How to Avoid Common Investment Mistakes by Becoming an Investment Advisor?

International College of Financial Planning

JULY 31, 2023

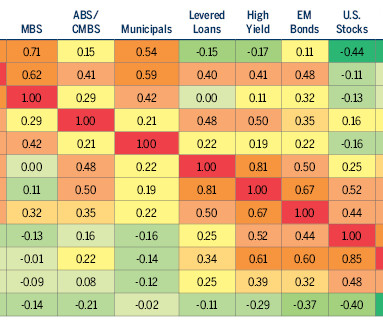

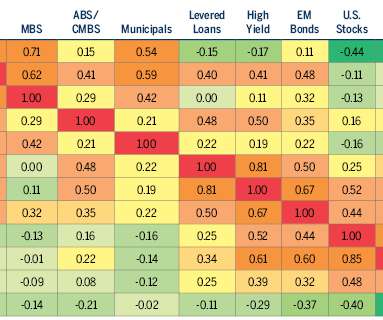

Let’s explore the role of investment advisors in helping individuals avoid these pitfalls and make informed decisions. By becoming an investment advisor, you can assist others in achieving their goals and strengthening your own financial journey. By diversifying investments advisors can help with asset allocation.

Let's personalize your content