Tax Advice Restrictions For Financial Advisors: How To Offer Tax Planning And Remain In Compliance

Nerd's Eye View

NOVEMBER 30, 2022

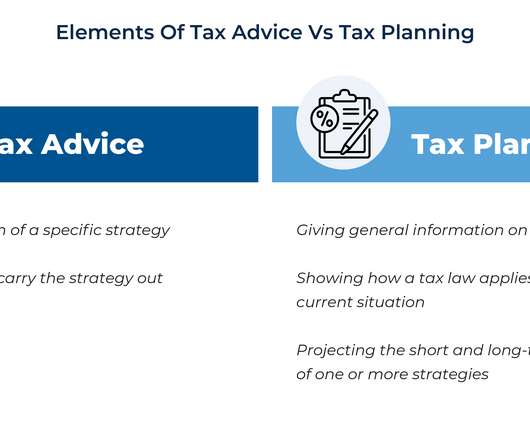

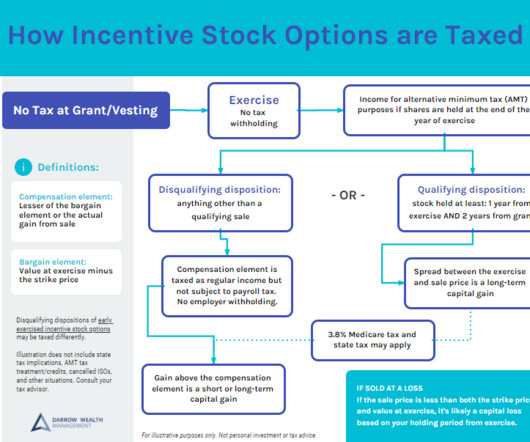

Which means that advisors are often left to figure out on their own how to guide their clients on tax-related matters without crossing the line into ‘Tax Advice’, which can potentially create certain liability issues for the advisor and their firm.

Let's personalize your content