IRS Extends Relief to 2023 for SECURE Act Era Designated Beneficiaries

Wealth Management

JULY 26, 2023

They won’t owe excise tax on required minimum distribution failures from 2021 to 2023.

Wealth Management

JULY 26, 2023

They won’t owe excise tax on required minimum distribution failures from 2021 to 2023.

The Big Picture

JULY 26, 2023

One of the more foolish arguments 1 that seem to be emanating from the Fed about their intention to raise rates another quarter point today: The 2% inflation target that has been in place pretty much the entire post-financial crisis era. There is no empirical evidence showing 2% is the optimal long-run inflation target, given the Fed’s dual mandate of price stability and maximum employment.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 26, 2023

With the average age of advisors hovering around 55, clients want to know they will be taken care of if something happens to their advisor, or if they retire.

Nerd's Eye View

JULY 26, 2023

Financial plans play an important role for both clients and advisors, as they not only help clients gain a clear perspective of their current financial position, but also provide advisors with a systematic way to organize their analyses and communicate their recommendations to the client. However, there is no standard style of what is included in these plans, and as financial planning software has gotten more sophisticated and capable over time, "The Plan" has gotten longer and longer with addit

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 26, 2023

Advisors are taking a close look at their portfolios given the current market and economic conditions.

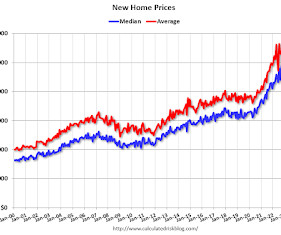

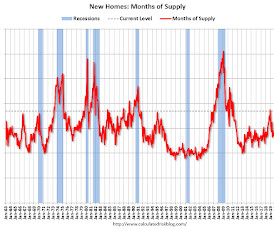

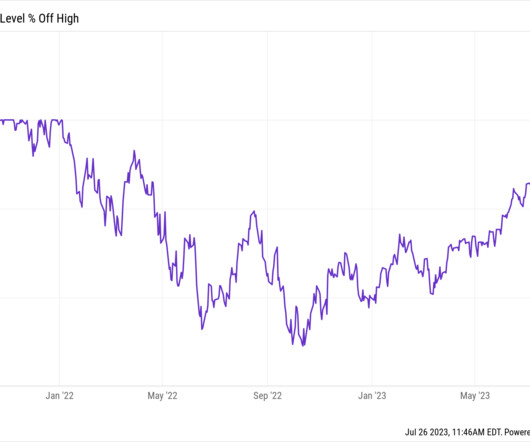

Calculated Risk

JULY 26, 2023

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales decrease to 697,000 Annual Rate in June Brief excerpt: And on prices, from the Census Bureau : The median sales price of new houses sold in June 2023 was $415,400. The average sales price was $494,700. The following graph shows the median and average new home prices. The average price in June 2023 was $494,700 up 5% year-over-year.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 26, 2023

Podcasts Doug Boneparth and Morgan Housel talk decision making with Cass Sunstein. (youtube.com) Christine Benz and Jeff Ptak talk with Joel Dickson of Vanguard about the state of retirement saving in America. (morningstar.com) Ten personal finance podcasts to check out including 'All the Hacks.' (money.usnews.com) Investing J.D. Roth, "Too many people try to overcomplicate investing.

Wealth Management

JULY 26, 2023

The newly-appointed advice tech executive talks about how he got started in politics, how this work intersects with his new role, his thoughts on the fee-for-service model debate and his vision for the future of the advisor billing software company.

Calculated Risk

JULY 26, 2023

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 697 thousand. The previous three months were revised down. Sales of new single‐family houses in June 2023 were at a seasonally adjusted annual rate of 697,000 , according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

Wealth Management

JULY 26, 2023

New York court allows minority owner to obtain information despite attorney-client privilege.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 26, 2023

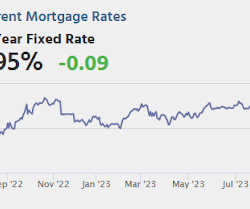

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 228 thousand last week. • Also at 8:30 AM, Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 1.8% annualized in Q2, down from 2.0% in Q1. • Also at 8:30 AM, Durable Goods Orders for June from the Censu

Wealth Management

JULY 26, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

Calculated Risk

JULY 26, 2023

Fed Chair Powell press conference video here or on YouTube here , starting at 2:30 PM ET. FOMC Statement: Recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated. The U.S. banking system is sound and resilient.

Wealth Management

JULY 26, 2023

By approaching compliance as a strategic opportunity rather than a regulatory burden, advisors can successfully navigate the maze and build a stronger practice.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

JULY 26, 2023

Strategy Eight ways compounding can get interrupted. (blog.validea.com) How to properly use a DCF model. (capitalgains.thediff.co) Finance Banc of California ($BANC) is buying PacWest ($PACW) with the help of private equity. (wsj.com) How Goldman Sachs' ($GS) relationship with Apple ($AAPL) soured. (theinformation.com) Wells Fargo ($WFC) has authorized a $30 billion stock buyback.

Wealth Management

JULY 26, 2023

Dale Buckner, CFP, is not your average advisor.

Calculated Risk

JULY 26, 2023

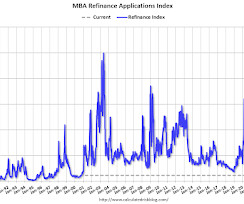

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 21, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 1.8 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JULY 26, 2023

Cannabis ETFs were among those posting the worst returns over the last year.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 26, 2023

Wealth managers must understand their clients' online behavior. Though we know them in some ways, we cannot assume their online behavior mimics what we know about them from past interactions.

Wealth Management

JULY 26, 2023

When it comes to succession planning, advisors shouldn’t leave their clients or employees in the lurch.

A Wealth of Common Sense

JULY 26, 2023

Today’s Animal Spirits is brought to you by YCharts: Submit your email here to receive 20% off a YCharts subscription for new clients On today’s show, we discuss: Tech stocks, meme stocks, crypto: Investors are feeling bold again The return on hassle spectrum ‘We were wrong'” Morgan Stanley’s Wilson offers stocks mea culpa A ‘soft landing’ and is Powell the most successful Fed.

Wealth Management

JULY 26, 2023

When it comes to financial planning, having an advisor who can connect clients with other resources can make all the difference.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Talon Wealth

JULY 26, 2023

If you’re new to the financial markets, figuring out where to stash your hard-earned money may feel like a daunting task. You may lack experience in understanding what makes a sound investment or don’t understand where you should put your money. That’s why before making any investment, you need a well-thought-out plan that considers your investment objectives, inflation rate, supply and demand, and your investment time horizon to have the best chance of success.

Wealth Management

JULY 26, 2023

The CEO of SignatureFD discusses the importance of understanding people’s motivations, the evolution of a firm’s messaging and why inclusion is key to a positive culture.

SEI

JULY 26, 2023

Coaching clients through the 'paradox of choice.

Wealth Management

JULY 26, 2023

As a female advisor, Karman Scott explains why communication and education are key differentiators at her firm.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Validea

JULY 26, 2023

By Justin Carbonneau ( Twitter | LinkedIn | YouTube ) — What do you think the main driver of long-term wealth creation is? Your job, profession and salary, your education, inheritance, hard work and resourcefulness, living within your means, savings or something else? Of course, all these things matter and play an important role, but for most of us who invest I would argue it’s the power of compounding over long periods of time that is the most powerful force in building wealth.

Wealth Management

JULY 26, 2023

They didn’t meet documentation requirements, and their appraisals contained valuation misstatements.

SEI

JULY 26, 2023

SEI empowers top technology talent to shape the future of wealth management.

Wealth Management

JULY 26, 2023

Jim Tausz of Bradford Financial Center explains how he manages money for clients through his firms’ proprietary program.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content