No Red Blood, Just Green Flood

Investing Caffeine

NOVEMBER 1, 2021

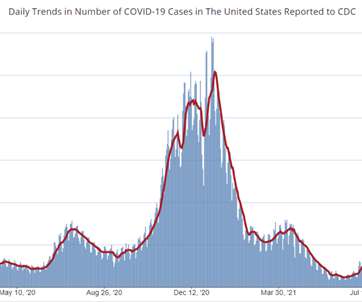

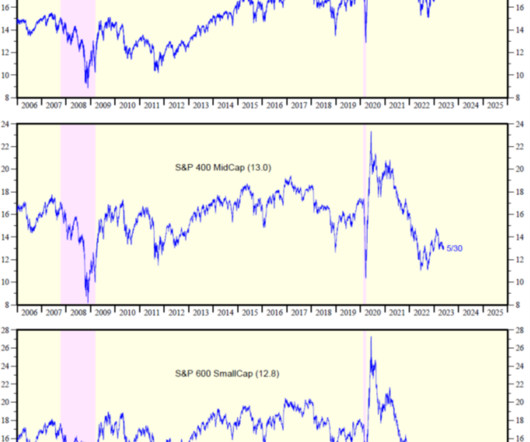

With the COVID Delta variant subsiding ( see chart below ), economic activity rising ( Q4 GDP is estimated at +4.8% ), and corporate profits going gang busters (33% growth and 84% of corporations are beating Q3 estimates ), it should come as no surprise that stock market values continue to rise. Slome, CFA, CFP®.

Let's personalize your content