Top clicks this week on Abnormal Returns

Abnormal Returns

AUGUST 27, 2023

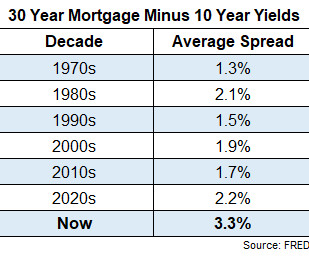

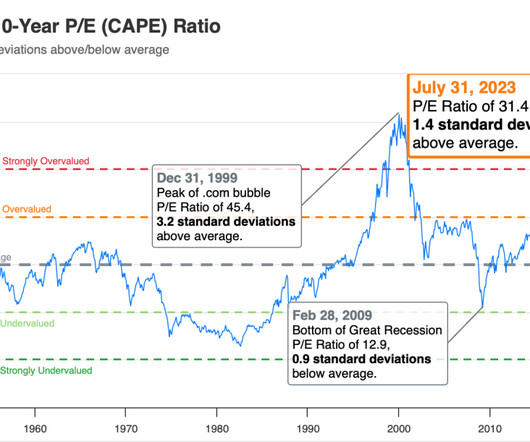

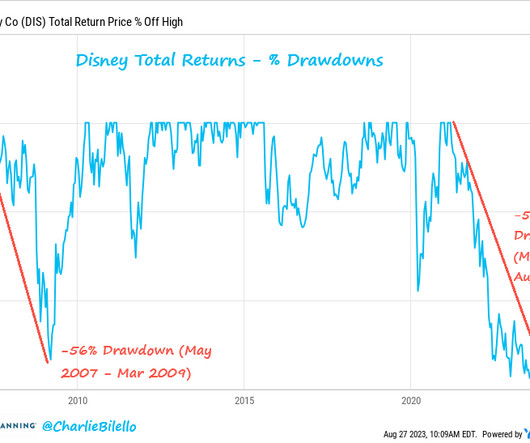

Top clicks this week Better investing comes from better decision making. (ritholtz.com) Asset allocation is not a science. (obliviousinvestor.com) It's hard to overstate the sea change that has occurred with interest rates. (theirrelevantinvestor.com) Quant strategies are not free from human input. (blog.validea.com) The only way to learn about investing is actually putting money on the line.

Let's personalize your content