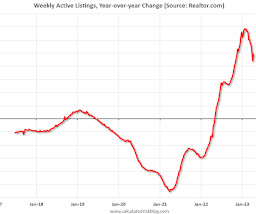

Realtor.com Reports Weekly Active Inventory Up 49% YoY; New Listings Down 5% YoY

Calculated Risk

APRIL 20, 2023

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 15, 2023 • Active inventory growth continued to climb, with for-sale homes up 49% above one year ago. The number of homeowners shifting home listing timelines around spring holidays helped push active inventory growth up this week.

Let's personalize your content