A Managed Accounts Case About More Than Managed Accounts

Wealth Management

JUNE 17, 2025

sends favorable message to advisors on managed accounts in retirement plans, highlighting key distinctions. Court dismissal of Hanigan v. Bechtel Global Corp.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 17, 2025

sends favorable message to advisors on managed accounts in retirement plans, highlighting key distinctions. Court dismissal of Hanigan v. Bechtel Global Corp.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JUNE 25, 2025

Many financial advisory clients might work for 40 years or more, ideally seeing their income – and capacity to save for retirement – increase over time as they advance in their careers. Still others, including adherents of the Financial Independence Retire Early (FIRE) movement, may hope to retire even sooner.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Wisconsin-based Resonant Capital and QBCo will share clients across wealth and tax in an increasingly popular service model.

Getting Your Financial Ducks In A Row

JUNE 23, 2025

Photo credit: jb When you have money in several accounts and you’d like to have that money consolidated in one place, the question comes up – Which type of account can be tax-free rolled over into which other type of accounts? The post What types of accounts can I rollover into? This is known as a Roth Conversion.

Darrow Wealth Management

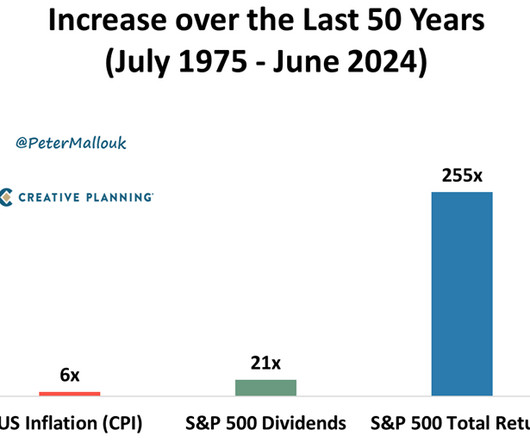

FEBRUARY 9, 2025

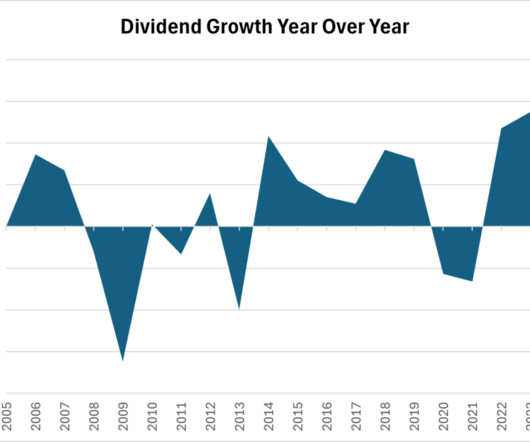

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. You may need more money than you think to retire on dividends. Retire on dividends?

Nerd's Eye View

FEBRUARY 12, 2025

While future retirees can find nonreduced benefit estimates on their Social Security statements or online accounts, those already receiving benefits don't have access to this information – making it necessary to find a different way to predict how much their payments will increase once the law is fully implemented.

Nerd's Eye View

JANUARY 15, 2025

For most people, Social Security benefits are calculated using a single formula, which takes into account the individual's history of earning income on which they paid Social Security tax. This lack of clarity made retirement planning significantly more challenging.

A Wealth of Common Sense

DECEMBER 5, 2024

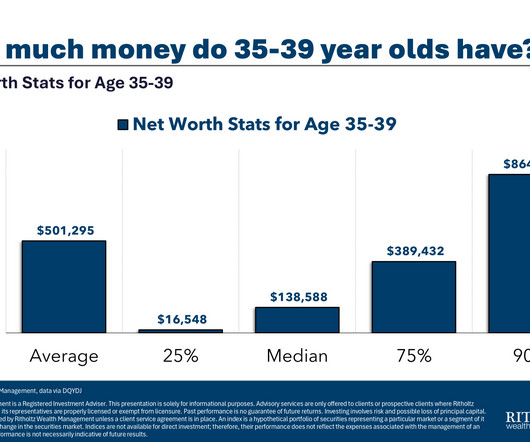

We also touched on questions about managing your brokerage account, the best way to optimize asset location, RSUs vs. HELOCs when paying for a home renovation and jewelry as an asset class. The post Are You on Track For Retirement? Further Reading: 10 Money Revelations in my 40s 1And these peer rankings are net worth figures.

A Wealth of Common Sense

FEBRUARY 13, 2025

Barry Ritholtz joined me on the show this week to discuss questions about timing market corrections with your savings account, how your portfolio should look heading into retirement, managing your parent’s financial plan and how to force yourself into splurging a little when you have more than enough money.

The Big Picture

APRIL 17, 2025

Your Lizard Brain : One of my favorite behavioral hacks is for you stock junkies: Manage your lizard brain via a Cowboy Account. Set up a mad-money account with less than 5% of your liquid capital. ” The cowboy account serves the same function. Buy high, sell low, repeat until broke. If it works out great!

Wealth Management

JUNE 26, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all businessmen around table RPA Operating On The Record Keepers’ Efficient Frontier Operating On The Record Keepers’ Efficient Frontier by Warren Cormier (..)

Nerd's Eye View

NOVEMBER 22, 2024

Also in industry news this week: Why the announced acquisition of RIA custodian TradePMR by retail brokerage firm Robinhood could prove to be a boon for RIAs on TradePMR's platform, who could receive a wave of referrals from Robinhood's massive base of next-generation retail clients How Morningstar is cutting the "Medalist Ratings" of thousands of (..)

Wealth Management

JUNE 26, 2025

Between 2014 and 2024, Mason transferred client funds into his own accounts and those of the two entities without clients’ authorization, according to the SEC. Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., He pleaded guilty to all of the criminal charges.

MainStreet Financial Planning

JULY 25, 2025

Retirement should bring financial freedom and peace of mind—not stress about market swings. Here’s how to build resilience into your retirement plan, no matter what the markets are doing. Debt: Do your best to minimize high-interest debt before retiring. A retirement check-in could make all the difference. The good news?

Abnormal Returns

DECEMBER 18, 2024

(tonyisola.com) Aging 10 steps to prepare financially for retirement, including 'Design a retirement paycheck.' theretirementmanifesto.com) How to think about retirement planning even though it may be decades off. nextbigideaclub.com) Some updated estimates of sustainable retirement withdrawal rates. signaturefd-3437664.hs-sites.com)

Random Roger's Retirement Planning

JULY 14, 2025

The magic of having $1 million for retirement is no longer what it once was. million as being sustainable for a 25 year retirement assuming 4%/$50,000/yr. million as being sustainable for a 25 year retirement assuming 4%/$50,000/yr. million account can be a source of $70,000/yr for a very long time. Is it enough?

Carson Wealth

DECEMBER 20, 2024

You can deposit money into the account now, receive the tax benefit, and then make the donation in your own time. You could place the money in the account now and let it grow, then make a charitable decision as a family over the holidays. Another important maneuver you can make is converting your traditional IRA to a Roth IRA account.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Plan for retirement 5. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

Wealth Management

AUGUST 5, 2025

Brian Marchiel August 5, 2025 4 Min Read Donny DBM/iStock/Getty Images Plus The unified managed account has undergone a quiet but powerful evolution over the past two decades as managed accounts continue their journey to client centricity. From Product Convenience to Coordinated Accounts UMA 1.0 Yet progress here remains slow.

Dear Mr. Market

DECEMBER 31, 2024

Three to six months worth of expenses tucked away in a high-yield savings account. Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. Whether youre fine-tuning your budget or planning your retirement roadmap, dont go it alone. A good rule of thumb? Ready to Tackle 2024?

MainStreet Financial Planning

OCTOBER 30, 2024

Whether it’s savings, retirement funds, or net worth, understanding where you stand can provide valuable perspective on your financial progress. 401(k) account contribution: 8.0% In 2023, Capitalize found the average employee-only contribution was 8%; the average dollar amount of employee-only contributions of $5,993.

Trade Brains

JUNE 9, 2025

When you are preparing for retirement, you should keep in mind both financial strategies and what tax benefits you may gain. Older citizens can get helpful guidance from the Income Tax Department’s special brochure for retirement taxation matters. Key Tax Advantages for Retirees 1.

The Big Picture

MAY 1, 2025

If you are retiring in the next 12-36 months, you have a right to be concerned. As youre likely aware, were in the midst of Peak 65, where were seeing more people turning the traditional retirement age of 65 than ever before. How should a person who is approaching retirement NOT invest?

Abnormal Returns

NOVEMBER 20, 2024

(sites.libsyn.com) Frazer Rice talks with Christine Benz author of "How to Retire" (podcasts.apple.com) Carl Richards talks money and more with journalist Kara Swisher. 50fires.com) Retirement Gray divorce can have a huge effect on your retirement. nytimes.com) Taxes in retirement only get more complicated.

Getting Your Financial Ducks In A Row

MARCH 10, 2025

Many of us are covered by one or more types of defined contribution retirement plans, such as a 401(k), 403(b), 457, or any of a number of other plans. These plans are also often referred to as Qualified Retirement Plans (QRPs). As you defer money into your retirement account, each dollar that you defer could be worth as much as $1.65.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Related: $2.2B

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline. What lifestyle do you envision?

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Converting a traditional IRA to a Roth doesnt make sense unless you have cash to pay taxes without dipping into your retirement savings.

Trade Brains

JULY 9, 2025

This poses a particular challenge for retirees who typically rely on fixed incomes from pensions, annuities, or savings accounts. That means if your retirement plan underestimates medical costs, you risk serious shortfalls. Written by Hiten Chauhan The post How Inflation Can Impact Your Retirement Plan – What You Must Know Now!

WiserAdvisor

JULY 2, 2025

Healthcare costs are rising at a pace that demands attention, particularly for individuals nearing retirement. Without proper planning, healthcare expenses can quickly consume a significant portion of retirement savings. They can build a more resilient financial strategy for retirement. increase from the previous year.

Clever Girl Finance

JANUARY 10, 2025

I didnt want to reach the end of my life with a big savings account but very few memories of enjoying the journey. Creating this list helps you see the bigger picturemoney isnt just numbers in a bank account. This could include saving for a down payment on a home, contributing to retirement accounts, or growing an investment portfolio.

Financial Symmetry

APRIL 14, 2025

Each of these account types has its pros and cons, which I have outlined below. Once you open this account, it functions the same way as every other bank account does for deposits and withdrawals, and you can order a debit card for your child once they get older for spending purposes.

Abnormal Returns

FEBRUARY 26, 2025

mrmoneymustache.com) Why you need to account for your Treasury income on your state taxes. aptuscapitaladvisors.com) Retirement There are different levels of retirement readiness. fastcompany.com) What to consider when rolling over a 401(k) account to an IRA. theretirementmanifesto.com) Gen X is next up for senior living.

Zoe Financial

JUNE 20, 2025

This guide consolidates what we’ve learned to help you refine, update, or pressure-test your current retirement and estate strategy with confidence. At Zoe Financial, we’ve seen firsthand how proactive planning with a fiduciary advisor helps individuals protect and grow their wealth across generations.

Wealth Management

AUGUST 4, 2025

Related: Edward Jones Doubles SMAs on Managed Account Platform, with Further Expansion Planned Meanwhile, Apollo will make some private market investment strategies available in GeoWealth’s UMA platform. 4, 2025) 11 Investment Must Reads for This Week (Aug. It has partnered with State Street on a target-date fund and a private credit ETF.

The Big Picture

MARCH 10, 2025

Who we are financially is very different than who we become in middle age or after retirement. I have 30,000 foot data on spending and contentment and lots of fun anecdotes, but I really dont know Q :“ Historically, money has been understood as both a ‘medium of exchange’ and a ‘unit of account.’

Carson Wealth

MAY 29, 2025

Imagine yourself on your last ride home from work on the day you retire. It probably depends on whether you have a strong plan in place for income during your retirement years. Having a retirement planning checklist can help make this final commute the time of reflection and joy it should be. Theres also no steady paycheck.

Wealth Management

JULY 2, 2025

Assets in active ETFs now account about 10% of the overall industry, compared to less than 5% a decade ago, Bloomberg Intelligence data show. Vanguard, long known for its index-tracking funds, has launched at least two actively managed ETFs so far this year, bringing its total stable to 12 funds.

Harness Wealth

NOVEMBER 12, 2024

Fully Utilize Tax-Advantaged Retirement and Savings Accounts There are multiple steps you can take using retirement accounts to reduce your taxable income. Roth IRAs are funded with after-tax dollars and cannot be deducted on a tax return, but they do offer tax-free growth and withdrawals during retirement.

Trade Brains

JUNE 16, 2025

Retirement sets in motion a new life—one that promises freedom from day-to-day grind but also requires prudent planning of finances. Thankfully, India provides a range of safe and sound passive income alternatives designed exclusively for retired citizens. Investment Limit: ₹9 lakh in a single account; ₹15 lakh for a joint account.

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. On the other hand, ICG has more than 90 employees who provide accounting, tax, fiduciary and business services for individuals and businesses.

Wealth Management

JUNE 27, 2025

He began his career in public accounting at Coopers & Lybrand, LLC. Michael was instrumental during AssetMark’s leveraged buyout transition to Genstar in 2013, its sale to Huatai Securities in 2016, its IPO in 2019, and its sale to GTCR in 2024.

Abnormal Returns

MARCH 12, 2025

wsj.com) On the growth of university-affiliated retirement communities. ft.com) Retirement The sequence of returns matters most in the first few years of retirement. morningstar.com) Why you need to understand your retirement withdrawal strategy, especially in a downturn.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content