Importance of Sticking to Asset Allocation

Truemind Capital

JANUARY 22, 2024

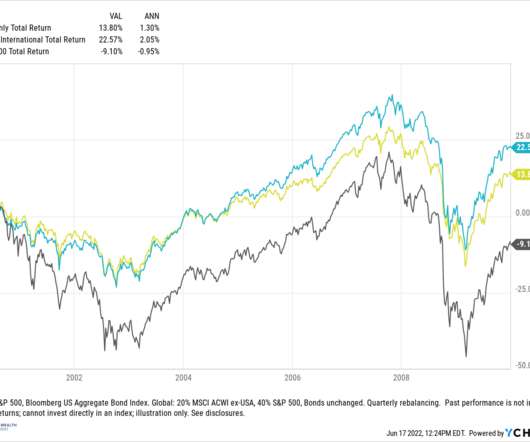

One of the biggest mistakes people commit is ignoring their risk profile and suitable asset allocation, especially during runaway prices in one asset class. The prices get more expensive from their long-term mean valuations and downside risk becomes much deeper.

Let's personalize your content