Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Harness Wealth

JULY 14, 2025

While the appeal of real estate may be evident, complex federal, state, and local tax regulations can present a major challenge to the profitability of your property investments. Table of Contents Understanding real estate taxes What are the most tax-efficient ownership structures? Net Investment Income Tax (NIIT): A 3.8%

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Zajac Group

NOVEMBER 7, 2024

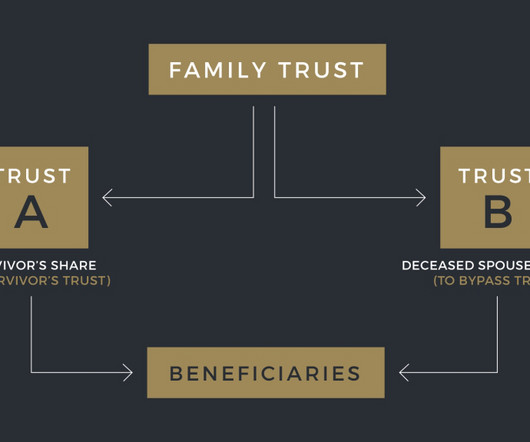

Creating wealth that can provide financial security for generations to come is an incredible feat, and it requires careful planning, consideration, and communication among family members. Let’s take a look at the tax impact and other considerations of each. million before triggering federal estate taxes).

SEI

JULY 15, 2025

Investor relations Our leadership team Newsroom Locations Careers Featured Login Contact us Careers US US EMEA Canada English Canada Français Our sites US EMEA Canada English Canada Français Insights 1031 Exchanges vs. opportunity zone investments Evaluating and comparing tax strategies for financial professionals.

Nerd's Eye View

JUNE 20, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Senate Republicans this week released their version of major tax legislation, following the passage of similar legislation in the House of Representatives last month.

The Big Picture

JUNE 16, 2025

So a world in which we have to make our own shirts and our own furniture is a world in which the other 350 million Americans who don’t make those things are taxed very heavily. I’m kind of hopeful that the 2026 Congress changes hands, the tariff power is retaken back by Congress, which is within their authority to do.

Dear Mr. Market

NOVEMBER 22, 2024

If so, there’s a good chance your plan includes the classic “AB Trust” structure, which—prior to 2011—was the primary way for married couples to double the value of their federal estate tax exemptions. If Bill dies in 2026 without using any of his ~$7.5 But in 2011, the concept of “portability” changed the estate planning landscape.

Let's personalize your content