Lawler: Treasury Secretary Wrongly Says Fed Has Been “Big Seller” of Treasuries

Calculated Risk

FEBRUARY 26, 2025

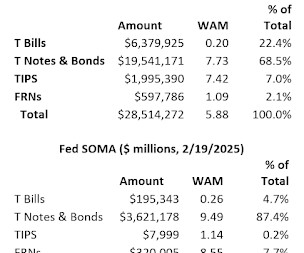

From housing economist Tom Lawler: Treasury Secretary Wrongly Says Fed Has Been Big Seller of Treasuries In an interview last week, Treasury Secretary Bessent said that any plans by the Treasury to extend the maturity were a long ways off. One of the reasons cited by Secretary Bessent was the Federal Reserves current balance sheet runoff policy. Here is a quote from Bessent.

Let's personalize your content