3rd Quarter Economic And Market Outlook: Understanding Risks And Opportunities In The Web Of Inflation, Interest Rates, Valuations, And More

Nerd's Eye View

OCTOBER 4, 2023

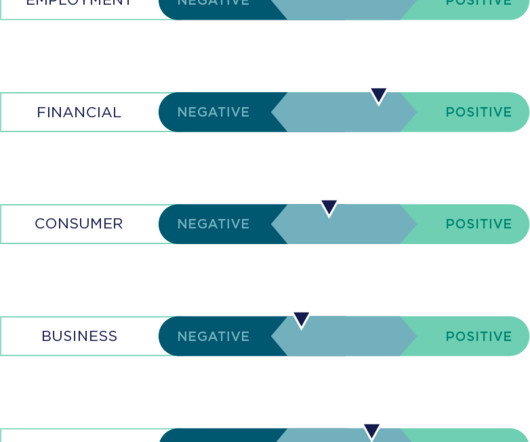

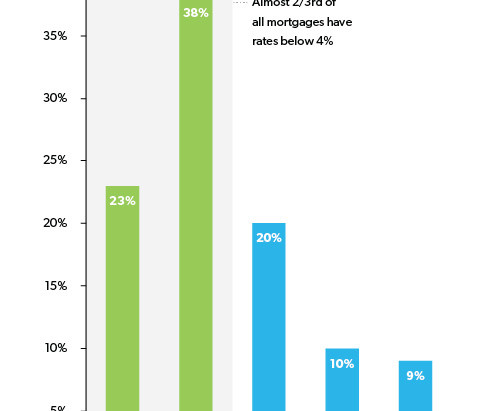

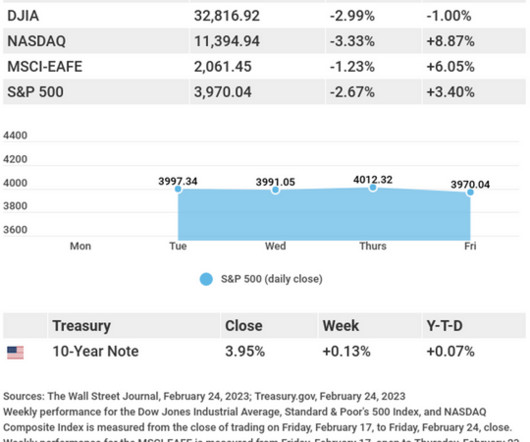

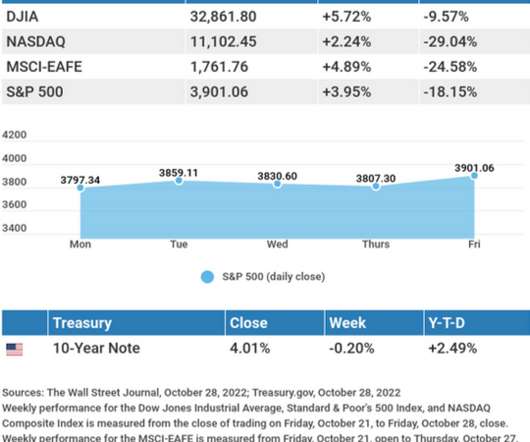

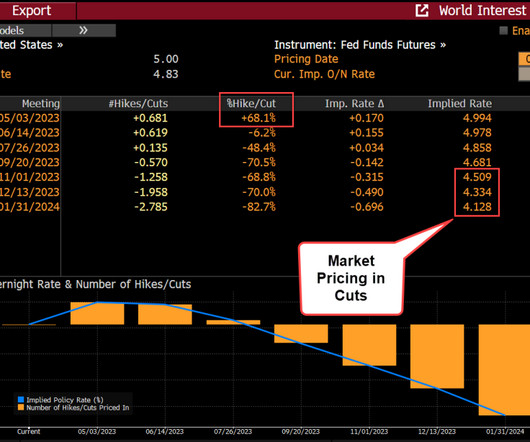

manufacturing sector, by the measures of employment and service prices, has been in a recession for nearly 12 months. What's driving many of the economic conditions today are higher interest rates resulting from the Fed's efforts to fight inflation. And even though U.S.

Let's personalize your content