Inflation Exposes Most Retirement Planning Models as Financial Russian Roulette

Wealth Management

OCTOBER 6, 2022

There's a reason Monte Carlo is synonymous with gambling.

Wealth Management

OCTOBER 6, 2022

There's a reason Monte Carlo is synonymous with gambling.

The Big Picture

OCTOBER 6, 2022

My morning train WFH reads: • Is the Era of Low Interest Rates Over? There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world. ( New York Times ). • What to Buy?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 6, 2022

While property damage from the storm is already second only to Katrina, the impact to business operations and cargo movement may double or triple total losses. However, logistics providers are getting better at minimizing the scale of disruption.

Nerd's Eye View

OCTOBER 6, 2022

When it comes to politically charged discussions, financial advisors generally try to stay neutral and focus on providing clients with objective financial advice. Yet, while they seek to remain apolitical in their financial advice, the shifting political environment has made it increasingly common for more clients to express their political concerns and feelings with their financial advisors.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 6, 2022

Increase loyalty, retention and referrals with proactive advice.

Abnormal Returns

OCTOBER 6, 2022

Contrarianism A new contrary indicator courtesy of FTX. (allstarcharts.com) The inverse Cramer ETF may soon be a thing. (fortune.com) Strategy Is timing the bond market any easier than timing the stock market? (awealthofcommonsense.com) Why you can safely ignore market forecasters. (novelinvestor.com) Elon Eight (stupid) ways the Twitter ($TWTR) deal could still fall apart.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 6, 2022

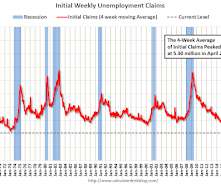

The DOL reported : In the week ending October 1, the advance figure for seasonally adjusted initial claims was 219,000 , an increase of 29,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 193,000 to 190,000. The 4-week moving average was 206,500, an increase of 250 from the previous week's revised average.

Wealth Management

OCTOBER 6, 2022

New Jersey-based Alex Guiliano, founder of Resonate Wealth Partners, left Merrill Lynch to join LPL under the IBD’s Strategic Wealth Services division.

Calculated Risk

OCTOBER 6, 2022

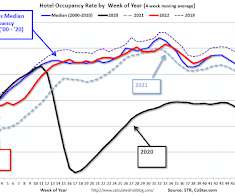

From CoStar: STR: Jewish Holiday Shift Leads to Expected US Weekly Hotel Performance Decline As expected with the Rosh Hashanah holiday, U.S. hotel performance dropped from the previous week and showed mixed comparisons with 2019, according to STR‘s latest data through Oct. 1. Sept. 25 through Oct. 1, 2022 (percentage change from comparable week in 2019*): • Occupancy: 66.4% (-2.4%) • Average daily rate (ADR): $149.71 (+15.7%) • Revenue per available room (RevPAR): $99.36 (+12.9%) In addition to

Wealth Management

OCTOBER 6, 2022

Act now because more people than ever are going online to begin their search for a ?nancial advisor.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

OCTOBER 6, 2022

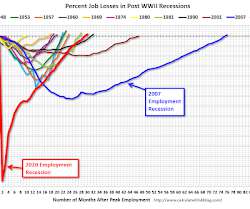

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%. There were 315,000 jobs added in August, and the unemployment rate was at 3.7%. Click on graph for larger image. • First, as of August there are 240 thousand more jobs than in February 2020 (the month before the pandemic).

Wealth Management

OCTOBER 6, 2022

Demand for apartments in the U.S. fell in the third quarter for the first time in 30 years. The New York Times looks at a blueprint for how to decarbonize an office building. These are among today’s must reads from around the commercial real estate industry.

Pragmatic Capitalism

OCTOBER 6, 2022

Here are some things I think I am thinking about: 1) The Jim Cramer ETFs. A firm has launched a set of inverse and long Jim Cramer ETFs.

Wealth Management

OCTOBER 6, 2022

This episode looks at the buy-side perspective of M&A, the attributes needed to become an attractive acquirer, the characteristics of prospective targets and more.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

OCTOBER 6, 2022

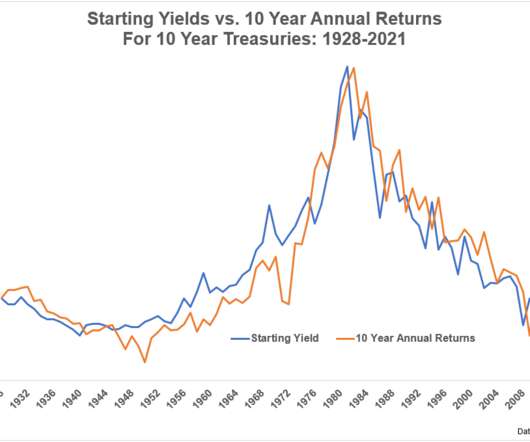

A reader asks: I know it’s not feasible to consistently time the stock market. But what about the bond market? It’s expected that the Fed will raise rates throughout 2022 and maybe 2023 and then cut them again in the near future (possibly before the elections). Isn’t the following strategy an easy win: buy when rates get “high”, sell when back to 0%?

Wealth Management

OCTOBER 6, 2022

Keith Todd Ashley killed his client and fraud victim, and tried to make it look like a suicide, according to the Justice Department.

Calculated Risk

OCTOBER 6, 2022

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill: We estimate nonfarm payrolls rose by 200k in September (mom sa), 50k below consensus and a slowdown from the +315k pace in August. We estimate the unemployment rate was unchanged at 3.7% in September. emphasis added CR Note: The consensus is for 250 thousand jobs added, and for the unemployment rate to be unchanged at 3.7%.

Wealth Management

OCTOBER 6, 2022

While the integrations from the two cryptocurrency investment platforms are currently limited to reporting feeds within the Envestnet | Tamarac platform, the RIA footprint is significant and, executives say, the demand is there.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

OCTOBER 6, 2022

My September Employment Preview Goldman September Payrolls Preview Friday: • At 8:30 AM ET, Employment Report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

Wealth Management

OCTOBER 6, 2022

Have you invited your representatives to your events, or to tour some of your properties? Have you attended any of their events?

The Reformed Broker

OCTOBER 6, 2022

Evercore’s bullish call on cybersecurity from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

OCTOBER 6, 2022

Thursday, October 27, 2022 | 4:00 PM ET

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

OCTOBER 6, 2022

Today, in the Calculated Risk Real Estate Newsletter: "For many [home] sellers, it likely feels like the rug has been pulled out from underneath them" A brief excerpt: A few early reporting markets … This is the first look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas.

Wealth Management

OCTOBER 6, 2022

After a brutal few months, small-time traders have been trying to recoup losses by betting against the market.

Alpha Architect

OCTOBER 6, 2022

Atilgan et al. contribute to the momentum literature with “Momentum and Downside Risk in Emerging Markets.”. Momentum Everywhere, Including Emerging Markets was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

OCTOBER 6, 2022

Fidelity, Vanguard and Alight are rolling out a service to automate the transfer of retirement accounts between employers.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Tobias Financial

OCTOBER 6, 2022

Acting plays a major part in Alex’s life and her journey toward her career. When she was younger, she wanted to pursue an acting career seriously and auditioned for a few roles in the theater at Belmont University. Growing up, Alex was very shy and for the most part kept to herself. The only place where she felt comfortable expressing her true self was the theater stage.

Wealth Management

OCTOBER 6, 2022

Declaration Partners collected $240 million from wealthy individuals and family offices to target multifamily housing and industrial properties across the US, the New York-based company said in a statement. Rubenstein is also an investor in the vehicle.

Carson Wealth

OCTOBER 6, 2022

Kevin Oleszewski, CFP ® , Senior Wealth Planner. It’s hard to fathom, but there are a lot of employee benefits that people aren’t using correctly — or aren’t using at all. Why? I blame it largely on the failure of employers to educate in a coherent and easy-to-understand fashion. The employee benefits business has its own language and most workers — even if they read all of their onboarding documents — won’t necessarily understand the content.

Clever Girl Finance

OCTOBER 6, 2022

As a quote from Benjamin Franklin says, " Happiness consists more in small conveniences or pleasures that occur every day, than in great pieces of good fortune that happen but seldom to a man in the course of his life." Making it a point to prioritize and enjoy life’s simple pleasures is one of the easiest ways to find joy every day. Like Ben said, you don't have to wait for those big, earth-shattering milestones to make you happy since those only come once in a blue moon.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content