Build (Customized) Flexible Estate Planning Strategies In A Constantly Changing Political Landscape

Nerd's Eye View

APRIL 5, 2023

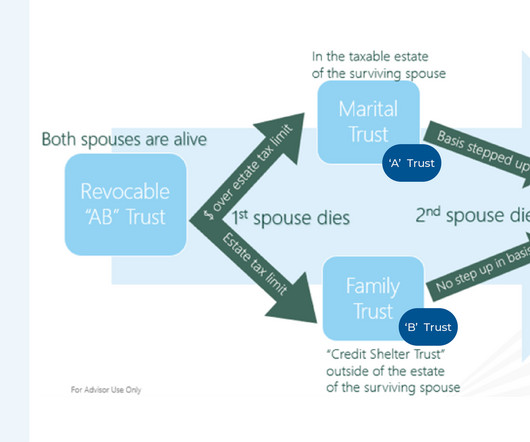

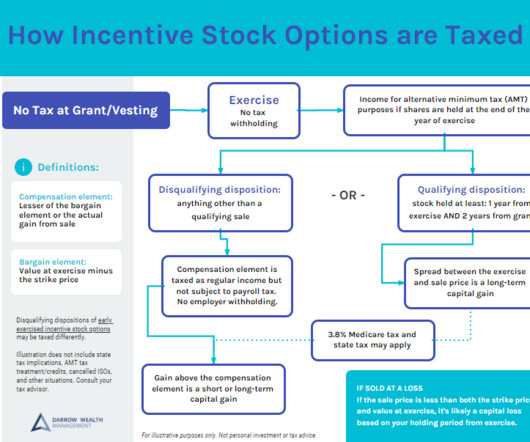

Given how frequently the tax code changes, advisors can add value for clients by ensuring their estate plans are aligned with current law to meet the clients’ objectives, and not with past rules that may no longer apply to them. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Let's personalize your content