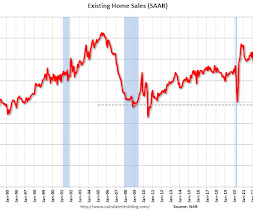

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 3.86 million SAAR in August

Calculated Risk

SEPTEMBER 21, 2024

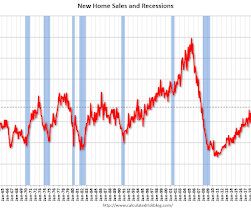

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August • Housing Starts Increased to 1.356 million Annual Rate in August • Part 2: Current State of the Housing Market; Overview for mid-September 2024 • Q2 Update: Delinquencies, Foreclosures and REO • Lawler: Early Read on Existing Home Sales in August This is usually published 4 to 6 times a week and provides more in-depth analysis of the housi

Let's personalize your content