getting clients to engage and change their behavior can often be an advisor’s biggest challenge.

Ron A. Rhodes

AUGUST 9, 2023

OVERVIEW: THE PRUDENT INVESTOR RULE The Uniform Prudent Investor Act (UPIA) (1995), adopted in some form by all 50 states, applies to the investment of private trust funds.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content