A Managed Accounts Case About More Than Managed Accounts

Wealth Management

JUNE 17, 2025

sends favorable message to advisors on managed accounts in retirement plans, highlighting key distinctions. Court dismissal of Hanigan v. Bechtel Global Corp.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 17, 2025

sends favorable message to advisors on managed accounts in retirement plans, highlighting key distinctions. Court dismissal of Hanigan v. Bechtel Global Corp.

Getting Your Financial Ducks In A Row

JUNE 23, 2025

Photo credit: jb When you have money in several accounts and you’d like to have that money consolidated in one place, the question comes up – Which type of account can be tax-free rolled over into which other type of accounts? The post What types of accounts can I rollover into? This is known as a Roth Conversion.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JANUARY 15, 2025

For most people, Social Security benefits are calculated using a single formula, which takes into account the individual's history of earning income on which they paid Social Security tax. This lack of clarity made retirement planning significantly more challenging.

Trade Brains

JULY 9, 2025

This poses a particular challenge for retirees who typically rely on fixed incomes from pensions, annuities, or savings accounts. That means if your retirement plan underestimates medical costs, you risk serious shortfalls. Written by Hiten Chauhan The post How Inflation Can Impact Your Retirement Plan – What You Must Know Now!

Getting Your Financial Ducks In A Row

MARCH 10, 2025

Many of us are covered by one or more types of defined contribution retirement plans, such as a 401(k), 403(b), 457, or any of a number of other plans. What many of these plans have in common is that they are referred to as Cash Or Deferred Arrangements (CODA), as designated by the IRS. How, you might ask?

Wealth Management

JUNE 26, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all businessmen around table RPA Operating On The Record Keepers’ Efficient Frontier Operating On The Record Keepers’ Efficient Frontier by Warren Cormier (..)

Wealth Management

JUNE 26, 2025

Between 2014 and 2024, Mason transferred client funds into his own accounts and those of the two entities without clients’ authorization, according to the SEC. Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., He pleaded guilty to all of the criminal charges.

Abnormal Returns

DECEMBER 18, 2024

tonyisola.com) Aging 10 steps to prepare financially for retirement, including 'Design a retirement paycheck.' theretirementmanifesto.com) How to think about retirement planning even though it may be decades off. nextbigideaclub.com) Some updated estimates of sustainable retirement withdrawal rates.

Nerd's Eye View

NOVEMBER 22, 2024

Also in industry news this week: Why the announced acquisition of RIA custodian TradePMR by retail brokerage firm Robinhood could prove to be a boon for RIAs on TradePMR's platform, who could receive a wave of referrals from Robinhood's massive base of next-generation retail clients How Morningstar is cutting the "Medalist Ratings" of thousands of (..)

Carson Wealth

MAY 29, 2025

Having a retirement planning checklist can help make this final commute the time of reflection and joy it should be. While you simply cant plan for everything, having the essentials in place can give you the confidence and clarity you need to enjoy the freedom retirement can provide.

Zoe Financial

JUNE 20, 2025

2025 Observations in Retirement and Estate Planning Trend Insight Increased Use of Roth Conversions More high-net-worth individuals are adopting Roth conversion strategies as part of long-term tax planning—not to time the market, but to shift assets into tax-advantaged accounts over time, especially ahead of potential future tax increases.

Carson Wealth

DECEMBER 20, 2024

Give with a Donor-Advised Fund A donor-advised fund (DAF) can be a powerful financial planning tool for charitable giving that offers you some measure of control as to how and when the donation will be made. You can deposit money into the account now, receive the tax benefit, and then make the donation in your own time.

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. This would apply to savings accounts as well.

Nerd's Eye View

FEBRUARY 12, 2025

While future retirees can find nonreduced benefit estimates on their Social Security statements or online accounts, those already receiving benefits don't have access to this information – making it necessary to find a different way to predict how much their payments will increase once the law is fully implemented.

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Converting a traditional IRA to a Roth doesnt make sense unless you have cash to pay taxes without dipping into your retirement savings.

Yardley Wealth Management

JANUARY 21, 2025

Retirement Planning Retirement planning is one area where talking to a financial planner proves particularly worthwhile. Accountability and Support The accountability aspect alone can make talking to a financial planner worth the investment.

Nerd's Eye View

JUNE 25, 2025

While Coast FIRE might sound appealing to many clients, the best candidates will tend to have already accumulated sufficient savings earmarked for retirement and have relatively predictable expenses, since a sharp increase in future spending would require a larger portfolio to compensate.

Yardley Wealth Management

DECEMBER 17, 2024

The Foundation: Emergency Funds and Debt Management The cornerstone of any solid financial plan is having a robust emergency fund. In today’s economic climate, I recommend maintaining 6-9 months of living expenses in easily accessible accounts. While that remains important, consider diversifying your retirement strategy.

WiserAdvisor

JULY 2, 2025

Selecting the right plan depends on individual medication needs, and advisors conduct cost-benefit analyses to reduce out-of-pocket spending. For individuals enrolled in a high-deductible health plan (HDHP), an HSA offers a structured way to build a healthcare reserve that grows with age and changing needs.

NAIFA Advisor Today

JANUARY 16, 2025

Advisor Today Guest Column January of 2025 is the 50th anniversary to one of the most important pieces of legislation in the retirement planning arena ever put into law by Congress. What Im referring to is the enactment of ERISA, the Employee Retirement Income Security Act.

MainStreet Financial Planning

JULY 25, 2025

Your plan can be built to handle it. Here’s how to build resilience into your retirement plan, no matter what the markets are doing. Strengthen Your Foundation First A resilient retirement starts with the basics: Emergency Savings: Keep 6–12 months of expenses in a high-yield savings or money market account.

Dear Mr. Market

DECEMBER 31, 2024

Three to six months worth of expenses tucked away in a high-yield savings account. Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. Make room for saving and investingnot just spending. Build (or Rebuild) Your Emergency Fund The unexpected is, well, expected. A good rule of thumb?

FMG

MARCH 3, 2025

Instead of listing ten tips for retirement planning, share your top three and ask, What would you add to this list? For instance, many people feel overwhelmed by retirement planning. Whats your biggest question about retirement? Whats your biggest challenge when it comes to retirement planning?

Harness Wealth

JANUARY 9, 2025

Backdoor strategies are retirement contribution methods that allow individuals to bypass income limits and contribute to tax-advantaged retirement accounts. Roth IRAs are also not subject to Required Minimum Distributions (RMDs), allowing more flexibility in retirement planning.

Harness Wealth

APRIL 17, 2025

As Gio Bartolotta, Partner at GoJo Accountants , explains “ordinary” means the expense must be common and accepted within your trade or business, while “necessary” indicates it should help or be appropriate for running operationsnot necessarily indispensable.

Tobias Financial

JUNE 16, 2025

Monthly or quarterly reviews of bank statements, budgets, and investment accounts can help monitor your day-to-day financial health. Annual reviews of tax filings, insurance policies, retirement plans, estate documents, and net worth statements support long-term clarity and preparedness.

Darrow Wealth Management

FEBRUARY 9, 2025

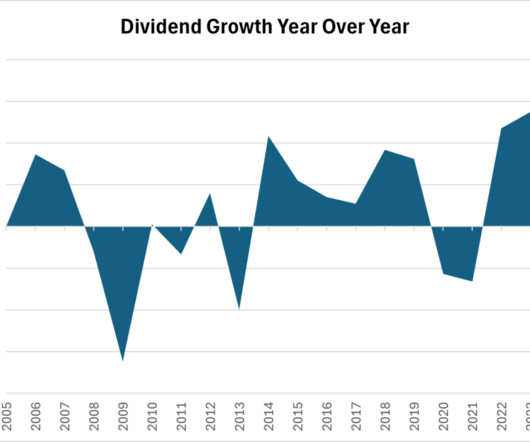

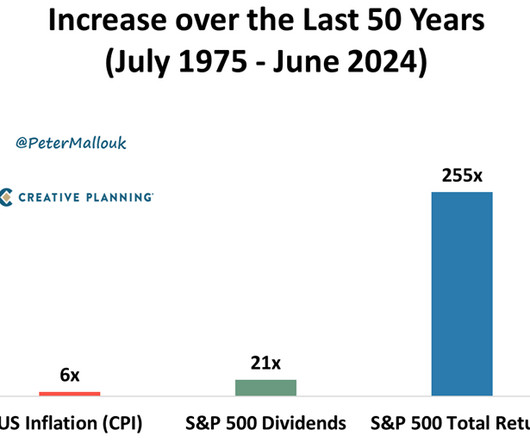

Hypothetical simulation assumes $1M was invested on 12/31/2004, 50% in SPY and 50% in AGG, portfolio was never rebalanced, dividends not reinvested, and no other contributions/withdrawals in the account. Hypothetical simulation uses current yields and assumes 60% of the account is invested in SPY and 40% AGG.

Midstream Marketing

DECEMBER 6, 2024

Scheduling tools, like Hootsuite, can help you manage your social media accounts. Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Use SEO tools like SEMrush or Ahrefs. This keeps your outreach regular and effective.

Harness Wealth

JULY 31, 2025

Estate planning takes on new urgency as the lifetime exclusion amount prepares to plummet from about $14 million to roughly $7 million. Retirement plan distribution changes Retirement planning in 2025 comes with important updates , particularly around Required Minimum Distributions (RMDs).

Random Roger's Retirement Planning

NOVEMBER 20, 2024

If someone has $930,000, they take out $37,200 that year but with asset appreciation the account goes up to $958,000 and they take out $38,320 the following year, there's the inflation bump but Bengen views it differently. I've been dismissive of that part of the rule. The growth of the portfolio takes care of that.

Random Roger's Retirement Planning

JULY 14, 2025

Stating the obvious, a $400,000 account can be a source of $16,000/yr for a very long time (hopefully that nudges higher over the years). million account can be a source of $70,000/yr for a very long time. How much do you have now and how much are you likely to have when you retire? How much will you get for Social Security?

Yardley Wealth Management

SEPTEMBER 10, 2024

Take advantage of tax-advantaged retirement accounts such as 401(k)s, IRAs, and Roth IRAs to maximize your contributions and benefit from tax-deferred or tax-free growth. Learn more about retirement plan options here. Diversify Your Portfolio Diversification is key to successful retirement investing.

Getting Your Financial Ducks In A Row

FEBRUARY 24, 2025

Photo credit: jb Employers have been giving us lots of opportunities to make this decision of late: when leaving an employer, whether voluntarily or otherwise, we have the opportunity to rollover the qualified retirement plan (QRP) such as a 401(k) from the former employer to either an IRA or a new employer’s QRP.

Sara Grillo

DECEMBER 16, 2024

Today I have Brian Williams of Northshire Consulting and were going to be talking about how financial advisors can help improve 401k plan access to the American people who are working at small businesses who currently do not offer them. What if the local baker had a 401k plan? Why are small business owners not offering 401k plans?

Darrow Wealth Management

FEBRUARY 13, 2025

The ability to advise on standard financial planning matters such as retirement planning should be table stakes (if not, red flag). Ask for referrals Asking friends, family, coworkers, an accountant, or personal lawyer for a referral can be one of the most effective ways to find a fee-only financial advisor.

International College of Financial Planning

JUNE 17, 2025

As a result, GIFT City becomes a vital testing ground for phased liberalization of India’s capital account. Additionally, funds held in foreign currency within IFSC accounts are not deemed to be remitted into India until they are converted to INR and invested domestically.

Financial Symmetry

MAY 22, 2025

However, claiming early can reduce your benefit by as much as 30% compared to waiting until your full retirement age (typically around 67). If you are in the fortunate position of having other income sources, such as a pension, 401(k), brokerage accounts, or IRAs, delaying Social Security becomes a viable strategy.

Harness Wealth

JANUARY 29, 2025

These contributions not only provide immediate tax relief but help secure longer-term financial stability during retirement. 401(k) Plans: Contribute the maximum allowable amount for 2024 : $23,000 if youre under 50, or $30,500 if youre 50 or older. Available to taxpayers aged 70.5

Random Roger's Retirement Planning

APRIL 22, 2025

Beyond those basics, there's a whole lot of nuance as well as subjective or mental accounting. The basic building block is that if your income is likely to be so much higher when you retire that it would push you into a higher tax bracket then converting to a Roth to avoid RMDs at that higher bracket makes sense.

Harness Wealth

APRIL 30, 2025

Employee Stock Ownership Plans (ESOPs) An ESOP allows owners to gradually sell their shares to employees through a qualified retirement plan. Buyers, however, may inherit more risk, which can affect the sale price or deal structure. These determinations require careful analysis and documentation.

Workable Wealth

NOVEMBER 25, 2020

When you actively contribute to your workplace retirement account, invest in a separate portfolio , and funnel money into your savings account, it can be difficult to open – let alone manage – another account. IRAs are a great addition to your retirement savings journey. Remember, there is no loan for retirement.

Carson Wealth

JUNE 27, 2025

Unexpected events can derail your progress toward your goals and even your financial security if you don’t have a plan for managing them. Financial planning should ideally involve every area of your financial life because they are all interrelated. Plan for retirement. Maximize your use of tax-advantaged accounts.

Yardley Wealth Management

FEBRUARY 4, 2025

Key Takeaways: Maximize available deductions through strategic planning Consider timing of income recognition and deductions Leverage investment and charitable giving strategies Stay informed about AMT implications Regularly review and update your tax strategy FAQ Q: What are the best tax deductions for high-income earners?

Carson Wealth

MAY 15, 2025

Act have affected millions of Americans inheriting or leaving behind a retirement account. While required minimum distributions (RMDs) for the account owner are delayed, there is now a 10-year window for many people who inherit these accounts to take their distributions. The SECURE Act and SECURE 2.0

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content