Your Retirement Planning Starter Pack

Carson Wealth

MARCH 7, 2024

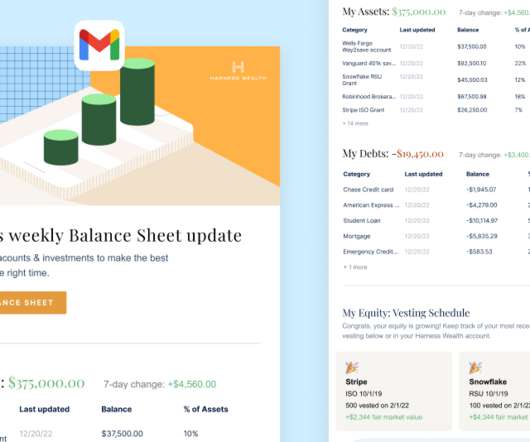

Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. Set Up Another Retirement Account Individual Retirement Accounts (IRAs) may offer tax advantaged savings as well. Contributions are taxed on the way in with these accounts. How much should I be saving?

Let's personalize your content