CFP Misconduct Research (And The Challenge Of Counting How Many Financial Advisors There Really Are)

Nerd's Eye View

FEBRUARY 27, 2023

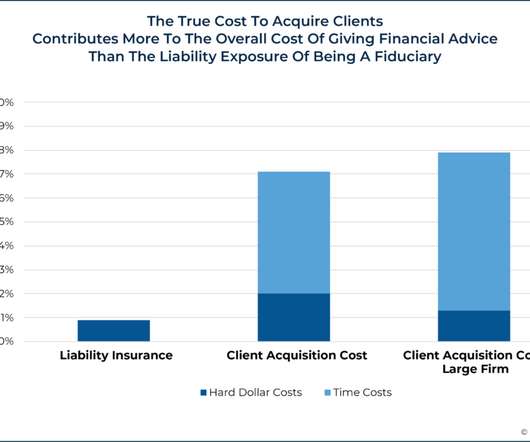

Financial advisors are generally required to abide by ethical standards, such as the duty to act in a client’s best interests when giving financial advice. in Journal of Financial Regulation, however, concludes the opposite. A forthcoming study by Jeff Camarda et al.

Let's personalize your content