Build (Customized) Flexible Estate Planning Strategies In A Constantly Changing Political Landscape

Nerd's Eye View

APRIL 5, 2023

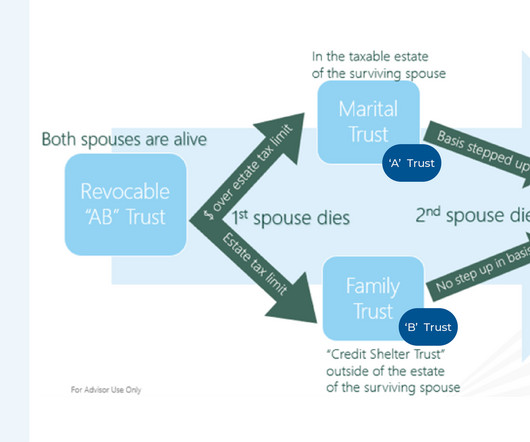

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. Contrary to what their name might suggest, flexibility can even be built into irrevocable trusts.

Let's personalize your content