Five Questions to Prepare Clients for Caregiving Needs

Wealth Management

OCTOBER 10, 2023

Who cares for the caretakers?

Wealth Management

OCTOBER 10, 2023

Who cares for the caretakers?

Calculated Risk

OCTOBER 10, 2023

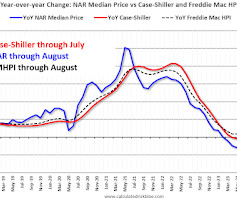

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-October A brief excerpt: Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-October I reviewed home inventory and sales. Most measures of house prices have shown an increase in prices over the last several months, and a key question I discussed in July is Will house prices decline further later this year?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 10, 2023

Who cares for the caretakers?

Abnormal Returns

OCTOBER 10, 2023

AI AI investment models can't explain how they do what they do. (msn.com) How JP Morgan Asset Management is rolling out AI tools for its analysts and PMs. (institutionalinvestor.com) How AI can be used to parse corporate risk disclosures. (papers.ssrn.com) Box spreads The pros and cons of using box spreads to generate cash-like returns. (morningstar.com) How to calculate the cost of borrowing through the options market.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 10, 2023

Molly Bennard discusses Connectus Wealth's business model, the importance of organic growth, future opportunities and more.

Nerd's Eye View

OCTOBER 10, 2023

Welcome everyone! Welcome to the 354th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Grier Rubeling. Grier is the founder of Advisor Transition Services, a consulting firm based in Cary, North Carolina, that helps advisors switch from one broker-dealer or custodian platform to another, often when breaking away from a larger firm to start up their own.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 10, 2023

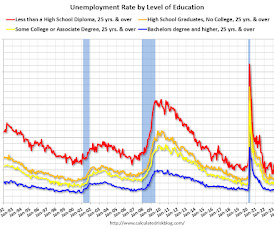

A few more employment graphs. Duration of Unemployment Click on graph for larger image. This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more. The short-term categories peaked at over 9% of the labor force at the onset of the pandemic.

Wealth Management

OCTOBER 10, 2023

Real estate managers’ assets under management fell by 2.9% during the year ended June 30, reported Pensions & Investments. S&P might downgrade Brookfield Real Estate to junk status because of its high maturing debt loan, according to Bisnow. These are among today’s must reads from around the commercial real estate industry.

The Reformed Broker

OCTOBER 10, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Have Treasury Bonds Bottomed? – The crash in long-dated Treasurys since the pandemic now ranks as one of the most destructive financial crashes ever.

Wealth Management

OCTOBER 10, 2023

During times of market uncertainty, a strong, clear message is vital to building and maintaining trust.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

OCTOBER 10, 2023

If you want to understand what’s happening in the US stock market these days, you need to understand what’s happening with the largest companies that make up such a heavy part of the index weighting. And to do that, you have to understand Big Tech. Which is where my friend Alex Kantrowitz comes in. He’s one of the foremost authorities on everything going on in the space.

Wealth Management

OCTOBER 10, 2023

One Arizona team has launched their own firm with the support of Dynamic Wealth Advisors, while three other advisors have joined Meridian Wealth Management.

A Wealth of Common Sense

OCTOBER 10, 2023

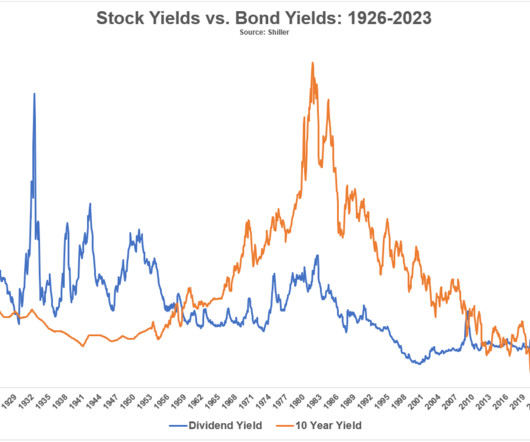

The 10 year Treasury yield recently hit 4.8%, its highest level since the summer of 2007. That’s higher than the dividend yield on all but 53 stocks in the S&P 500. Just four stocks out of 30 in the Dow Jones Industrial Average yield more than the benchmark U.S. government bond.1 The dividend yield on the S&P 500 has been falling for years from a combination of rising valuations and the increased usage of sh.

Wealth Management

OCTOBER 10, 2023

Jonathan Vincent Glenn faces 25 years in prison after pleading guilty to federal securities fraud charges.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

OCTOBER 10, 2023

This was a lot of fun, hope you get something interesting from it. Thanks so much to the Professor. The post Catch me on Scott Galloway’s show appeared first on The Reformed Broker.

Wealth Management

OCTOBER 10, 2023

Build strong relationships through exceptional service.

Advisor Perspectives

OCTOBER 10, 2023

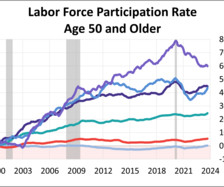

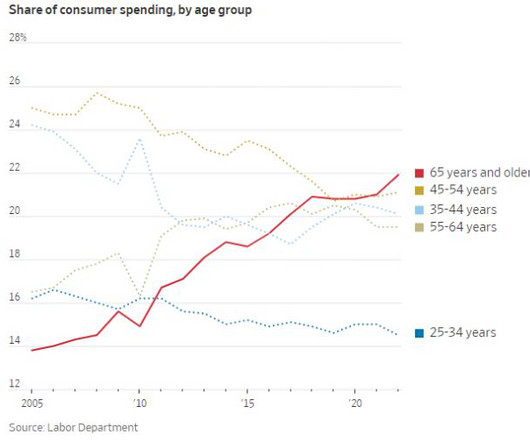

Today, one in three of the 65-69 cohort, nearly one in five of the 70-74 cohort, and nearly one in ten of the 75+ cohort are in the labor force.

Wealth Management

OCTOBER 10, 2023

Financial advisors say more clients than ever are making timing-related missteps when it comes to savings and investments.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Steve Sanduski

OCTOBER 10, 2023

Guest: Saundra Davis, the Founder and Executive Director of Sage Financial Solutions , an organization that develops comprehensive financial capability programs for low- and moderate-income communities throughout the United States. Saundra is a U.S. Navy veteran, financial coach, educator, and consultant who is nationally recognized as an expert in the financial coaching field and for her work with community-based organizations that focus on asset-building for the working poor.

Wealth Management

OCTOBER 10, 2023

Thursday, November 09, 2023 | 2:00 PM ET

Million Dollar Round Table (MDRT)

OCTOBER 10, 2023

By D. Kyle Atkins, CLU, CFP What we found from experience, having done one acquisition and working on two others now, is to make sure we’re clear as to what the current owners are trying to achieve. The guys and the gals who are out there just for the largest amount of money, we may not be a great fit. Nevertheless, if our cultures work together, if they’re looking to sell off gradually into the sunset, well, that’s marvelous.

Accounting for Good

OCTOBER 10, 2023

A message from the outgoing CEO. Kirsten Forrester leaves the business in excellent shape and in the hands of skillful and experienced professionals.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Clever Girl Finance

OCTOBER 10, 2023

Pre-approved credit cards are one way that credit card companies attract new customers. These offers are typically sent by mail to potential cardholders who meet some minimum criteria for approval. If you’ve ever received one of these offers, you may be wondering how it impacts your credit score. Or perhaps you are wondering what to do next. But first off, what does pre-approved for a credit card actually mean?

Advisor Perspectives

OCTOBER 10, 2023

Selling a business and managing sudden wealth calls for guidance from trusted advisors and a consistently mindful approach.

The Irrelevant Investor

OCTOBER 10, 2023

Today’s Animal Spirits is brought to you by YCharts: See here to register for YCharts webinar discussing this quarter’s top 10 visuals for clients and prospects. On today’s show, we discuss: Are bond yields too high, or too low? The US economy’s secret weapon: Seniors with money to spend Investors are yanking cash from stock funds, fast Airlines are just banks now Millennials on better track for retire.

Advisor Perspectives

OCTOBER 10, 2023

In the next year, we will see the introduction of the fully functioning, digital-human financial advisor.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

OCTOBER 10, 2023

Parabolic SAR Indicator : Technical analysis plays a major role in analysing the securities from both trader’s and investor’s perspectives. Among all technical indicators, the Parabolic SAR indicator has its own importance under the technical analysis of securities. Here, we shall discuss the Parabolic SAR indicator with its strategies, calculations, charts and applications.

Advisor Perspectives

OCTOBER 10, 2023

By placing personalization at the forefront, advisors make the financial journey more than just a series of transactions – it becomes a curated experience tailored to each client.

Indigo Marketing Agency

OCTOBER 10, 2023

Considering custom content but wondering if it’s worth it? We get it! Most financial advisors already know the importance of using valuable content to reach more clients. But if you’re anything like the professionals we work with, you’re probably curious about whether clients will notice the difference between canned content and custom content. Or whether providing custom content would truly make a difference to your business.

Advisor Perspectives

OCTOBER 10, 2023

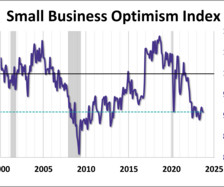

The headline number for the NFIB Small Business Optimism Index fell to 90.8 in September, as small business owners continued to report inflation as their biggest problem. The latest reading was worse than the forecast of 91.4 and marked the 21st straight month the index has been below the series average of 98.1.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content