Financial Market Round-Up – Jan’24

Truemind Capital

JANUARY 16, 2024

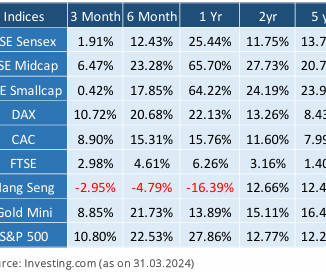

Some of the fund managers continued discouraging flows in Mid & Small Cap stocks by either sounding cautious, dropping coverage, or stopping the inflows owing to frothy valuations in the space. We maintain our underweight position to equity (check the 3rd page for asset allocation) due to an unfavorable risk-reward ratio.

Let's personalize your content