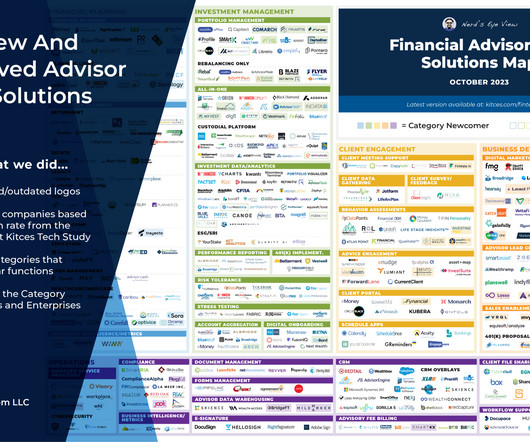

The Latest In Financial #AdvisorTech (October 2023)

Nerd's Eye View

OCTOBER 2, 2023

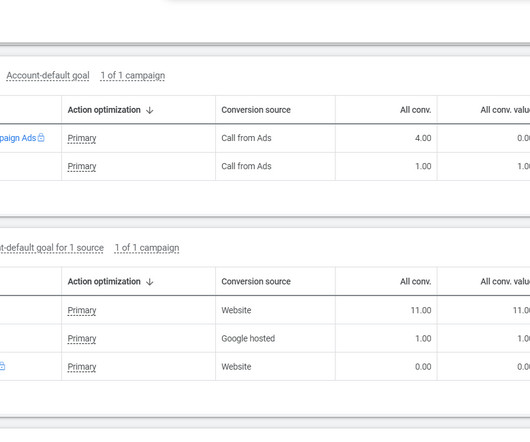

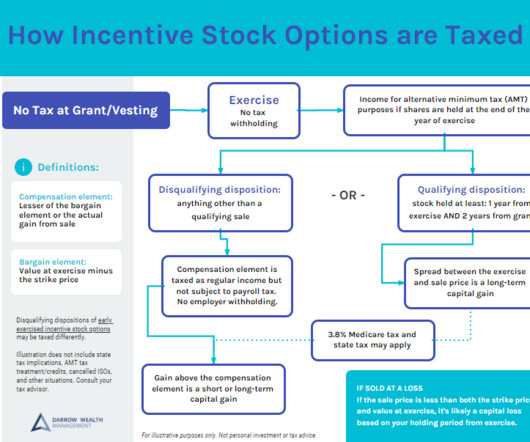

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including: Brand design consultancy firm Intention.ly

Let's personalize your content