Financial Market Round-Up – Apr’23

Truemind Capital

APRIL 21, 2023

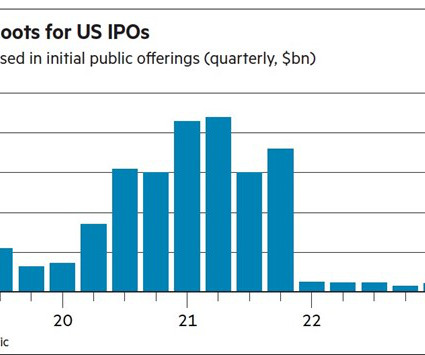

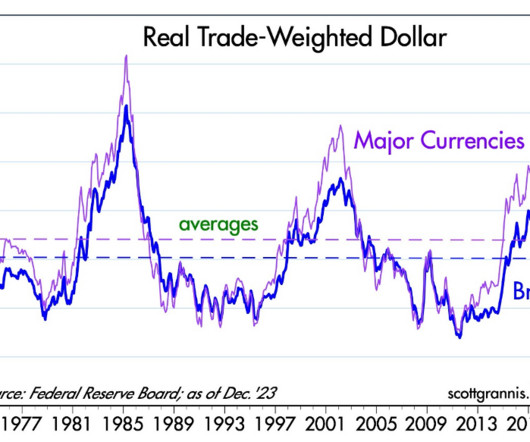

Equity Market Insights: The last quarter has seen one of the major shakeups from the prevailing easy situation over the last decade for the global economies. This approach has delivered outperforming results for our clients over the last 1.5 years (Oct 2021-Mar 2023) when the benchmark indices produced negligible returns.

Let's personalize your content