Top Compliance and Litigation Tips for 401(k) Plans

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

Nerd's Eye View

JANUARY 3, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with a recent survey indicating that a majority of advisors are viewing new client acquisition as their primary challenge in the current competitive environment for financial advice (followed by compliance and technology management) and suggests (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors (..)

Nerd's Eye View

AUGUST 5, 2022

We also have a number of articles on retirement planning: How the variability in annuity payouts across annuity providers has exploded in 2022, creating an opportunity for advisors to add value to clients by comparison shopping across insurance companies.

Nerd's Eye View

JANUARY 26, 2024

Also in industry news this week: A House committee has advanced a bill that would extend several expired business-related tax measures from the Tax Cuts and Jobs Act and would increase the value of the Child Tax Credit The SEC released its examination priorities for 2024, which include a focus on advisers' adherence to their duty of care and duty of (..)

Nerd's Eye View

NOVEMBER 11, 2022

While some are looking to gain a first-mover advantage by leveraging client testimonials and third-party endorsements (and adjusting their compliance programs before doing so), others are taking a wait-and-see approach. Also in industry news this week: Why “SECURE 2.0”

Nerd's Eye View

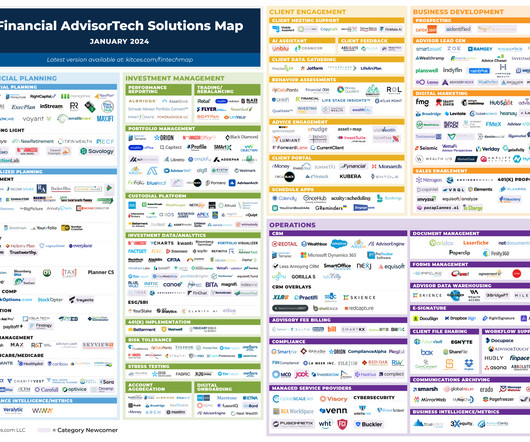

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

JANUARY 13, 2023

FINRA has released its enforcement priorities for 2023, including a continued focus on compliance with Regulation Best Interest as well as several new priority topics, such as manipulative trading, fixed-income pricing, and trading in fractional shares.

Nerd's Eye View

JULY 26, 2024

Also in industry news this week: While the number of RIA M&A deals has not surged in 2024, the average size of deals has increased, demonstrating interest from (often private-equity-backed) firms in pursuing larger targets Off-channel communication tops the list of concerns amongst RIA compliance professionals, with advertising and marketing coming (..)

Nerd's Eye View

AUGUST 4, 2023

Also in industry news this week: RIA M&A activity fell in the second quarter compared to the same period last year amid rising financing costs, though continued private equity interest in the RIA space could help buoy deal volume going forward According to a recent survey, RIAs appear to be taking a defensive approach toward the SEC's new marketing (..)

Nerd's Eye View

FEBRUARY 17, 2023

Further, an investment adviser who can make trades on behalf of a client would be deemed to have custody of the client’s assets, which could substantively shift a very sizable portion of the wealth management RIA community under the custody rule, though it remains to be seen whether or what exact custody rule compliance requirements would be (..)

Nerd's Eye View

JUNE 5, 2023

This month's edition kicks off with the news that Riskalyze has completed its previously-announced rebranding, and will now be known as “Nitrogen”, a ”growth platform” for advisory firms – which represents less of a shift in the platform’s core function (given that Riskalyze’s risk tolerance tool was always (..)

Carson Wealth

JULY 3, 2024

Develop a risk management plan to implement strategies that minimize or eliminate risks, and protect your business with appropriate insurance coverage, such as liability, property and business interruption insurance. Get Help with Tax Planning Tax planning is a critical component of financial management.

International College of Financial Planning

JUNE 17, 2025

These institutions operate under international compliance norms, positioning GIFT City alongside global financial hubs such as Singapore, Dubai, and Hong Kong. Transparent Taxation and Compliance Operating within GIFT City allows investors to benefit from low transaction costs, international audit standards, and applicable DTAA benefits.

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

WiserAdvisor

SEPTEMBER 13, 2023

While grappling with various aspects of retirement planning, it is imperative to acknowledge a critical factor that often does not receive its due attention – longevity risk. While this is undoubtedly positive, it introduces the challenge of ensuring that your financial resources last an extended retirement period.

Harness Wealth

APRIL 16, 2025

Leveraging retirement plans for tax advantages Tech entrepreneurs can create substantial tax advantages through Solo 401(k) plans, which allow contributions up to $69,000 in January 1, 2024 for those under 50. For growing tech startups, establishing company retirement plans serves multiple purposes beyond tax benefits.

Indigo Marketing Agency

JUNE 17, 2025

A key insight from Colton was also helpful: when someone asks AI about retirement planning, what’s the logical follow-up question? Write like you’re actually talking to someone in your office, not like you’re writing a compliance manual. Structure everything clearly and use smart internal linking.

Sara Grillo

DECEMBER 16, 2024

Today I have Brian Williams of Northshire Consulting and were going to be talking about how financial advisors can help improve 401k plan access to the American people who are working at small businesses who currently do not offer them. What if the local baker had a 401k plan? Why are small business owners not offering 401k plans?

Harness Wealth

APRIL 16, 2025

The fundamentals of Roth and traditional IRAs Traditional IRAs have long served as a cornerstone of retirement planning, offering immediate tax benefits through deductible contributions while deferring taxes until withdrawal. This systematic approach ensures compliance and optimal tax outcomes.

Harness Wealth

APRIL 17, 2025

The calculation becomes increasingly complex for higher-income taxpayers , as it introduces factors such as W-2 wages paid to employees, the unadjusted basis of qualified property, and retirement plan contributions. Partner with Harness for top-tier advisory services in financial, tax, and estate planning.

Harness Wealth

JANUARY 9, 2025

Both the Mega Backdoor Roth IRA and Mega Backdoor Roth 401(k) allow the additional contribution of funds to retirement plans after pre-tax and Roth contribution limits have been reached. Roth IRAs are also not subject to Required Minimum Distributions (RMDs), allowing more flexibility in retirement planning.

Carson Wealth

JULY 12, 2022

The first step in the competency stairway is regulatory compliance. . The securities industry weaves the Financial Industry Regulatory Authority (FINRA) and state securities commissioners into a regulatory quilt, also requiring stockbrokers and their registered agents to pass registration exams and complete annual compliance training.

Brown Advisory

JANUARY 20, 2023

We work closely with our clients and their outside professional advisors to identify when FBAR filings are required and to help facilitate compliance. FBAR compliance was enforced by the Treasury Department’s Financial Crimes Enforcement Network bureau, or FinCEN until 2003, when enforcement was delegated to the IRS.

Midstream Marketing

DECEMBER 6, 2024

Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Compliance and Security for RIAs Compliance and data security matter a lot in the financial services industry. A lot of clients use these devices.

Harness Wealth

APRIL 30, 2025

Self-employed individuals enjoy unique advantages when it comes to health insurance and retirement planning. Business-related vehicle expenses can be claimed using either the standard mileage rate of $0.67 per mile (as of January 1, 2024) or by tracking actual expenses.

Fortune Financial

MARCH 5, 2024

A 401k is a company-sponsored retirement plan that allows employees to elect contributions to be withheld from their wages and salaries and deposited into an investment account. It is named after a section of the Internal Revenue Code that provides regulations for these types of retirement plans. What is 401k?

Fortune Financial

JANUARY 11, 2024

Based on the 2022 Workplace Wellness Survey , published in the Employee Benefit Research Institute (EBRI) journal, younger employees prioritize professional development opportunities, while older employees value retirement planning more. Retirement benefits are a key component of a benefits package that attracts and retains top talent.

Harness Wealth

APRIL 30, 2025

Employee Stock Ownership Plans (ESOPs) An ESOP allows owners to gradually sell their shares to employees through a qualified retirement plan. Setting up an ESOP requires careful planning and the guidance of specialized advisors to navigate complex regulations and maximize available tax benefits.

Midstream Marketing

NOVEMBER 5, 2024

Understand why compliance, engagement, and tracking success are vital for your social media efforts. Introduction In today’s digital world, having a good social media plan is very important for financial advisors who want to succeed. Are they interested in retirement plans?

Midstream Marketing

DECEMBER 10, 2024

Do you specialize in retirement planning for small business owners? Financial advisors can use videos in different parts of financial planning. You can make explainer videos about investment ideas, retirement plans, or tips on saving on taxes. It also shows that you are a good guide for their financial planning.

Park Place Financial

JULY 6, 2022

RETIREMENT PLANNING The Impact of Public Retirement in Texas Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Current and upcoming rulings are changing public retirement for Texans. Current and upcoming rulings are changing public retirement for Texans. What Is Texas HB 3898?

Fortune Financial

SEPTEMBER 25, 2023

Long-term goals typically encompass retirement planning, wealth preservation and estate planning. Certified Financial Planner (CFP) CFPs are professionals who have completed rigorous education, passed a comprehensive exam and have substantial experience in financial planning.

Fortune Financial

SEPTEMBER 25, 2023

Long-term goals typically encompass retirement planning, wealth preservation and estate planning. Certified Financial Planner (CFP) CFPs are professionals who have completed rigorous education, passed a comprehensive exam and have substantial experience in financial planning.

Harness Wealth

MAY 19, 2025

Understanding the tax filing requirements and payment schedules is essential for compliance and effective tax planning. Additionally, C Corps can deduct contributions to employee retirement plans and health insurance premiums, which can also serve as incentives for attracting and retaining talent.

International College of Financial Planning

MARCH 31, 2023

The program is designed to provide students with practical exposure to the wealth management industry through internships and hands-on training.

Sara Grillo

AUGUST 25, 2023

Hottleman and Associates www.hottleman.com Avg account size: $300k Niche: Single professional women approaching retirement Services: Financial planning, investment management, college planning, tax services, company retirement plans Note: Andrea holds insurance and FINRA licenses. 56 Capital Partners www.56capitalpartners.com

Brown Advisory

JANUARY 20, 2023

We work closely with our clients and their outside professional advisors to identify when FBAR filings are required and to help facilitate compliance. FBAR compliance was enforced by the Treasury Department’s Financial Crimes Enforcement Network bureau, or FinCEN until 2003, when enforcement was delegated to the IRS.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content