Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

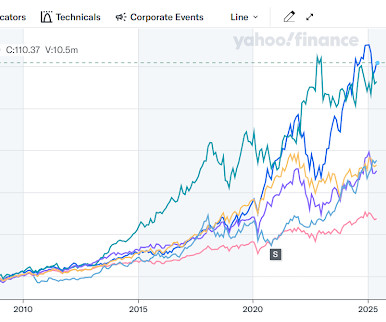

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

Let's personalize your content