2nd Look at Local Housing Markets in December

Calculated Risk

JANUARY 13, 2025

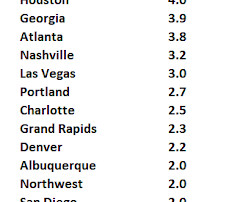

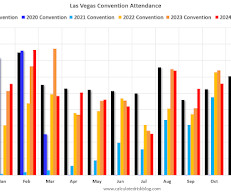

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available). This is the second look at several early reporting local markets in December.

Let's personalize your content