Bank CDs Are an Insult to America’s Savers

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

Nerd's Eye View

APRIL 25, 2023

Ari is Managing Partner of Values Added Financial, an independent RIA based in Washington, D.C., that oversees $143 million in assets under management (AUM) for nearly 75 client households. Welcome back to the 330th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Ari Weisbard.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MARCH 25, 2025

AJ is the co-founder of Brooklyn Fi, an RIA based in Brooklyn, New York but operating as a fully remote business, that oversees $370 million in assets under management for more than 400 client households. My guest on today's podcast is AJ Ayers.

Nerd's Eye View

MARCH 11, 2025

Lorie is the wealth manager of Fearless Financial Advisors, a dba of hybrid advisory firm Fidelis Wealth Advisors based in Castle Rock, Colorado, where Lorie personally oversees $30 million in assets under management for 88 client households. Welcome to the 428th episode of the Financial Advisor Success Podcast !

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

Nerd's Eye View

OCTOBER 31, 2023

Jon is the Founder and CIO for Echo45 Advisors, an independent RIA based in Walnut Creek, California, that oversees $163 million in assets under management for more than 180 client households. My guest on today's podcast is Jon Henderson.

Nerd's Eye View

OCTOBER 3, 2023

Brett is the Founder of Brett Danko Educational Center, a CFP Board Education and Exam Prep provider, and the CEO and Managing Partner for Main Street Financial Solutions, an independent RIA based in Newtown, Pennsylvania, that oversees almost $2 billion in assets under management for nearly 1,700 client households.

Nerd's Eye View

MAY 7, 2024

Hannah is a partner and financial advisor at Lomanto Provost Financial Advisors, a hybrid advisory firm based in Plattsburgh, New York, that oversees approximately $150 million in assets under management for about 380 client households.

Nerd's Eye View

AUGUST 15, 2022

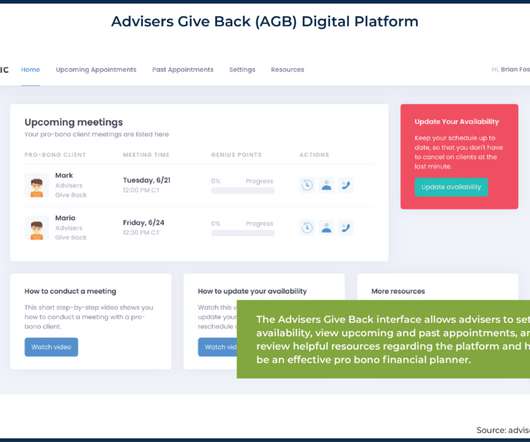

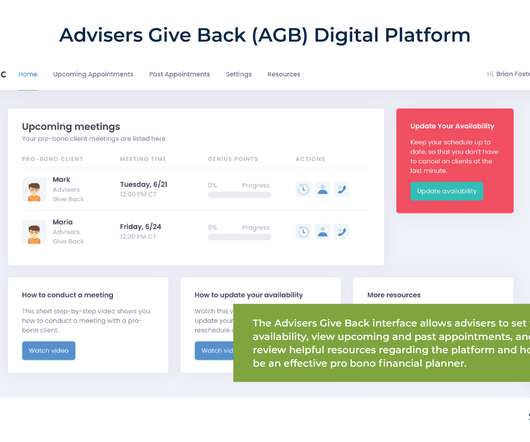

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it. law) with established pro bono programs.

Nerd's Eye View

AUGUST 15, 2022

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it. law) with established pro bono programs.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

Nationwide Financial

DECEMBER 1, 2022

A quickly accelerating inflation rate coupled with periods of unprecedented market volatility and negative returns have many clients holding large portions of their assets in cash — particularly in money markets. This means that with qualified assets sitting in cash, retirement savings are at risk of being outpaced by inflation.

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Although some firms use these compensation methods, the majority base fees on a percentage of assets under management (AUM) for their services. Independent firm.

International College of Financial Planning

OCTOBER 26, 2023

Their primary objective is to ensure that the assets are managed & distributed according to the wishes of the client. Investment Oversight: Post the formulation of your financial plan, the next step is to channel your assets into fruitful investments.

Tobias Financial

AUGUST 28, 2023

In the midst of interest rate hikes, the world of certificates of deposit (CDs) is buzzing. Before deciding to capitalize on high-yield CDs, it is important to remember that a well-informed approach, tailored to your financial goals, is your greatest asset.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. Here will discuss why CFP professionals are the first choice for millions of people worldwide regarding managing their finances. The key to building wealth is diversification and asset allocation.

Trade Brains

DECEMBER 5, 2023

Top 7 Derivatives Trading Courses in 2024 : Derivatives are secondary markets where the performance of an instrument is dependent on an underlying asset or a group of assets. By enrolling in this course, you will learn the options trading concept with risk management techniques. You can enroll in the course here.

The Big Picture

JANUARY 16, 2024

She has had a number of different positions within PIM, including managing their flagship core real estate fund. Before she moved into management, she has been on all of the big lists. You, you study real estate, finance and entrepreneurial management at Wharton. Essentially you buy assets. I like architecture.

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

International College of Financial Planning

OCTOBER 26, 2023

If the thought of enlightening others on sound financial choices resonates with you, if you’re intrigued by the world of investment management, and if building lasting relationships is your forte, then financial advisor as a career choice is the chosen one. Various profiles as a Financial Advisor?

WiserAdvisor

MAY 29, 2025

Time is another valuable asset in wealth building that allows you to benefit from the magic of compounding. Best 1,000-dollar investment instruments High-yield savings accounts or certificates of deposit (CDs) : High-yield savings accounts and CDs are excellent entry points for those who prioritize safety and stability.

Clever Girl Finance

AUGUST 15, 2022

Liquidity means you have a sufficient amount of accessible liquid assets that you can easily convert into cash. Liquid investments are assets that can easily be converted into cash in a short amount of time with little to no decrease in their value. The asset must maintain a large number of readily-available, interested buyers.

Carson Wealth

DECEMBER 13, 2022

RIAs commonly use two titles for their IARs: Financial Advisor and Wealth Manager. Financial Advisors and Wealth Managers have a common knowledge and skill sets. What Do Wealth Managers Do? Wealth management is also a phrase used to describe the process of choosing a client’s investment portfolio. The Similarities.

Harness Wealth

APRIL 5, 2023

In this article, we’ll explore the challenges of balancing liquidity, returns, and risk management when optimizing idle cash in personal financial planning. We’ll dive into various cash management strategies, their benefits and drawbacks, and how to align them with your financial goals.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Harness Wealth

APRIL 17, 2025

Modern digital receipt-tracking applications have made this process more manageable, enabling busy business owners to maintain compliant records without incurring excessive administrative burdens. This option is particularly valuable for businesses seeking to minimize current-year tax liability while investing in growth-oriented assets.

Ballast Advisors

MARCH 15, 2023

.” This refers to a partnership between the RIA and a financial institution that acts as the custodian of the client’s investment assets. For example, Ballast Advisors uses Charles Schwab as custodian for client investment assets. As an investor, here are three key questions you should be asking your RIA: 1.

International College of Financial Planning

DECEMBER 9, 2024

The financial planning industry has witnessed remarkable growth, making the Certified Financial Planner (CFP) certification increasingly valuable for professionals seeking to advance their careers. Why Choose CFP Certification? This accelerated program enables qualified candidates to obtain their certification within just 4 months.

Clever Girl Finance

SEPTEMBER 11, 2023

Liquidity means you have a sufficient amount of accessible liquid assets that you can easily convert into cash. E.g., your liquid net worth, when you add all of your liquid assets together and subtract your liabilities. The asset must maintain a large number of readily-available, interested buyers.

MarketWatch

MARCH 24, 2023

Schwab could borrow from the Federal Home Loan Bank, issue certificates of deposit, or collect interest paid on its bond portfolio, he said. The comments came as investors study reduced values of long-term holdings and other assets held by financial firms that may not be sufficient to cover a sharp drop in deposits.

International College of Financial Planning

DECEMBER 29, 2024

The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field. The CFP certification prepares professionals for these challenges through rigorous training and practical application.

Good Financial Cents

DECEMBER 9, 2022

1) Certificates of Deposit (CDs). For those of you who like to see the numbers, here’s an example of compound interest at work: Suppose you invest $1,000 in a five-year certificate of deposit, paying 5% and compounded annually. Most savings accounts, money market accounts, and certificates of deposit earn compound interest.

Good Financial Cents

DECEMBER 22, 2022

Certificates of Deposit . Certificates of Deposit. Note that Fundrise requires a 0.15% annual advisory fee and an annual asset management fee of up to 0.85%. annual management fee, which is higher than the fees you’ll pay with most other investments I recommend. Certificates of Deposit. Index Funds.

Darrow Wealth Management

SEPTEMBER 25, 2023

Think of it as a way to help protect your assets for the cost of a light fixture. This includes getting an insurance certificate, which your homeowners insurance will want a copy of. Travers suggests verifying that your broker has confirmed that your contractor actually has the insurance stated on the certificate.

International College of Financial Planning

SEPTEMBER 7, 2024

The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry. Unlike the regular pathway that requires passing multiple exams over a year, the fast track allows eligible candidates to take just one exam and complete the certification in 3-4 months.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Nationwide Financial

FEBRUARY 14, 2023

Members include Advisor Group , Capital Group/American Funds , Franklin Templeton , Huntington Bank , Miami Life , Morgan Stanley , M Financial Group , NFP , RBC Wealth Management , Swiss Re , and Nationwide.

International College of Financial Planning

SEPTEMBER 23, 2024

This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. b) Increased Earning Potential Obtaining a CFP® certification significantly enhances your earning potential.

Good Financial Cents

FEBRUARY 15, 2023

Investment management companies – firms that provide individual portfolio management and may work with other investment companies. For example, do you want to make investment decisions or let the experts do it through a managed portfolio? Robo-advisors, in particular, have democratized investment management.

International College of Financial Planning

JUNE 10, 2022

CFP, also known as Certified Financial Planner , is a certification given by the Financial Planning Standards Board (FPSB) to professionals who wish to take up financial planning. This certification is recognized internationally and considered the best for financial planning training, education, and ethical practice. .

International College of Financial Planning

JULY 10, 2023

How Investment Advisors Play a Significant Role in Managing Finances? Their primary objective is to help clients make informed investment decisions, manage risks, and achieve financial objectives. Investment advisors can also specialize in specific areas such as retirement planning, tax planning, or portfolio management.

International College of Financial Planning

OCTOBER 10, 2024

The CFP® Fast Track offers a time-efficient and cost-effective solution for becoming a Certified Financial Planner, especially for those in India where the cost and time associated with traditional certification methods can be daunting. Why is CFP® Certification Important for Financial Planners?

International College of Financial Planning

AUGUST 31, 2023

However, relying on a single asset class or Investment within an Asset class can be risky and limiting. Diversifying your investment portfolio is a vital strategy for managing risk, optimizing returns, and achieving your financial goals. This is where diversifying your investment portfolio comes into play.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content