$6.5B RFG Advisory Launches Suite of Active ETFs

Wealth Management

JUNE 25, 2025

RFG Advisory introduces a suite of actively managed ETFs designed to address clients' entire asset allocation portfolios, available to all advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 25, 2025

RFG Advisory introduces a suite of actively managed ETFs designed to address clients' entire asset allocation portfolios, available to all advisors.

Nerd's Eye View

JANUARY 9, 2025

While financial advisors offer valuable services for their clients, it can sometimes be challenging to gauge how much clients actually value those services. On one hand, a client's willingness to pay an ongoing fee for financial advice suggests that they find the advisor's services worthwhile.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 17, 2025

He said the tie-up made sense with Innovative CPA Group clients looking for wealth management capabilities, and his background in institutional investing meaning expanded investment options for high-net-worth clients. In addition to ICG clients, Minopoli said the Innovative Asset Advisors will offer to “be the RIA arm” of other CPAs.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Nerd's Eye View

JUNE 24, 2025

Griffin is the owner of GK Wealth Management, an RIA based in Reno, Nevada, that oversees $200 million in assets under management for 450 client households. My guest on today's podcast is Griffin Kirsch.

The Big Picture

JUNE 27, 2025

Peneva joined Swiss Re in 2017, becoming co-head of client solutions & analytics, before being named Group Chief Investment Office and member of the Group Executive Comittee in 2023. She explains the importance of matching your assets to your future liabilities, and why liquidity and quality are so important.

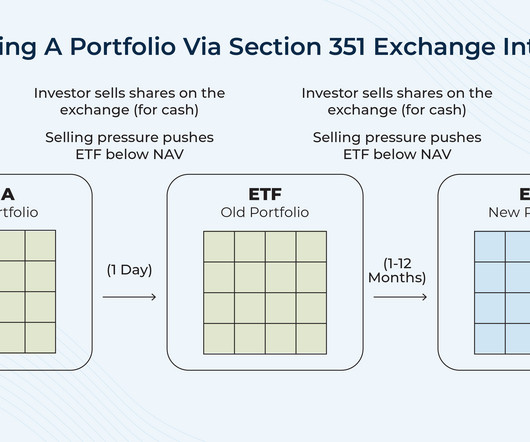

Nerd's Eye View

MARCH 12, 2025

Because when it comes time to rebalance the portfolio to its asset allocation targets – or to reallocate the portfolio to a new strategy – any trades made to implement those changes can generate capital gains, resulting in tax consequences for the investor.

Wealth Management

JULY 2, 2025

At Wealth Management EDGE , I had the privilege of moderating a panel— “Work Smarter, Not Harder: AI’s Role in Operational Excellence” —where we talked about how artificial intelligence is already automating advisor workflows, transforming client meetings into structured insights, and reshaping the nature of operational roles within firms.

International College of Financial Planning

JULY 9, 2025

To fulfil the aspirations of a medium sized clients, SEBI has come out with the product like Specialised Investment Funds (SIF) which has 10 lakhs of investing requirement. The Client First approach is the Need of the hour with multiple products flowing into the mark.

Truemind Capital

APRIL 4, 2025

AI could eventually take over such tasks: – Investment recommendations based on past performance – Standard asset allocation models taught in theory and even used by many wealth managers – Service aspects regarding operations like transactions, reporting, changes in credentials, etc.

The Big Picture

JULY 16, 2025

And find the entire musical playlist of all the songs I have used on At the Money on Spotify TRANSCRIPT: Speak to any financial advisor and they’ll tell you one of the biggest challenges they have professionally is getting clients to actually spend their money after decades of working and saving and investing. Why is figuring out.

Yardley Wealth Management

DECEMBER 17, 2024

Helping clients achieve their monetary aspirations, I’ve seen how proper goal-setting can transform financial futures. I often advise clients to use the debt avalanche method – targeting debts with the highest interest rates first while maintaining minimum payments on others.

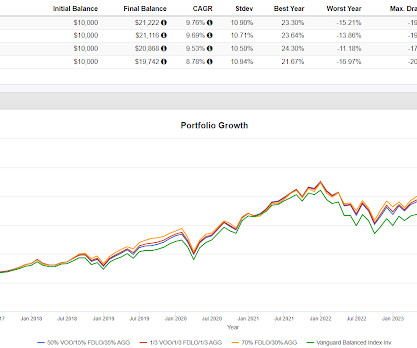

Tobias Financial

NOVEMBER 4, 2024

Accordingly, there is a strong case for investors to rely on a consistent approach to asset allocation—making a long-term plan and sticking to it. __ Source: Dimensional Fund Advisors Tobias Financial Advisors is registered as an investment advisor with the SEC. On the contrary, it may lead to costly mistakes.

Carson Wealth

JANUARY 22, 2025

The process of diversifying among asset classes is known as asset allocation, and the exact composition should be based on your financial goals and risk profile. You can also further diversify within an asset class. You should be re-evaluating your asset allocation at regular intervals to keep your portfolio on track.

The Big Picture

JULY 1, 2025

There’s interesting clients, there’s quite a lot of us partners there. I mean, I was in Zurich, but I was serving a lot of the European clients. Here is the plan, here’s how you should go about in this deal or in, in this new asset class. But then it’s up to the client to implement it.

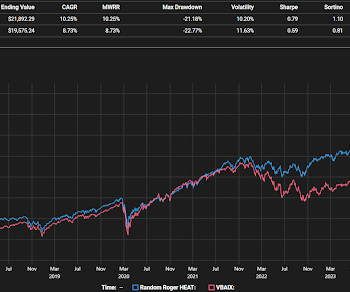

Random Roger's Retirement Planning

MARCH 20, 2025

The asset allocation was 10% to hedges, 30% to T-bills for asymmetry but that seems more like optionality to me, 9% to edges which included one broad stock picking ETF, a derivative income fund and a short volatility product. None of them were hideously wrong out of the blocks but it's too soon to declare victory with them.

A Wealth of Common Sense

JULY 17, 2025

Do you think CFA Level 1 is worth it for someone going into advising mainly to better understand markets and explain them to clients? Obviously, investment management plays a huge role in the financial planning process but it’s certainly not the only thing advisors help their clients with.

Random Roger's Retirement Planning

MAY 4, 2025

The more someone trades, the more they are fighting that natural inertia other than proper asset allocation targets and mitigating sequence of return risk when relevant. I have quite a few names for clients that I've held for more than 15 years. The names don't matter.

MainStreet Financial Planning

MARCH 7, 2025

More Cost-Effective Over Time Instead of paying an ongoing percentage of your investments, a fee-only financial planner charges a fixed amount for their servicesoften saving clients hundreds of thousands of dollars over time. Are There Any Benefits to AUM-Based Advisors?

Random Roger's Retirement Planning

NOVEMBER 28, 2024

The first example to look at they call Leverage In The Strategic Asset Allocation via this table in the paper. The paper introduces the idea of mixing momentum and value in some combo that they never quantified as a possible substitute for low volatility before digging in more deeply into different examples or cases.

The Big Picture

APRIL 29, 2025

They sent you out to clients very early on in your career, and you also got people management skills pretty early on. And as a result, I got hired away by one of Anderson’s clients, which was Aetna. It’s, you know, just well-known quality firm, strong results, impressive client roster.

Tobias Financial

MARCH 16, 2025

This is a representation of a general case scenario, however individual client timeline and experience may vary due to ones unique circumstances. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change.

Truemind Capital

JANUARY 10, 2025

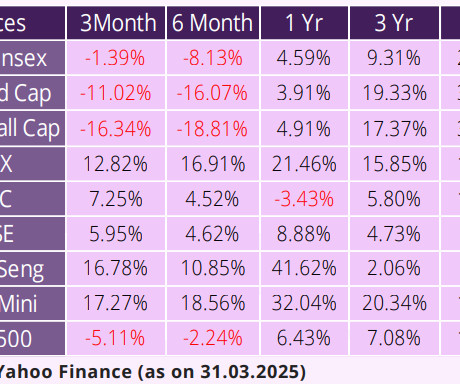

I wonder what stories will be told when the portfolios will decline to such an extent for those who are not following a suitable asset allocation. During this recent correction, none of our clients reached out to us with concerns. Because our client’s portfolios declined much less than the correction in the markets.

Gen Y Planning

MARCH 10, 2025

As we move through the first quarter of 2025, weve had several clients, colleagues, and friends reach out with questions about recent market movements and the impact of tariff discussions on their personal financial plan. Diversifying portfolios across asset classes, sectors, and geographies to reduce concentrated risks.

Random Roger's Retirement Planning

MAY 1, 2025

My hunch is that this is nowhere close to being over but client outcomes are not relying on that hunch being correct. Other than having the proper asset allocation and addressing sequence of return risk when relevant, I would not want to get too aggressive, like selling 95% of my stocks, trying to fight that inertia.

Random Roger's Retirement Planning

DECEMBER 22, 2024

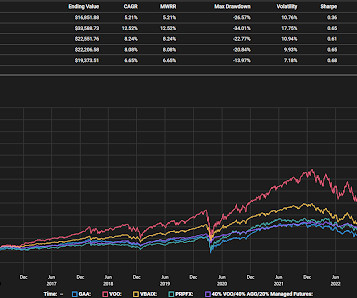

GAA stands for Global Asset Allocation and it has been lagging for 15 years. The next allocation in this set but don't completely forget is a first responder type of defensive. For me this is AGFiQ US Market Neutral Anti-Beta ETF (BTAL) which is a client and personal holding. Northrup Grumman and CBOE are client holdings.

Random Roger's Retirement Planning

DECEMBER 23, 2024

This is a little bit of a follow up to yesterday where I mentioned the Global Asset Allocation as mentioned in a paper by Meb Faber. Today, Meb Tweeted out a reference to the Atlas Lifted report from Robeco which references a similar idea, the Global Market Portfolio which is allocated as follows.

Truemind Capital

JULY 18, 2025

We are advising clients to avoid fresh property purchases at this stage. Truemind’s Model Portfolio – Current Asset Allocation Personal Finance Capsule: Changing world order and what you should do? However, real estate overall has become expensive.

Midstream Marketing

JUNE 4, 2025

The High Stakes of Your ‘About’ Story Your About Page isn’t just a nice-to-have—it’s a make-or-break moment for prospective clients. These five mistakes are some of the most common—and costly—for financial advisors trying to connect with potential clients. Showcase Client Success Feature 2–3 mini-case studies or testimonials.

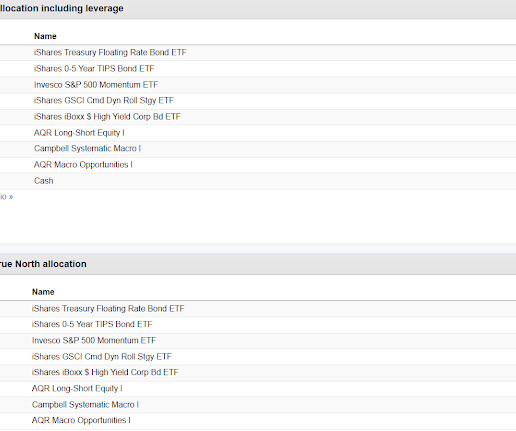

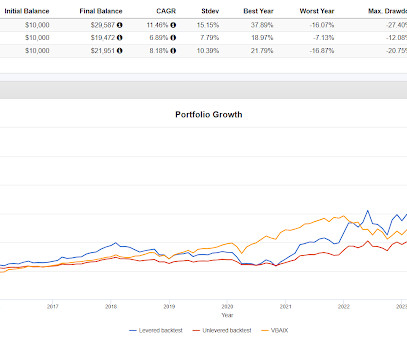

Random Roger's Retirement Planning

NOVEMBER 21, 2024

There's no fact sheet yet and while the holdings are available, the asset allocation is vague without calculating the spreadsheet yourself which I did (hopefully correctly). PPFIX, MERIX and BTAL are client and personal holdings. Offering diversified exposure to U.S. Treasuries, real estate, gold, and agricultural commodities."

The Big Picture

JUNE 23, 2025

Steve Laipply : Yeah, so I, I think that group, the idea was to work with institutional clients to really help them manage risk, right? You need to get those assets allocated, you know, on a risk basis. Tell us a little bit about your time at Bank America Merrill Lynch. We, we launched money market ETFs.

Random Roger's Retirement Planning

MARCH 21, 2025

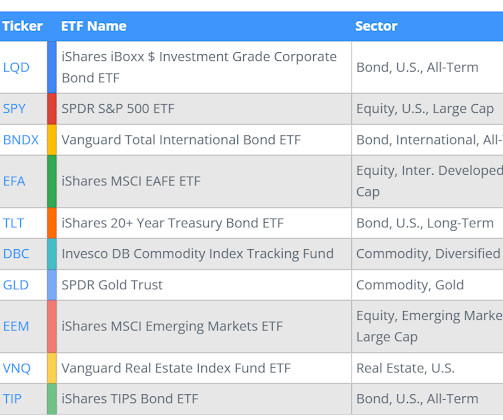

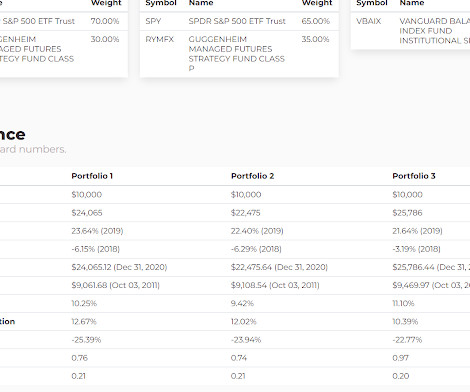

One of the pre-market Bloomberg emails gave a positive mention to the Cambria Global Asset Allocation ETF (GAA) because it is up in what of course has been a tough tape for equities this year. It is an interesting asset allocation that targets 40% in equities, 40% in fixed income and 20% in alternatives.

Random Roger's Retirement Planning

FEBRUARY 14, 2025

Right or wrong, I think of endowment style investing as being a similar to the Permanent Portfolio, not so much quadrants but more like disparate asset class segments which gets us to a paper about endowment asset allocation from True North Institute. QGMIX is a client and personal holding.

The Big Picture

JANUARY 21, 2025

But today, you know, a lot of brokers, you know, whether they’re with the big full service brokerage firms now have advisory accounts that they flog to clients where they can buy ETFs. And one of the common conversations is, I have a client, he’s got millions of dollars invested. We can’t get him to spend money.

Random Roger's Retirement Planning

JANUARY 22, 2025

The starting point today is the that Rational ReSolve Adaptive Asset Allocation Fund (RDMIX) has gone through a strategy change, renaming as the ReturnStacked Balanced Allocation & Systematic Macro Fund and keeping the same symbol. " balanced allocation and $1 of exposure to a systematic macro strategy."

The Big Picture

APRIL 8, 2025

She was CIO at Merrill Lynch Asset Management, and now CIO at both Morgan Stanley Wealth Management and runs their asset allocation models and their outsourced chief investment officer models. I knew that I wanted to work with clients. All the clients were getting proprietary Sanford Bernstein asset Management product.

The Big Picture

JULY 15, 2025

My biggest client turned out to be the Merrill Lynch Investment Strategy Group. Went back and got my MBA, and after a while, without sounding stupid about this, realized I was a, I knew more about this stuff than many of my clients did. But the heart of the firm was still on the private client side for any number of strategic reasons.

Wealth Management

JULY 15, 2025

Is a Roth Conversion Worth It for All Clients? Zephyr , is an award-winning asset and wealth management software that offers portfolio construction, proposal generation, advanced analytics, asset allocation, manager screening, risk analysis, portfolio performance and more, transforming multifaceted data into digestible intel.

Truemind Capital

APRIL 11, 2025

Have exposure to Gold: We have been investing 15-20% of all our client’s portfolios in Gold since 2018 (when quantitative tightening was reversed to easing) 2. Diversify across asset classes – equity, debt & Gold and across geographies. Stick to your suitable asset allocation. Focus on valuations.

Random Roger's Retirement Planning

NOVEMBER 17, 2024

MDCEX is in Morningstar's Tactical Asset Allocation (TAA) category and the Fidelity info page for the fund offers the following comparison to other funds. I built out the following to backtest where the only difference is a 20% allocation to MDCEX or iShares Aggregate Bond ETF (AGG). BTAL is a client and personal holding.

Truemind Capital

APRIL 18, 2025

This market correction opened up opportunities for us to realign portfolios in line with our strategic asset allocation framework. Real Estate has become expensive, and we are advising our clients against fresh purchases. Still, sentiment remains fragile, especially with US-China tensions flaring up again.

The Big Picture

MAY 7, 2025

His firm, Efficient Frontier Advisors manages $400 million in client assets ($25m minimum). He is also the author of multiple books, the Intelligent Asset Allocator, four Pillars of Investing, investors Manifesto, and on and on. Did you develop systems for managing assets and dealing with clients or checklists?

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content