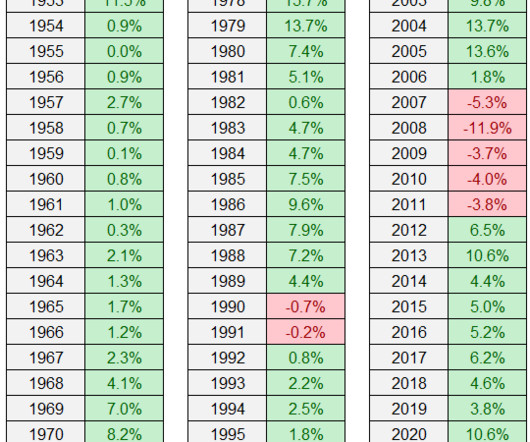

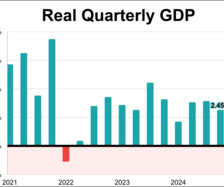

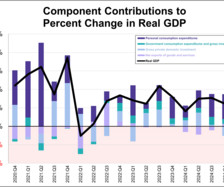

Q4 GDP Growth Revised up to 2.4% Annual Rate

Calculated Risk

MARCH 27, 2025

From the BEA: Gross Domestic Product, 4th Quarter and Year 2024 (Third Estimate), GDP by Industry, and Corporate Profits Real gross domestic product (GDP) increased at an annual rate of 2.4 percent in the fourth quarter of 2024 (October, November, and December), according to the third estimate released by the U.S. Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1 percent.

Let's personalize your content