Sanctuary Wealth Lands $2B Team from UBS

Wealth Management

MAY 9, 2025

1280 Financial Partners also comes with institutional consulting capabilities it will offer to other Sanctuary partner firms.

Wealth Management

MAY 9, 2025

1280 Financial Partners also comes with institutional consulting capabilities it will offer to other Sanctuary partner firms.

Nerd's Eye View

MAY 9, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent survey found that long-feared fee compression in the financial advice industry has yet to come to pass, though some advisors continue to see potential for small reductions in asset-based fees in the future. These results largely match results from the recent Kitces Research Study on Advisor Productivity, which found that the typical fee schedule for firms charging

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 9, 2025

With summer beach reading season approaching, you cant beat these 10 novels centering on wealth managers.

Calculated Risk

MAY 9, 2025

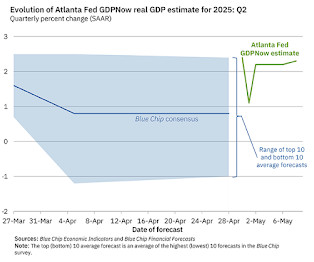

Plenty of data next week! Note that the Blue Chip consensus is wide - and currently around 1%. From the Atlanta Fed: The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.3 percent on May 8, up from 2.2 percent on May 6. After this mornings wholesale trade report from the US Census Bureau, the nowcast of the contribution of inventory investment to annualized second-quarter real GDP growth increased from -0.46 percentage points to -0.43

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

MAY 9, 2025

Several wealth managers announced hires for key positions, including Cetera Investors, Citi Wealth and multi-family offices Parcion and Nordwand.

A Wealth of Common Sense

MAY 9, 2025

A lot of advice out there sounds good on paper but fails to work in reality. Follow your passion! Sure, but does your love of fantasy football pay the bills? You can do anything you set your mind to! Tell that to my 5th-grade NBA dreams. The same is true of some financial advice. It sounds good as an inspirational quote but ends up being more or less impossible to pull off in real world for most people.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

MAY 9, 2025

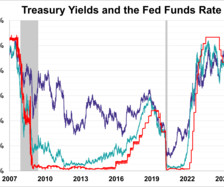

The yield on the 10-year note ended May 9, 2025 at 4.37%. Meanwhile, the 2-year note ended at 3.88% and the 30-year note ended at 4.83%.

Mullooly Asset Management

MAY 9, 2025

Buffett To Retire as CEO On May 3, 2025, Warren Buffett announced (at the end of the Berkshire Hathaway annual meeting) he would be stepping down as CEO of the organization.

Advisor Perspectives

MAY 9, 2025

The S&P 500 ended the week lower, falling 0.47% from last Friday and snapping its two-week win streak.

Harness Wealth

MAY 9, 2025

Successful tax advisory practices dont happen by chancetheyre the result of many years’ worth of hard work. Most importantly, tax practices are built on strong client relationships and specialized knowledge. Succession planning for tax practices, therefore, is as delicate a process as it is important. In this article, well examine the key considerations of tax practice succession planning, from initial preparation to a strategic exit, and how best to secure your firm’s continued succ

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

MAY 9, 2025

Investors bearish on the dollar have generated attractive returns in the current environment with Invesco's UDN.

SEI

MAY 9, 2025

Empowering advisors with custody, tech, and investment solutionsSEI supports your evolution, every step of the way.

Calculated Risk

MAY 9, 2025

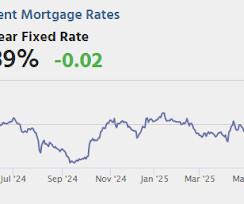

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. For deaths, I'm currently using 4 weeks ago for "now", since the most recent three weeks will be revised significantly. Note: " Effective May 1, 2024, hospitals are no longer required to report COVID-19 hospital admissions, hospital capacity, or hospital occupancy data. " So, I'm no longer tracking hospitalizations.

Darrow Wealth Management

MAY 9, 2025

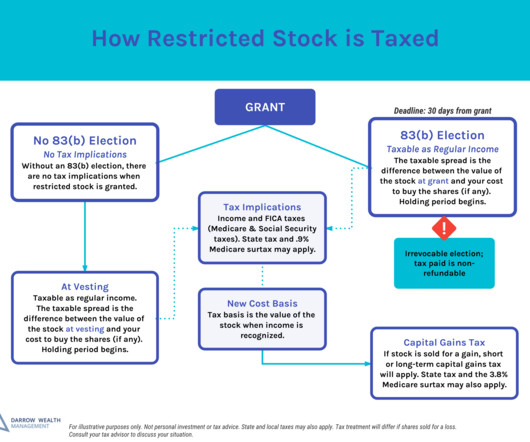

A restricted stock award (RSA) is a form of equity compensation. RSA grants are commonly issued by private companies, particularly early-stage startups, and may be referred to as founder’s stock or simply restricted stock grants awarded to employees. When restricted stock is granted, shares of company stock are held in escrow until vesting requirements have been met.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

MAY 9, 2025

In this WealthStack podcast episode, Lauren Clough details how bQuest's platform helps financial advisors support clients through aging transitions and elder care planning.

The Big Picture

MAY 9, 2025

This week, I speak with Karin Risi , who spent 27 years at Vanguard , the world’s 2nd largest asset manager. She has reported directly to the past four CEOs of VG. She formulated enterprise-level strategy, drove client and revenue growth, oversaw talent development, and influenced capital allocation for the $10 trillion investment firm serving 50 million investors globally.

Wealth Management

MAY 9, 2025

Financial Synergies has completed a long-term plan to transfer ownership to a new generation of advisors, passing up private equity and outside capital along the way.

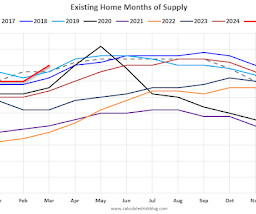

Calculated Risk

MAY 9, 2025

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-May 2025 A brief excerpt: This 2-part overview for mid-May provides a snapshot of the current housing market. Right now, the key story for existing homes is that inventory is increasing sharply, and sales are essentially flat compared to last year.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

MAY 9, 2025

During an earnings call, CEO Rich Steinmeier said LPL was in line to retain 90% of Commonwealth advisors, while CFO Matt Audette said it would be challenging for smaller firms to counter LPLs scale.

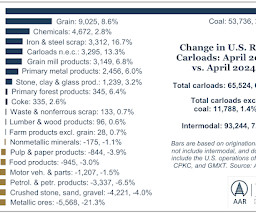

Calculated Risk

MAY 9, 2025

From the Association of American Railroads (AAR) AAR Data Center. Graph and excerpts reprinted with permission. Recent shifts in U.S. policies on trade and immigration have introduced volatility in financial markets and heightened uncertainty for firms. The ultimate outcomes and impacts of these policy changes remain unclear. Nevertheless, U.S. rail volumes have thus far remained stable , and many core economic indicators continue to signal underlying resilience.

Wealth Management

MAY 9, 2025

Asking clients about their favorite charity can help differentiate your practice.

Abnormal Returns

MAY 9, 2025

Listening PodX is buying Lemonada Media. (variety.com) The Golden Globes is adding an award for podcasts. (hollywoodreporter.com) Business Jack Altman talks with Josh Kopelman, co-founder of First Round Capital, about the increasingly difficult math in venture capital. (youtube.com) Patrick O'Shaugnessy talks with David Senra about lessons learned from the best founders.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Wealth Management

MAY 9, 2025

Recent AI developments in wealth management include Cetera's collaboration with Jump, HighPeak's healthcare planning platform and Integrated Partners partnership with Carefull.

Abnormal Returns

MAY 9, 2025

Markets This model has turned bearish for the first time in two years. (bloomberg.com) Six reasons why the stock market turned on a dime. (downtownjoshbrown.com) Americans say real estate and gold are the best long term investments. (cnbc.com) Fund management Active management industry has to remake itself to survive. (blogs.cfainstitute.org) Target-date fund managers want clear guidance on including private assets.

Wealth Management

MAY 9, 2025

Founder and President Rita Robbins says disruption and the desire for personalized support have helped attract advisor teams with about $1.5 billion in client assets.

Advisor Perspectives

MAY 9, 2025

For more than a year, Alphabet Inc. shareholders have fretted over long-term risks posed by artificial intelligence to the company’s money-printing search business. This week the threat became much more immediate.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealth Management

MAY 9, 2025

In a lawsuit filed in Georgia, Mercer argues Ryan Malec and David Weitz took former clients with them when they quit Mercer to form Unified Investment Management in 2023.

Sara Grillo

MAY 9, 2025

Many may think when they see the words flat fee, that is the only point that they should focus on! Some may even think it’s more important than the actual investments in the portfolio, and the return it should generate!Theres talk that flat fee advisors are just there to deflate the cost of investing, so investors will levitate to it. There is way more to flat fee financial advisors – it’s about transparency – not the flat fee price cut you get.

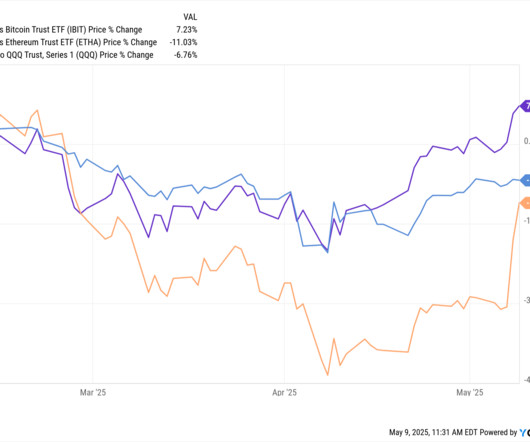

Advisor Perspectives

MAY 9, 2025

The culture clash between Bitcoin enthusiasts and gold bugs is about to be played out in the world of exchange-traded funds.

Harness Wealth

MAY 9, 2025

Successful tax advisory practices dont happen by chancetheyre the result of many years’ worth of hard work. Most importantly, tax practices are built on strong client relationships and specialized knowledge. Succession planning for tax practices, therefore, is as delicate a process as it is important. In this article, well examine the key considerations of tax practice succession planning, from initial preparation to a strategic exit, and how best to secure your firm’s continued succ

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content