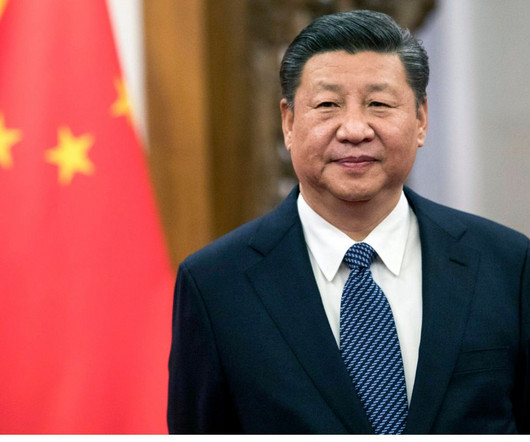

What’s Wrong with China’s Economy?

Trade Brains

SEPTEMBER 6, 2023

2023 was supposed to be China’s economic comeback year. 5️⃣ Foreign direct investment is down 6️⃣ Overall debt-to-GDP ratio is about 300% and rising 7️⃣ Decreasing population: In 2022, China’s population fell for the first time since 1961, which was not expected until 2029 or later. But what’s really going on?

Let's personalize your content