The Strategy Behind Invesco’s New Non-Traded REIT Launch

Wealth Management

JULY 20, 2023

How and why the company is trying to bring opportunities for investment in real estate credit to high-net-worth investors.

Wealth Management

JULY 20, 2023

How and why the company is trying to bring opportunities for investment in real estate credit to high-net-worth investors.

Calculated Risk

JULY 20, 2023

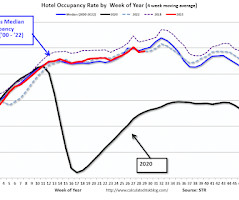

From STR: U.S. hotel results for week ending 15 July U.S. hotel performance increased from the previous week and showed improved comparisons year over year, according to CoStar’s latest data through 15 July. 9-15 July 2023 (percentage change from comparable week in 2022): • Occupancy: 72.0% (+0.1%) • Average daily rate (ADR): US$159.98 (+1.5%) • Revenue per available room (RevPAR): US$115.18 (+1.6%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate using

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 20, 2023

Evolving global tax and disclosure regimes to consider.

Calculated Risk

JULY 20, 2023

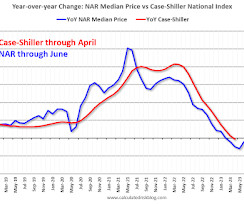

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.16 million SAAR in June; Median Prices Declined 0.9% YoY in June Excerpt: On prices, the NAR reported : The median existing-home price for all housing types in June was $410,200, the second-highest price of all time and down 0.9% from the record-high of $413,800 in June 2022.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 20, 2023

Savant Wealth Management is acquiring Raymond F. Book & Associates, along with its affiliated RIA, a Dover-based firm with about $376 million in AUM.

Calculated Risk

JULY 20, 2023

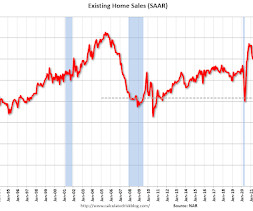

From the NAR: Existing-Home Sales Retreated 3.3% in June; Monthly Median Sales Price Reached Second-Highest Amount Ever Existing-home sales slipped in June, according to the National Association of REALTORS®. Sales varied among the four major U.S. regions, with the Northeast experiencing gains, the Midwest holding steady, and the South and West posting decreases.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

JULY 20, 2023

“A new product that offers investors complete downside protection: Investors in the $7.5 trillion ETF universe can now put money behind the Innovator Equity Defined Protection ETF, which began trading under the ticker TJUL on Tuesday. The offering comes from Innovator Capital Management, which launched the first so-called buffer ETFs, also sometimes referred to as defined-outcome funds, in 2018.” – Bloomberg Let’s get this out of the way: I dislike any product that exchanges a port

Wealth Management

JULY 20, 2023

What’s happening with this asset class?

Calculated Risk

JULY 20, 2023

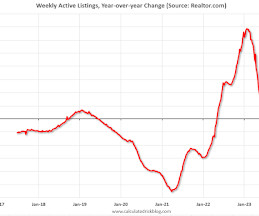

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu and Danielle Hale: Weekly Housing Trends View — Data Week Ending July 15, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 6%. Following a year of declining newly listed homes, the stock of active inventory began to decline in June and this past week continued a four week trend with an annual decline of 6%.

Wealth Management

JULY 20, 2023

A valid investment discipline regardless of the politics.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 20, 2023

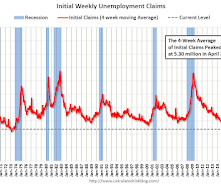

The DOL reported : In the week ending July 15, the advance figure for seasonally adjusted initial claims was 228,000 , a decrease of 9,000 from the previous week's unrevised level of 237,000. The 4-week moving average was 237,500, a decrease of 9,250 from the previous week's unrevised average of 246,750. emphasis added The following graph shows the 4-week moving average of weekly claims since 1971.

Wealth Management

JULY 20, 2023

Fewer commercial real estate borrowers are seeking traditional refinancing, reported The Business Journals. Prologis CEO predicted a more normal period for the industrial sector after outsized growth over the past few years, according to Bisnow. These are among today’s must reads from around the commercial real estate industry.

Abnormal Returns

JULY 20, 2023

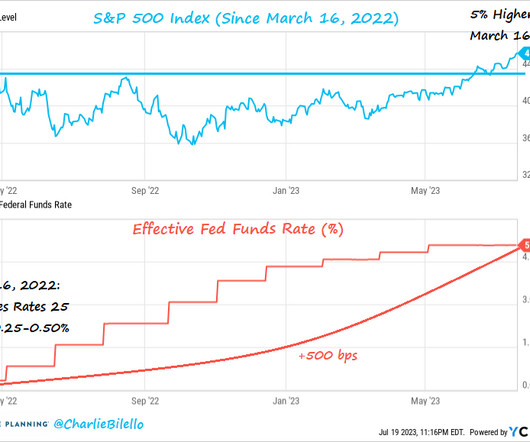

Strategy Why stock market valuations are logically higher today than they were in the past. (ofdollarsanddata.com) Why compounding is still unheralded. (blog.validea.com) Finance Blackstone ($BX) now manages more than $1 trillion in assets. (finance.yahoo.com) The airport lounge wars are heating up with JP Morgan Chase ($JPM) joining the fray. (wsj.com) The U.S. lags, badly, in real-time funds transfer.

Wealth Management

JULY 20, 2023

Edward Jones advisors not only have the option to share offices, but they can now share clients. The firm expects 1,000 advisors to work in teams by year-end.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

JULY 20, 2023

Ritholtz’s Josh Brown responds to the parabolic reversal of DHI post-earnings from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

JULY 20, 2023

One of the most influential people in the financial planning and investment management profession discusses what fueled his firm’s growth, the importance of financial education, the value of embracing technology and more.

A Wealth of Common Sense

JULY 20, 2023

On this week’s show, Josh Brown and Phil Pearlman joined me to talk about questions on gambling in your Roth IRA, talking finances with your partner, how to change bad health habits and much more. Further Reading: The Psychology of Sitting in Cash 1If I’m being honest I’ve probably used this advice in the past. Credit to me for changing my mind.

Wealth Management

JULY 20, 2023

These funds saw the most activity over the past 30 days.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Million Dollar Round Table (MDRT)

JULY 20, 2023

By Matt Pais, MDRT Content Specialist Brad Elman, CLU, CLTC , believes in a simple, circular process of focus, skill and happiness: If you enjoy something, you’ll be motivated to do it. If you’re motivated to do something, you will do it more frequently. If you do something more frequently, you become better at it. If you’re good at it, you’ll enjoy it more.

Wealth Management

JULY 20, 2023

Three Wall Street veterans weigh in on the dangers facing investors in coming years.

Integrity Financial Planning

JULY 20, 2023

As retirees look for ways to stay entertained and engaged, movies provide a fantastic option for a fun and relaxing pastime. With a plethora of genres, themes, and characters, there is something for everyone to enjoy. Here are some recent films that retirees will find fascinating and entertaining that engage with what it’s like to grow older and care about the people around you. “The Best Exotic Marigold Hotel” (2011) – This heartwarming film tells the story of a group of

Wealth Management

JULY 20, 2023

A study from SmartAsset looked at how much people with six-figure salaries in New York, San Francisco and Chicago can save if they leave for Austin.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

NAIFA Advisor Today

JULY 20, 2023

A study conducted by OneAmerica found that 46% of financial professionals do not recommend long-term care (LTC) protection to their clients. The study highlights a potential gap in helping clients prepare financially for potential LTC expenses. It is estimated that almost 70% of individuals over the age of 65 will require LTC services at some point in their lives, making LTC protection an important aspect of retirement planning.

Wealth Management

JULY 20, 2023

The $3.7 million NightShares 500 ETF (NSPY) and the $1.4 million NightShares 2000 ETF (NIWM) will stop trading at the end of this month and liquidate on Aug. 10.

The Irrelevant Investor

JULY 20, 2023

Today’s Compound and Friends is brought to you by Kraneshares: See here and here for more information on Kraneshares China Internet & Covered Call Strategy ETF $KLIP On today’s show, we discuss: Ice T thanks the haters in Hollywood Apple tests ‘Apple GPT’, developers’ generative AI tools to catch OpenAI The problem with valuation Shiller: Past high stock returns an ‘anomaly’ The post The Compound and Friends: We Have Lost All Sense of Decorum appeared fi

Advisor Perspectives

JULY 20, 2023

The Conference Board Leading Economic Index (LEI) for June dropped to 106.1 from May's figure of 106.9. This is the index's lowest reading since July 2020 and the 15th consecutive monthly decline, the longest streak since 2009. Today's reading represented a 0.7% month-over-month decline, slightly worse than the forecast.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Irrelevant Investor

JULY 20, 2023

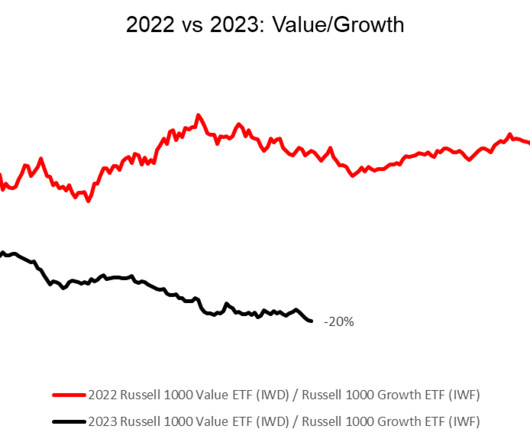

Investors tend to over-extrapolate. I’ll use myself as an example. One of my ten predictions for 2023 was that energy would be the first sector to lead the pack for three consecutive years since utilities did in the late 80s. ¯_(ツ)_/¯ Not only did this not come true, but the opposite is happening. Energy is the second-worst performing sector YTD.

Random Roger's Retirement Planning

JULY 20, 2023

Marketwatch posted an advice type of column where a reader asked about his retirement readiness as he just got laid off and now would like to be done with working. He is 61, no mention of his wife's age or whether she is still working. They have a combined $350,000 in qualified retirement accounts and $200,000 in taxable accounts. He said his Social Security will be $2035 at 62 and his wife's will be "way less.

Ron A. Rhodes

JULY 20, 2023

In previous posts I discussed several “factors” – characteristics of stocks – that can be utilized in portfolio construction to seek to improve equity (stock) returns over long periods of…

Validea

JULY 20, 2023

In this episode, we talk growth investing with Wedgewood Partners Chief Investment Officer David Rolfe. We discuss the characteristics of great growth companies and the details of their process to identify them. We cover the importance of dominant products, the characteristics of strong management teams, the role of valuation in growth investing and a lot more.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content