What Clients Need to Know About Whole Life Insurance Dividends

Wealth Management

DECEMBER 11, 2022

Dividends from participating whole life policies are dependent on many factors and are not guaranteed.

Wealth Management

DECEMBER 11, 2022

Dividends from participating whole life policies are dependent on many factors and are not guaranteed.

Calculated Risk

DECEMBER 11, 2022

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and increase the "terminal rate" to 5-5.25%. From Merrill Lynch: "A relatively soft November inflation report is unlikely to affect the Fed’s decision. It has clearly telegraphed a 50bp hike in December , which would take the federal funds rate to 4.25-4.5%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

DECEMBER 11, 2022

Matt Chisholm, senior vice president for RIA services and practice management at Commonwealth Financial Network, describes the three ways advisors can benefit from outsourcing.

Abnormal Returns

DECEMBER 11, 2022

Top clicks this week Nick Maggiulli's favorite investment writing of 2022. (ofdollarsanddata.com) Things that never happened in markets before happen all the time. (awealthofcommonsense.com) The bonds vs. bond fund equation is more complicated than it looks. (morningstar.com) How much wealth does it take to crack the 0.1%? (ritholtz.com) Bond lingo, 101.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

DECEMBER 11, 2022

Kristine McManus, vice president of business solutions and practice management at Commonwealth Financial Network, explains why it is imperative for practices to engage with the next generation.

A Wealth of Common Sense

DECEMBER 11, 2022

Some random thoughts about markets and investing I’ve been thinking about lately: The fear of missing out and the joy of missing out are two sides of the same coin. In bull markets, you feel like an idiot for not going all-in on the highest of high fliers. In bear markets, that FOMO quickly turns into JOMO (the joy of missing out). If nothing else, both up and down markets provide reminders that there is rarely an e.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

DECEMBER 11, 2022

Weekend: • Schedule for Week of December 11, 2022 • FOMC Preview: 50bp Hike, Increase "Terminal Rate" Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value). Oil prices were down over the last week with WTI futures at $71.02 per barrel and Brent at $76.10 per barrel.

Financial Symmetry

DECEMBER 11, 2022

Behavioral finance biases can make or break your journey to building wealth. The truth at the heart of behavioral finance is the fact that we are not rational decision-makers when it comes to our money. The following five psychological and … Continued. The post Types of Behavioral Finance and How to Overcome Them appeared first on Financial Symmetry, Inc.

Advisor Perspectives

DECEMBER 11, 2022

The steady drumbeat of warnings that the American economy is careening toward a recession finally struck a nerve on Wall Street.

Random Roger's Retirement Planning

DECEMBER 11, 2022

Barron's had an article titled " Retirees Put Their Lives on Hold for Covid. Inflation Is Forcing Them to Do It Again." The article is mostly short profiles of retirees and how they are reacting to the higher prices of late. They are collectively spending less, cancelling travel plans, cancelling plans to move, not driving one of their cars, one lady started some sort of homemade soap business that involves her being on the "craft fair circuit.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

DECEMBER 11, 2022

The recent escalation in interest rates is squeezing household budgets.

The Irrelevant Investor

DECEMBER 11, 2022

Today’s Talk Your Book is brought to you by Helios: See here to learn more about utilizing Helios’ insourced CIO and other tailored tools for advisors On today’s show, we are joined by Joe Mallen, CIO of Helios to discuss Helios’ offerings for advisors. On today’s show we discuss: What Helios does Typical Helios clientele The growth of model portfolios Insourced vs outsourced CIOs How advisors are.

Advisor Perspectives

DECEMBER 11, 2022

For the first time in a long time, muni investors may be able to earn attractive yields without having to take undue risk.

oXYGen Financial

DECEMBER 11, 2022

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Clever Girl Finance

DECEMBER 11, 2022

Making a plan for the year can be your secret weapon for success. Year planning allows you to set goals and be more prepared for the upcoming year. Imagine how good it'll feel achieving everything you set out to accomplish. Yes, life is unpredictable and a good system can easily unravel from the complexities of life. Yet if you have goals in place, you’ll be better equipped to handle the surprises that happen.

James Hendries

DECEMBER 11, 2022

The end of the year can be a chaotic time for business owners. It is a time to compile data, review the numbers, evaluate strengths and weaknesses, and determine growth opportunities for the future. A business owner would be keen to review several factors in preparing year-end documents and preparing for the following year. Here are five tips that may assist with organizing a strategy.

Trade Brains

DECEMBER 11, 2022

Fundamental Analysis of Torrent Pharmaceuticals: Investors eye for stocks that can give consistent returns over the years, steadily rising over time like Titan Co. or any of the big tech stocks. How about we introduce you to a new stock: Torrent Pharma, a leading drug maker that has risen consistently over time? In this article, we perform a fundamental analysis of Torrent Pharmaceuticals to find out how it has generated impressive returns for its shareholders.

Advisor Perspectives

DECEMBER 11, 2022

That question is likely top of mind for anyone who has seen or played around with ChatGPT, the AI-powered chat tool from OpenAI, the $20 billion AI research organization.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

WiserAdvisor

DECEMBER 11, 2022

The end of the year is all about festivities. However, before you get caught up in the holiday mood, it is vital to carve out some time and prepare for the coming year. The New Year is an excellent time to start planning for your financial needs for the future. It can offer you a fresh start and perspective. It is also an excellent time to plan your tax liabilities and look for ways to minimize them.

Advisor Perspectives

DECEMBER 11, 2022

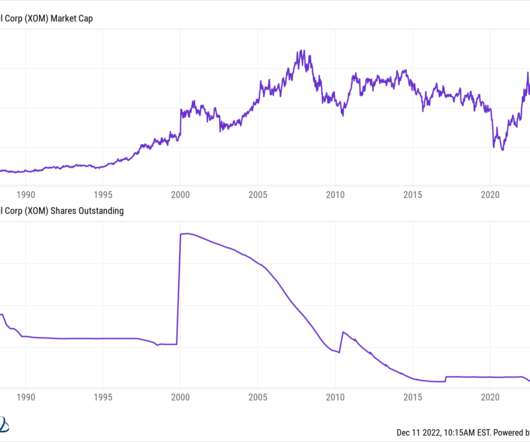

For some investors, this year’s rout in high-flying technology stocks is more than a bear market: It’s the end of an era for a handful of giant companies such as Facebook parent Meta Platforms Inc. and Amazon.com Inc.

Mish Talk

DECEMBER 11, 2022

"CZ" Image likeness courtesy of Coin Telegraph article below. Binance's Proof of Reserves Statement When we say Proof of Reserves, we are specifically referring to those assets that we hold in custody for users. This means that we are showing evidence and proof that Binance has funds that cover all of our users assets 1:1, as well as some reserves. When a user deposits one Bitcoin, Binance's reserves increase by at least one Bitcoin to ensure client funds are fully backed.

Advisor Perspectives

DECEMBER 11, 2022

For a long time, one acronym reigned supreme on Wall Street — TINA, or “there is no alternative,” which was used to talk about the allure of stocks in a low interest-rate environment. But now, BARB — or “bonds are back” — is the new queen.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Abnormal Returns

DECEMBER 11, 2022

Bonds What is the bond market saying about the economy right now? (awealthofcommonsense.com) Bond investors are using 2022 to swap mutual funds into ETFs. (wsj.com) It's easy to overlook these bond market nuances. (humbledollar.com) A look at liquidity in the Treasury market. (ft.com) Crypto How CoinDesk broke the FTX story and the fallout that ensued.

Advisor Perspectives

DECEMBER 11, 2022

It has been my tradition to informally rate the investment-related books I read in the past year.

Million Dollar Round Table (MDRT)

DECEMBER 11, 2022

By Randy Marshall, Ph.D. Knowing the difference between a goal and a desire has saved careers and given many financial advisors a new lease on why they do what they do. Yet, many people operate with the wrong perspective because they don’t understand the huge difference between a goal and a desire. By understanding this, you as a financial advisor can increase both your productivity and inner peace.

Advisor Perspectives

DECEMBER 11, 2022

Why everyone should invest this way. With this video, I have revisited previous videos going back as far as July 2017.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Cordant Wealth Partners

DECEMBER 11, 2022

Today we are going to tell you everything you need to know about the Intel Minimum Pension Plan (MPP). We’ll cover: How the Intel pension plan works. How your Intel pension benefit is calculated. The steps you should take if you’re retiring from Intel. But first, grab your free resources (no email required!). Free Resources: Pension: Lump Sum vs.

Advisor Perspectives

DECEMBER 11, 2022

A near-total ban on imports of Russian crude into the European Union is finally hitting Russia’s oil revenue. Concerns that it would provide the Kremlin with a windfall to fund its war in Ukraine have been confounded — for now.

The Big Picture

DECEMBER 11, 2022

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • You’re Being Lied to About Electric Cars : Science has repeatedly shown EVs are better for humans, despite the meme you just retweeted. ( MotorTrend ). • Conservatism as an Oppositional Culture: How a sociological concept explains the “Scam Right” Spend some time consuming conservative media, and you’ll see it’s all just one scam after the other: “commemorative” gold coins, something abou

Advisor Perspectives

DECEMBER 11, 2022

Many have been asking this question since earlier this year, a question that has no easy answer. As economists – us included – continue to forecast the most ‘telegraphed’ recession in history, it is important to point to those things that make this economic cycle very different from past economic cycles.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content